Fresh Del Monte Produce (NYSE:FDP) may be poised for a nice run higher in price. In late 2020, the stock valuation reached a decade low, using basic fundamental comparison ratios. Operating income is projected by Wall Street analysts to almost double 2020’s result. And the stock price just broke out above a nine-month base pattern. I am particularly attracted to Del Monte as another food inflation hedge to counter record money printing by central banks globally. All told, this brand-name food company has plenty of pent-up value as a foundation, while much brighter operating results should serve as a catalyst for improving levels of investor interest throughout the coming year.

The Business

Fresh Del Monte grows, markets, and distributes fresh fruits and vegetables in North America, Europe, the Middle East, Africa, and Asia. Its fresh produce includes pineapples, melons, grapes, apples, citrus, blueberries, strawberries, pears, tomatoes, peaches, plums, nectarines, cherries and kiwis, and avocados. The company prepares cut fruits and vegetables, creates juices and other beverages, plus packages a variety of fruit/vegetable snacks. The company also sells poultry and meat products, and transports ocean freight. Del Monte manufactures plastic and box products, such as bins, trays, bags, and boxes.

Image Source: Company Website

Fundamental Review

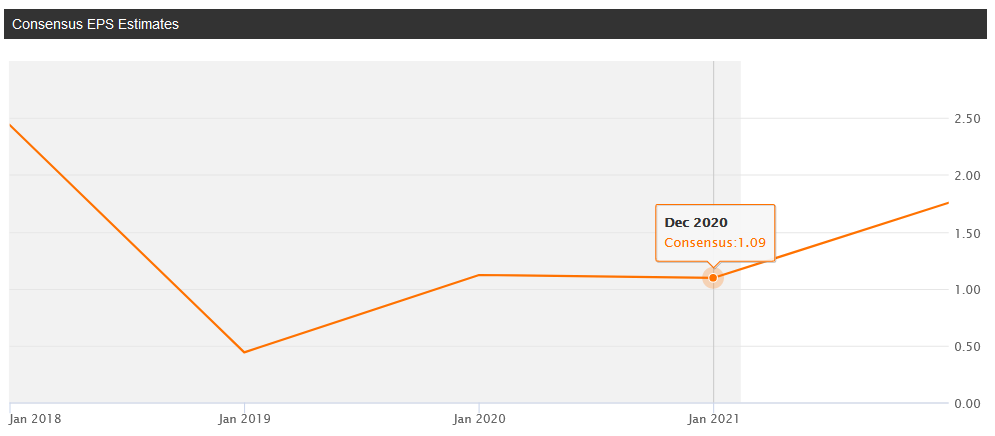

Fresh Del Monte has just endured a rough couple of years for operating profitability. Everything from weather issues, to new trade barriers, to asset write-downs have been part of the equation for lower results. However, Wall Street is forecasting a very strong recovery in 2021, especially as pandemic travel and shipping issues subside. Below is a graph of the analyst consensus EPS forecast around $1.80 today.

Net profit margins, although low in 2020, were still better than a variety of competitors hamstrung by COVID-19 problems for both supply and demand. Using Seeking Alpha’s list of peers and competitors