When I published my first article on Corning Incorporated (NYSE:GLW) in September of 2019, I thought the company was misunderstood by the market, and that there was modest upside potential. Since then, the stock has gained 32%, in comparison to the 31% gain of the S&P 500, so my call has failed to generate any meaningful alpha, although it has provided adequate returns for bearing the risks. In early-2020, many of the end markets served by Corning came under pressure, painting a bleak outlook for the company. Things, however, turned for the better in the second half of last year, and Corning reported YoY revenue growth from each of its 5 business segments in Q4 2020. The new year is promising to be even better for the company as many of these business segments are facing macroeconomic tailwinds, and I believe the stock remains undervalued despite the strong performance since last March.

Q4 earnings recap

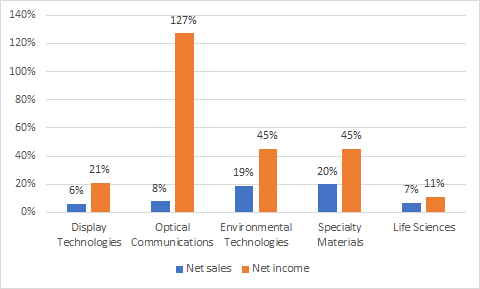

Corning beat analyst estimates modestly by reporting earnings per share of 52 cents for the fourth quarter against the consensus estimate of 49 cents. The company topped revenue estimates handsomely by $150 million. Since the earnings release on January 27, Corning shares have gained over 5%, so there seems to be momentum behind the stock, but the returns are not eye-popping by any stretch of the imagination. The below is a breakdown of revenue growth by business segment for the fourth quarter.

Exhibit 1:YoY net sales and net income growth by business segment

Source: Company filings

The company guided for sales and earnings growth in 2021 as well, and even more importantly, free cash flow growth. Based on this guidance and the improving macroeconomic conditions that I will discuss in the next segment, Wall Street analysts have revised their earnings estimates for the company to the upside, which is a

Go to bed a little smarter every day

-Warren Buffett

At Leads From Gurus, our approach to becoming smarter involves analyzing hundreds of portfolios of the most successful investors to find the best stocks to invest in.

Your subscription includes access to:

- Actionable ideas based on market commentary and real-time investments of gurus

- In-depth research reports on stocks owned by gurus

- Three model portfolios designed with stocks owned by gurus

- A database to track real-time investments of top gurus

- Educational articles discussing the strategies followed by gurus

- An active community of like-minded investors to share your findings

Act now to secure the launch discount!