It isn't easy to find value in this market. Many investors might still be chasing the same stocks that have been big winners over the years, even though multiples are stretched to extremes, and it will take 5-10 years for most of these high-flying stocks to grow into their current valuations. I would argue that, on the whole, the mega-cap growth companies will underperform for the short to medium-term; I see far better options.

Investors (particularly those in the U.S.) are faced with the prospects for a continuous surge of monetary inflation, as an additional stimulus package will soon arrive just as COVID-19 vaccines become more readily available over the next several months. It will be a double-shot (no pun intended) of economic growth, as stimulus checks will provide a boost to consumers, and pent up demand for travel, dining, etc. will drive more spending as the hardest-hit areas of the economy begin to open back up fully (or at least return to some normalcy).

With the Fed hell-bent on keeping short-term rates low, and considering the focus has shifted to average inflation targeting — allowing inflation to rise well above the 2% goal before the Fed feels the need to act — the money supply will continue to break records (and not the kind that we want to see broken). Forget the ever-elusive CPI inflation — which will finally present itself shortly — as it's the current monetary inflation that is deeply concerning.

At this time, investors should broaden their horizons and start looking for asset classes and individual stocks that are not only values (both absolute and relative to the market as a whole) but that offer the best protection from inflation.

Obviously, that's the purpose that gold and silver serve. Gold has been in correction mode since last summer, but

Subscribe To The Gold Edge

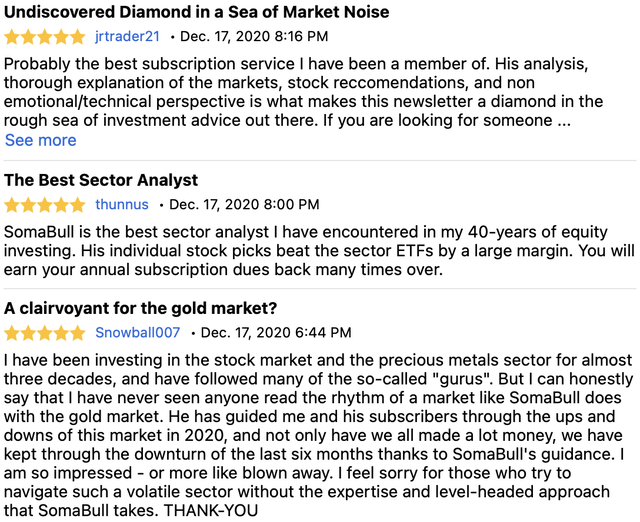

The opportunity in this sector is here, but to succeed, you need a deep knowledge of gold and the miners. The Gold Edge is my premium, research-intensive service that provides that knowledge as I'm sharing all of my thoughts, ideas, and research on the gold sector. If you would like access to all of my analyses, including my top gold and silver mining picks, subscribe to The Gold Edge. Click here for details.