Anyone who is not investing now is missing a tremendous opportunity – Carlos Slim

NYSEARCA:XLC offers investors exposure to telecommunication services, media, entertainment, and interactive media & services. This Fund is relatively new, having been established in June 2018. It was created in response to a worldwide change in index taxonomy that shuffled social media giants from the technology sector into a new “communications services” category. Since then, it has attracted capital to the tune of $12.42bn.

Investors looking for broad-based exposure to companies such Facebook, Google, Netflix, and the like, will find those stocks generously represented in this ETF.

XLC’s closest rival is the Vanguard Communication Services ETF (VOX), which is almost identical, except for VOX’s lower expense ratio and differences in Vanguard's methodology for index rebalancing.

Furthermore, XLC has a TTM dividend yield of 0.63%, offering investors the change of passive income and significant capital appreciation.

Let’s breakdown XLC’s holdings to see what kind of growth we can realistically expect going forward.

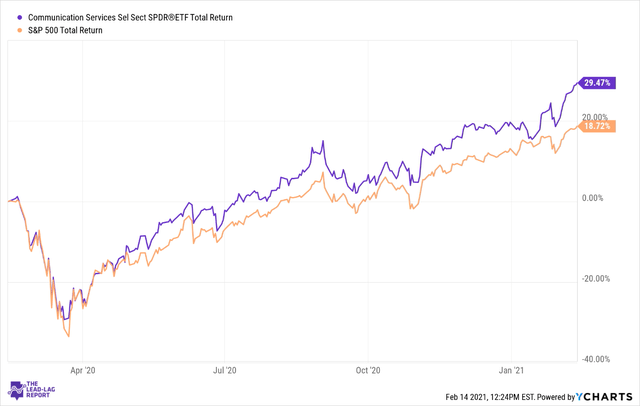

Over the last year, XLC delivered about 30% overall, higher returns than the broader S&P index, which was up around 19% over the same period.

Despite a slow start to the period, XLC was able to gain momentum end the period with positive returns. As the global economy slowed due to the pandemic, government-imposed lockdowns began to wreak havoc on restaurants, traditional movie outlets, and retailers who felt most of the brunt of the negative impact.

As consumers were forced to stay home, the reliance on social media tools such as Facebook continued to soar. The significant shift of viewership to streaming services began to fly once stay-at-home orders were in effect. As a result, Netflix (NFLX) added a record 15.77mn paid subscribers globally in the first quarter of 2020, double the new subscribers its analysts