Our new series Cannabis Industry Analysis is where we analyze the latest and hottest topics in the industry to help you stay ahead of the curve.

2021 Reefer Madness

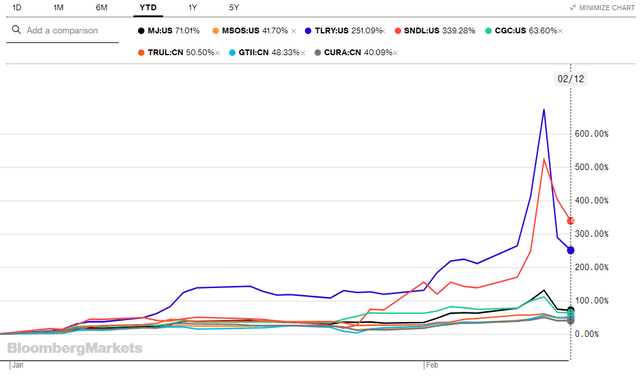

As we have covered extensively in recent weeks, the cannabis sector is experiencing a strong rally across the board. However, a select few cannabis stocks in Canada have entered bubble territory. We have analyzed and warned investors of names like Tilray (TLRY) and Sundial (SNDL) and both stocks plunged towards the end of last week. However, the outperformance in Canadian cannabis names remains meaningful which we would like to analyze in this article. Furthermore, we would like to make the argument that the rally in Canadian cannabis stocks as shown by Canada-focused cannabis ETF (MJ) is misplaced and based on the ill-informed idea that potential federal legalization would benefit Canadian cannabis names disproportionately. On the contrary, we believe the U.S. MSOs as shown by U.S.-focused cannabis ETF (MSOS) is best-positioned to benefit from federal legalization, and their underperformance to date highlights an attractive entry point for U.S. cannabis names.

(Source: Bloomberg)

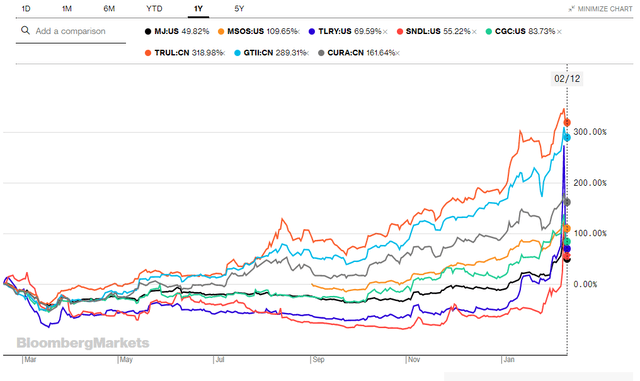

It is also important and imperative to have the background that Canadian cannabis stocks have underperformed U.S. names by a wide margin in the last 12 months. The U.S. cannabis sector has significantly outperformed Canadian peers due to stronger financial performance (revenue growth, profitability) and a more supportive macro backdrop. This distinction is very important because it further supports our conclusion that the recent outperformance of Canadian stocks is irrational and a reversal is likely to happen.

(Source: Bloomberg)

U.S. Federal Legalization

The biggest reason why cannabis stocks have rallied strongly is that the November U.S. election and subsequent Georgia Senate run-off created a best-case scenario for cannabis legalization. Senate Majority Leader Chuck Schumer and two other Democratic senators recently