Biogen (NASDAQ:BIIB) has been caught in a bit of a rut as its top therapies face competition from alternatives. It has also been buffeted by COVID-19 as have many biotechs; Biogen has not however benefited from vaccines or therapies attacking the pandemic as have so many of its peers. In sum, Biogen has had a bad pandemic.

As 2021 unfolds, Biogen, like our nation and our world, is preparing for post-COVID-19 prosperity. Such prosperity is uncertain; nonetheless hope remains undimmed. In Biogen's case, the principal vehicle for near-term hope is its Alzheimer's disease [AD] therapy, aducanumab, whose PDUFA date has been reshuffled to 6/7/2021.

As a senior citizen, I am all too aware of the ferocity with which Alzheimer's attacks victims and their families. It leaves them bereft of any prospects; the only FDA approved drugs have but limited impact on symptoms without effectively slowing the disease process. Accordingly, I am truly high on hope that aducanumab receives a pass from the FDA with a more supportive label than any currently approved therapy.

In this article, I will set out Biogen's current situation and its prospects going forward explaining why I have a reservedly bullish position on the stock primarily fueled by its upcoming PDUFA.

Biogen's quant grade points to its suboptimal growth metrics.

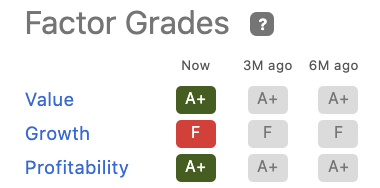

Biogen's (2/12/20) "F" quant grade for growth as shown below is no anomaly:

Rather stark...A+'s for Value and Profitability, F's for Growth — same story no matter what time period you choose, now, 3 months, or 6 months ago.

Rather stark...A+'s for Value and Profitability, F's for Growth — same story no matter what time period you choose, now, 3 months, or 6 months ago.

When you look behind the grade to the metrics upon which it is based as compared to the other ~880 stocks in the quant healthcare universe, it is hard to quarrel with the teacher's severe choice; when measured against others' evaluation, the result is much the