In the business world, the rear mirror is always clearer than the windshield - Warren Buffett

NYSEARCA:PBD offers investors exposure to the global clean energy index, which includes both U.S. and international stocks. PBD also diversifies its portfolio across different clean energy types, including wind, solar, and hydro.

PBD is passively managed. It looks to invest in a wide range of global renewable energy companies, including those involved in improving energy efficiency and those looking to advance renewable energy.

This makes it an exciting option for investors looking to bet on a clean energy boom but is also unwilling to make a concentrated bet on a specific sub-sector.

Given that the clean energy sector is still a nascent industry, PBD can be considered one of the pioneers in the field, given that it was established way back in 2007.

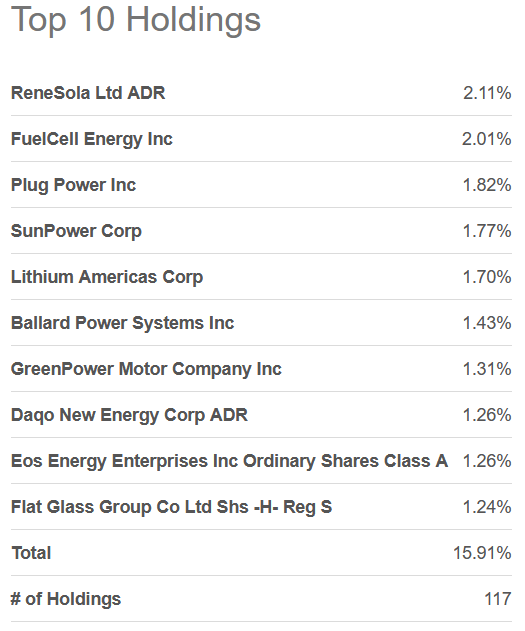

There are many available alternatives to PBD in the market, but what sets this ETF apart is its low concentration risk. Compared with peers, PBD's top 10 holdings only make up about 16% of the Fund, significantly reducing its dependency on its top holdings.

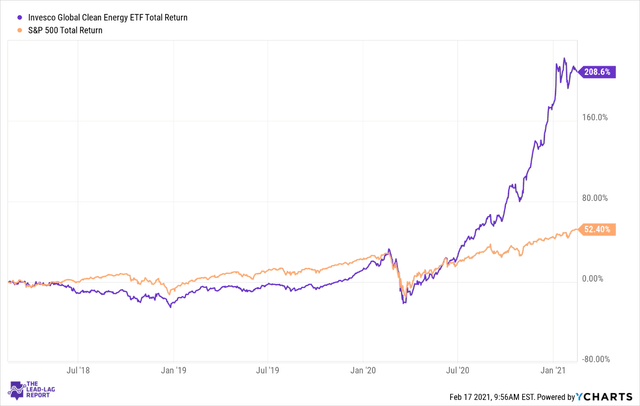

As is evident from the chart above, PBD has widely outperformed the broader market, delivering returns above 200%. Growing awareness amongst the general public regarding the importance of environmental sustainability bodes well for the Fund in the long term.

Constituent Holdings

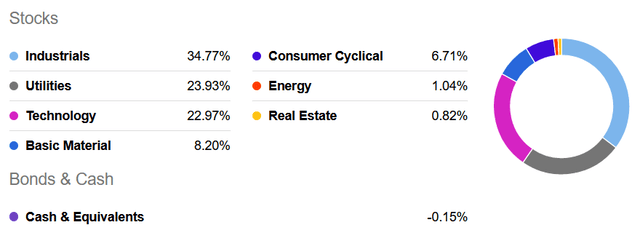

PBD is well-diversified amongst sectors, as can be seen from the chart below. Its top 3 sector allocations include Industrials with 34.77%, followed by Utilities & Technology with 23.93% and 22.97%.

Source: SeekingAlpha

PBD's top 10 holdings make up just 16% of the Fund's portfolio. Its top 10 holdings include solar panel manufacturers such as ReneSola (SOL), SunPower (SPWR) & Daqo New Energy (DQ), fuel cell manufacturers like FuelCell Energy (

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.