For all drug manufacturers (major, generic or specialty), biotech, diagnostics, and research companies, most of their budgets go towards Research & Development. They must manage their pipeline of new products and their patents. A company may be able to surf on its previous successes for a decade due to their patents' protection of their research. However, they must constantly renew their portfolios. This frequently impacts their ability to increase their dividends in a predictable manner. Price volatility both up and down are also frequent characteristics of companies in this industry.

As for Healthcare plans, long-term care facilities, medical care and distribution companies are more likely to be affected by governmental regulations. The cost of healthcare is a major topic for governments across the world. Should it be free, sponsored or insured? This question leads to much debate and uncertainty for the future. No matter what happens, the industry will find a way to adjust their business models, but volatility will be the continuing and on-going characteristic of this sector.

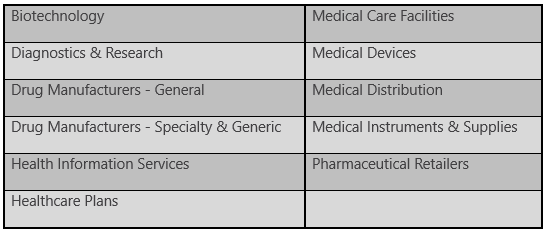

Sub-Sectors (Industries)

Greatest Strengths

The advantage for dividend investors in this sector is the wide choice of large and well-established companies. The best-performing companies in this sector are often the long-term established companies that have a strong distribution network or a large drug portfolio and pipelines full of new products. Big pharmaceuticals usually offer a safe haven for your money over the long run. They know how to manage their R&D budgets and drug pipelines. The healthcare sector often sees stock surges both upward and downward based upon the results of their discoveries. Patents and regulations are part of their daily routine.

Medical devices, instruments or supply companies will provide products with repetitive purchases. They enjoy wide distribution networks, loyal customers, and constant repeat orders. They can make great dividend growers too.