Introduction

Despite being one of the largest pharmaceutical companies in the world, Novartis (NYSE:NVS) is often overlooked. With strong free cash flow results despite spending billions on R&D, Novartis is providing shareholders with a generous dividend and share buybacks.

Although Novartis has a full listing in the US, the company is Swiss and the dividend is subject to a standard 35% withholding tax. The company does report its financial results in US dollars so I will refer to the US listing when I’m talking about the per-share metrics. However, to make things a little bit more complicated, Novartis declares its dividends in CHF. The standard dividend withholding tax in Switzerland is 35%.

Novartis had a very satisfying 2020 after it spun off Alcon in 2019

2020 was the first full year after spinning off Alcon to its shareholders, so while the net income now no longer includes the income from discontinued operations (resulting in a lower net income), Novartis actually performed pretty well as on an underlying basis (excluding the impact of discontinued operations), the net income increased by more than 10%.

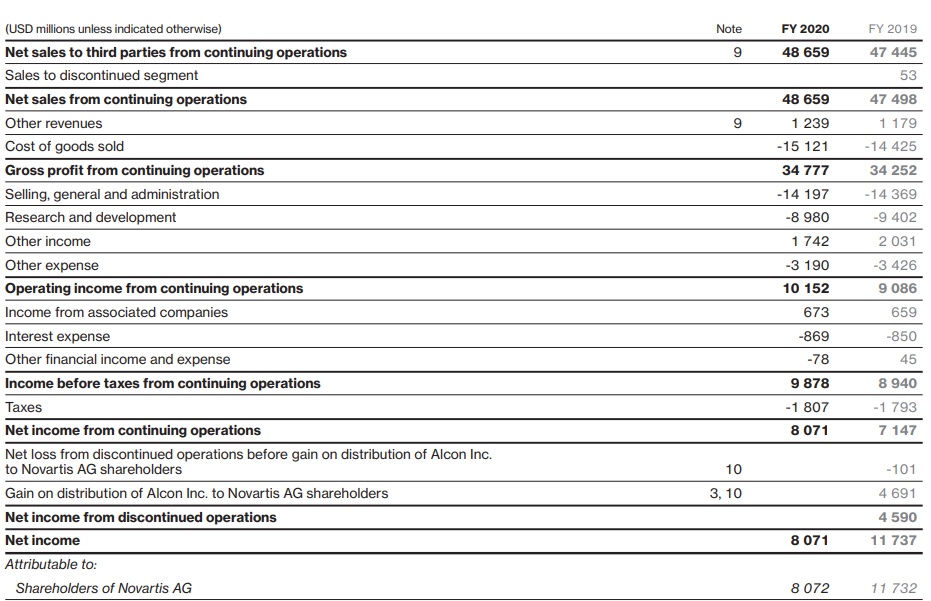

In 2020, Novartis reported a total revenue of almost $49B, an increase of in excess of 2% compared to 2019. The impact on the profitability metrics was a bit lower as the COGS increased by about 5% to $15.1B resulting in a gross profit of almost $34.8B, up about $500M or 1.5% compared to 2019.

Source: full-year 2020 financial results

As you can see on the image above, Novartis was able to cut its SG&A expenses while its total net "other expense" remained pretty stable. Additionally, Novartis reduced its R&D expenses by about $400M and these three elements helped to boost the operating income by more than 10% to $10.15B. This ultimately resulted in a net income of $8.07B, and while that’s lower than the $11.7B in FY 2019 which

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!