Dollar General (NYSE:DG) stock was off to a bad start in 2021 as the stock fell -4.1% YTD, lagging behind its peers and the S&P 500 (SPY +4% YTD). DG is due to report its FY20 earnings next month and I am expecting FY20's annual EPS growth above +60% YoY and foreseeable sustained growth for FY21+ with 2,900 real estate projects already lined up for FY21.

The company manages a portfolio of over 17,000 convenient stores and plans to accelerate growth across the US with increased product offerings to existing and potential customers. Building off my previous article "Dollar General: The Bargain Retailer", I believe DG remains undervalued by the market and Part II of this research examines the following three bullish DG signals:

- Q4 FY20 and full year FY21 estimates

- Market is not pricing in sustained growth

- DG's comparable valuation

1. FY20 and FY21 Financial Estimates

Analysts are expecting DG to pull off sales and EPS growth of +21% and +60% YoY for the financial year to Jan 2021 (FY20) respectively. Meanwhile, the stock only appreciated 24% in the past 12 months. Perhaps analysts are expecting a pessimistic quarterly report next month and a weak FY21 outlook. I believe these views are overly pessimistic and here's why:

Q4 and full year to January 2021

Using Costco (COST) as a proxy to the industry outlook, DG looks capable of meeting its sales growth estimates. COST announced double-digit sales comp growth across the months of Nov 20-Jan 21.

In many ways, DG's business model is the opposite of Costco. DG offers convenience to its customers and operates in places where Costco would deem too "small" to operate. Other key distinctions (not exhaustive list) include average items per transaction, profit margins and business model.

Costco's monthly sales report served as a reasonable publicly available proxy to the supermarket and DG's Q3 sales because Costco's comparable monthly sales data are released by the 1st week of subsequent months. By applying Costco's November 2020-January 2021 sales comps, DG should be expecting another blockbuster quarter to cap off a fantastic FY20.

Table: August 2020-January 2021 Sales Growth in COST and DG

Table: August 2020-January 2021 Sales Growth in COST and DG

Although Costco's comps may not be the best like-for-like comparison to DG, I believe both DG and Costco show strength in their brands and continue to deliver exceptional growth through the pandemic. The table above suggests DG achieved better total sales growth vs COST by +1.9% in the same comparable period (August to October 2020, which is DG's third quarter). Therefore, it is not unreasonable to expect DG sales growth of +16.2%, marginally above current analyst estimates of +15.9% growth assuming similar outperformance is achieved in Q4.

Full Year to January 2022

Thinking beyond the pandemic, analysts are expecting FY21 sales of $34.18B (+1.8% YoY) and FY21 EPS of $10.13 (-4.7% YoY). These appear significantly underestimated given DG's excellent cost management, ability to generate sustainable growth on top of successful periods, and new initiatives (discussed in section 2 below).

Source: Seeking Alpha

It appears the consensus estimate failed to account for the following:

- DG's real estate plan is to build 1,050 new retail stores, a 6.1% addition to the portfolio of retail locations.

- DG boasts a 30-year SSSG track record, proving that the business experienced sustained annual growth through the 1990s, early 2000s and the '08-'09 recessions.

- DG's net margin expanded from 4% to 7.84% in the past decade.

- Aggressive share buyback schemes since 2010 to drive EPS growth.

DG's business model presents itself as one of the retailers to experience growth during and beyond economic recessions. By applying conservative estimates, one may assume a 5% growth in retail store count (although unlikely that management falls short of the 1,050 new stores target), Same-Store-Sales-Growth (SSSG) growth of 0.5%, consistent net margin in FY21 and outstanding share count reduction of 0.5%. These assumptions will drive net sales increase of ~5.5% and net profit increase of at least ~6%.

Estimates provided in this article are far below DG's sales and EPS 10-CAGR of 8% and 16% respectively. However, the current analyst expectations of +1.79% sales growth and -4.7% EPS contraction for FY21 appear significantly detached from the reality of DG's proven track record and growth potential.

2. Market Is Not Pricing In Sustained Growth

Lack of Demand post COVID?

Consumer staples and hypermarkets had a spectacular 2020 in part due to restaurant closures and the stockpiling behaviour introduced by the pandemic.

DG and other retailers offering relatively cheaper products stand to benefit from the post pandemic economic recovery. Positive news from the vaccination drive does not necessarily translate to immediate substitution away from discounted products to luxury grocery shopping. For most individuals and especially DG's target customers, economic recovery to pre-pandemic levels will be disproportionate and relatively slower for the rural community. A recent McKinsey report further indicated that full economic recovery is unlikely for the disadvantaged communities at least until 2024.

Falling demand for DG's products should not be a concern, given the company operates as a local monopoly in rural communities where alternative retailers seldom exist.

DG is pulling in higher profit margins in rural convenient stores vs peers. Customers shopping in DG spend less in a single receipt vs larger retailers (i.e. Costco), which means customers often do not benefit from bulk buy discounts. DG generates more profit on a per unit sold basis because customers cannot afford bulk buy purchases, whereas occasionally customers value the convenience of smaller stores and are willing to pay the premium for smaller purchases.

Business Outlook

As discussed in my previous article, DG continues to focus on product innovation to capture potential customers and retain existing ones. DG is eager to offer higher margin products by increasing non-consumables and DG Fresh offerings to attract customers into the retailer's premises. Popshelf amongst other initiatives would expand DG's target customer base to the middle income households as the company continues to appeal more customers with its value proposition. To summarise, more products sold does not always lead to more profits; however, DG seems to manage costs meaningfully and effectively as sales continue to grow.

Margins

I believe one of the biggest concerns by the market is DG's ability to generate sustainable growth for the medium term (2-5 years) future. With DG's 2021-2022 real estate growth commitments and a successful 2009-2011 period of sustained growth, I believe top- and bottom-line growth and margins can easily be maintained through FY21 and beyond.

Source: Author

After a successful year to 31 January 2010, DG did not experience a dip in 2011. In fact, sales continued to grow, margins expanded, and net earnings per share continued their growth at a blistering pace. Fast forward to present day, DG had a spectacular year to 31 January 2021 and growth is not expected to reach its 10-year CAGR; however, I do expect positive growth in sales and EPS of minimum +5% for the year to 31 January 2022.

DG's fantastic FCF generated this year could lead to a one-off staff appreciation bonus in Q4 FY20 of less than ~US$100 million. DG continues to improve employee wellbeing by subsidising frontline workers to get COVID-19 Vaccine.

DG's foreseeable demand growth, business outlook, employee management and robust controls act as strong investment catalysts for the stock.

3. Valuation

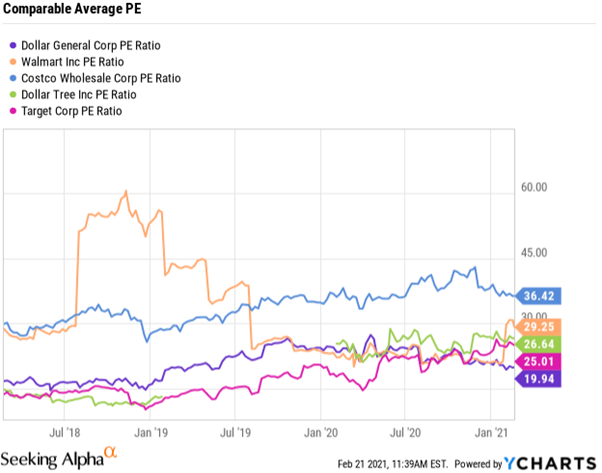

In my previous article, the comparable PE valuation yielded $233.08 based on my estimated FY20 EPS $10.09 and TTM PE of 23.1x. With an upgraded FY20 consensus EPS of 10.63, median and average comparable PE ratio have increased to a median 25.0x TTM, valuing DG at $265.75, an implied ~32% upside from today's price.

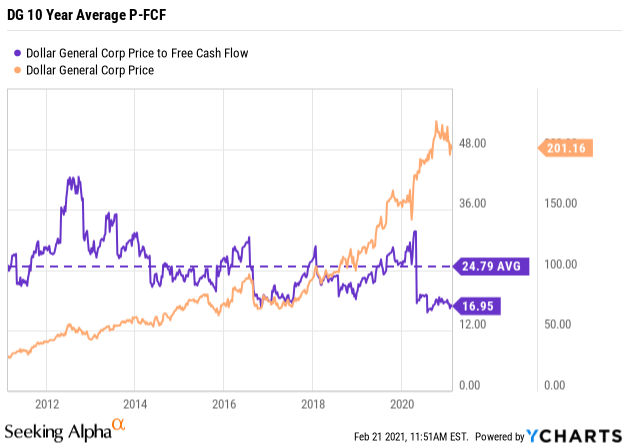

In addition, DG appears undervalued on a P-FCF basis as the company trails its historical 10-year P-FCF average of 24.82 due to a spectacular FY20. Should DG trade at its 10-year P-FCF average, the stock should trade at $294.40 (undervalued by 46.3%) if TTM and future FCF growth is sustainable.

The company raised $1.5b in long-term debt last April as $2.5b of debt will expire in the next 7 years. Dollar General's leverage ratios are at healthy levels in comparison to its peers (net debt/equity 0.28x, net debt/EBITDA 0.47x, EBITDA /net interest expense 30x). With an impressive growth outlook ahead of DG, the company should capitalise on cheap debt and its investment grade credit rating to fuel further expansion across North America.

Risks

Growth

Vaccination drive is under way and speculations suggest the US economy is on track to reopen by autumn 2021. As it stands, partial lockdowns across the states are unlikely to be fully lifted over the next quarter. Perhaps DG could deliver yet another pandemic-like Q1 (Feb-Apr) FY21?

The pressure is on management to deliver FY21 YoY growth. FY20's success will be a difficult comp to beat as consumers stocked up on essentials and spent more per average transaction. However, I trust that management is capable of maintaining SSSG via a multitude of innovative solutions such as DG Pickup and Popshelf.

Cost Management

Cost of Goods Sold remains a huge cost component of retailers, especially Dollar General (~70% of sales). Partial lockdowns and extreme winter conditions will put DG's supply chain management to the test. Amongst many other concerns, delays in perishable deliveries could lead to cancellation of customer orders and inventory write offs.

The company announced that inventory shrink reduced for Q3 last year. Shrinkage might have reduced due to stimulus packages and better surveillance; however shrinkage and inventory damage remains a huge challenge to dollar stores, especially if the US economy is not expected to recover soon. Failure to manage shrink will lead to margin erosion.

Valuation

The PE calculation above generated extreme upside potential based on 25.0x comparable PE ratio; however, DG could appear to be fairly valued, trading slightly above its historical 10-year PE average of 19.35x. With an expected FY20 EPS of 10.63, DG is fairly valued at $205.69, implying a ~2.2% undervaluation vs today's price.

At first glance, DG's current FCF vs historical P-FCF indicated 46.3% undervaluation. However, short term FCF improvement appears to be a common the trend amongst other retailers during this pandemic-driven recession. DG's P-FCF ratio of 16.95x now appears fairly valued when compared to its peers. A comparable median TTM P-FCF of 17.1x suggest limited upside and DG should trade at a fair value of $203.04, in line with its closing price of $201.16 on Friday, 19 February 2021.

Final Thoughts

DG continues to smash estimates, leading to upward revisions as DG remains on track to achieve 31 years of consecutive Same-Store-Sales-Growth and increase its retail store count.

A combination of conservative and base case comparable valuation scenarios indicated that DG's stock could trade at $203.04-$294.40. By attaching equal probability on each outcome, DG's average price target is $242.22, an implied TTM PE 22.8x and FY21 PE 21.5x.

In today's market, what should be deemed a reasonable price for investors to own a company that grew at a 10-year CAGR sales +8% and EPS +16%? DG's current market cap is slightly below $50b with over 17,000 retail shops and has not seen the end of its growth story. At 19.9x TTM PE, DG is an attractive investment in today's market and I would rate Dollar General's stock a BUY.