Higher-yielding dividend and income-producing stocks could be about to get hammered, especially if Treasury rates continue to push higher. ETFs like the Utilities (XLU) and Consumer Staples (XLP) house many higher-yielding and income-producing stocks. But these two ETFs have been hit hard in recent days, and that's because of rising interest rates.

As interest rates in the bond market rise, it will continue to push dividend yields for many stocks higher, translating to lower stock prices. It's likely why options traders have been buying puts in both the XLU and XLP ETF in recent days.

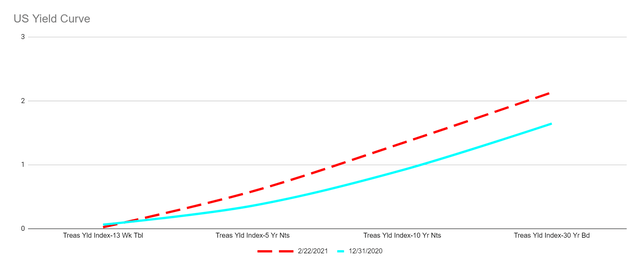

Yield Curve Shifts Higher

The yield curve has risen sharply since the beginning of the year. Since Dec.31, the 30-year rate has climbed by almost 50 basis points, while the 10-year has climbed by almost 45 bps, a big move in a relatively short period of time.

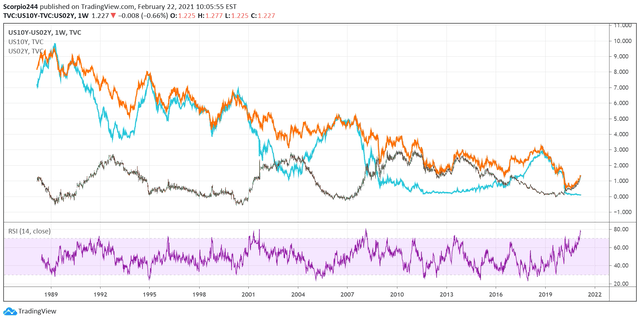

Those rates may only continue to rise over the longer term, especially if the economy is only at the early recovery stages. Typically, in normal periods of economic expansion, we have seen the 10-year minus two-year spread widen to as much as 2.7% to 3%. More interesting is that despite the interest rate environment, whether higher or low, going back to the late 1980s, this spread has consistently performed in the same manner, with the spread widening and narrowing to within the same ranges.

Those rates may only continue to rise over the longer term, especially if the economy is only at the early recovery stages. Typically, in normal periods of economic expansion, we have seen the 10-year minus two-year spread widen to as much as 2.7% to 3%. More interesting is that despite the interest rate environment, whether higher or low, going back to the late 1980s, this spread has consistently performed in the same manner, with the spread widening and narrowing to within the same ranges.

If the same holds for this current period, then it seems possible that if the two-year stay anchors at 10 bps, the 10-year could rise to around 2.5 to 3% over the next few years.

Impact On Stocks

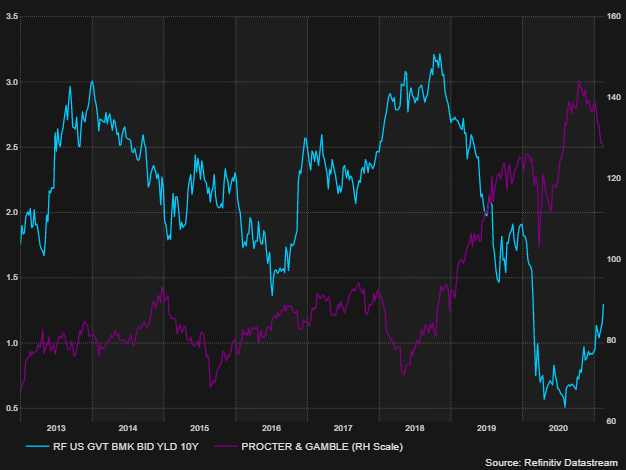

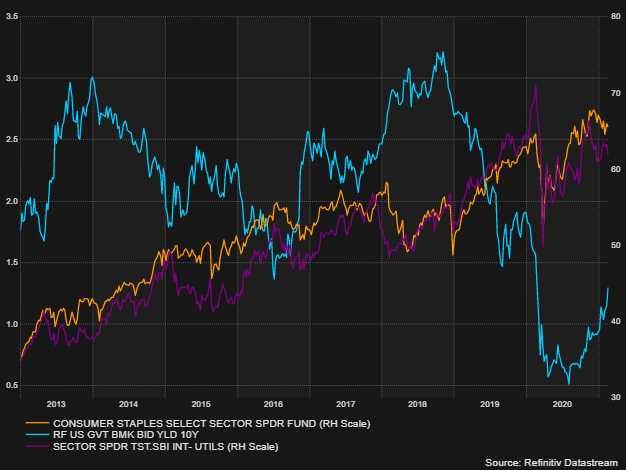

That would likely suggest that the dividend yield for equities could see a tremendous amount of pressure. A stock like Procter & Gamble (PG) had a terribly difficult time from 2013 until the middle of 2019, trading in a range of $81 to $92, as the Treasury yield fluctuated between 1.7% and 3%, with the stock rising as Treasury yields were falling, and the stock falling as Treasury yields were rising.

The same pattern is visible in the XLU and XLP ETF, with the ETF price typically peaking when the 10-year yield troughed while the ETF bottomed when 10-year yields peaked.

Bearish Bets

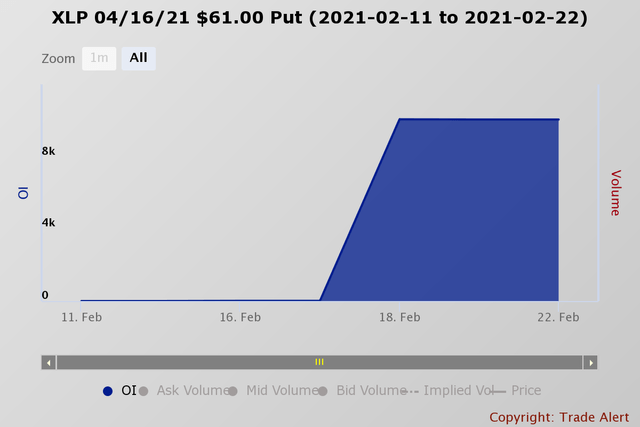

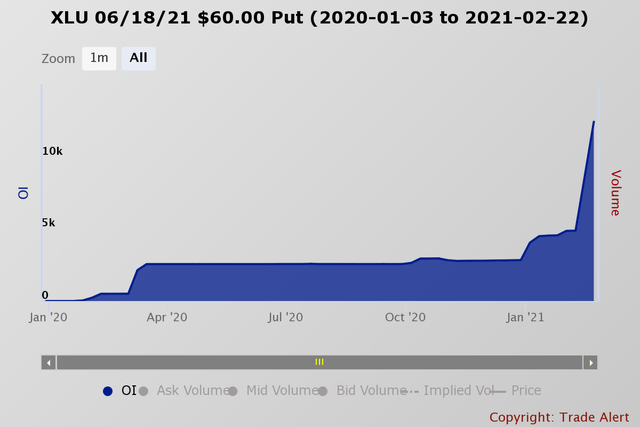

It could be why some traders are betting that both ETFs fall in the months ahead.

On Feb. 17, the XLP ETF's open interest rose by around 10,000 contracts for the April 16 $61 put. The data shows the puts were bought for about $0.40. It would indicate that the ETF is trading below $60.60 by the expiration date, a drop of about 6.5%.

Meanwhile, since Feb. 8, the open interest for the June 18 $60 puts have seen their open interest levels rise to 12,400 contracts currently from around 4,900 on Feb. 8. The data shows the puts were bought between $2.20 to $2.30 per contract over that time. It would suggest that the ETF is trading at $58.30 or lower, a decline of about 4%.

Meanwhile, since Feb. 8, the open interest for the June 18 $60 puts have seen their open interest levels rise to 12,400 contracts currently from around 4,900 on Feb. 8. The data shows the puts were bought between $2.20 to $2.30 per contract over that time. It would suggest that the ETF is trading at $58.30 or lower, a decline of about 4%.

Technical Trends Breaking Down

Technical Trends Breaking Down

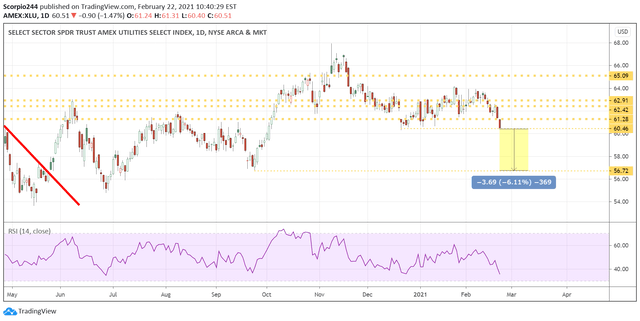

The technical chart for the XLU is also suggesting that ETF falls from its current levels. The ETF is currently testing a level of support at $60.50. Should it fall below that support, its next major support level might not come until $56.75, a drop of about 6%.

The relative strength index is also trending lower, suggesting bullish momentum is leaving the ETF and potentially has further to fall.

Meanwhile, the Staples ETF is also showing some of the same trends. The ETF is currently approaching a level of support at $64.15, with a break below that support level, potentially sending the ETF to around $61.50.

The further rates rise on Treasuries, the more pressure it will place on these dividends and income-producing segments of the market. As yields rise, it will pressure dividend yields higher and the stock and ETF prices lower. While these groups may continue to produce income, it doesn't mean there can't be losses on the underlying security.

Reading The Markets is designed to provide members with a better understanding of the stock market and to provide stock ideas. Just like the free articles you have grown to love reading.

Or if you want to learn about how the markets function, I can teach you that too.

To Find Out More Visit Our Home Page