Ongoing COVID-19 lockdown measures dealt a further blow to the eurozone's service sector in February, adding to the likelihood of GDP falling again in the first quarter. However, the impact was alleviated by a strengthening upturn in manufacturing, hinting at a far milder economic downturn than suffered in the first half of last year.

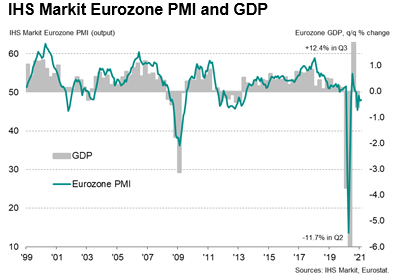

The headline flash IHS Markit Eurozone Composite PMI® edged higher from 47.8 in January to 48.1 in February. By remaining below 50.0, the latest reading indicated a fourth consecutive monthly contraction of business activity, but also registered a slight easing in the rate of decline compared to January.

Despite the rise in the PMI, the average reading of 47.9 for the first quarter so far is marginally lower than the average of 48.1 seen in the fourth quarter of last year. The sustained downturn therefore hints at a further deterioration in the economy - and a double-dip recession - as measures to control the coronavirus disease 2019 (COVID-19) pandemic continued to disrupt business activity across the region.

Importantly, however, the last four months have seen the PMI remain far higher than during the initial months of the pandemic in the spring of last year, suggesting that the economic impact of the second wave of virus infections has so far been much less severe than during the first wave.

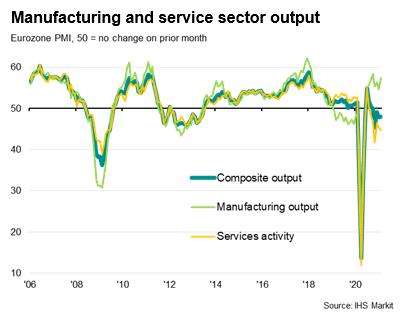

The deterioration in output was driven by the service sector, where activity fell at the fastest rate since November, registering the second-steepest fall since last May, largely in response to COVID-19 related restrictions. In contrast, manufacturing output growth accelerated to the fastest since October, and the second-fastest in three years.

Germany outperforms

Particularly strong manufacturing growth meant Germany once again outperformed. However, at 51.3 (up only modestly from 50.8 in January) the composite index registered only a marginal expansion due to the