Introduction

When last reviewing the small and largely unknown ethanol-focused partnership, Green Plains Partners (GPP), it was found that they were walking a proverbial tight rope with their choking credit facility repayment terms, as my previous article explained. This article provides a follow-up analysis that reviews their progress fighting out of this situation along with their fourth quarter of 2020 results and their upcoming asset sale.

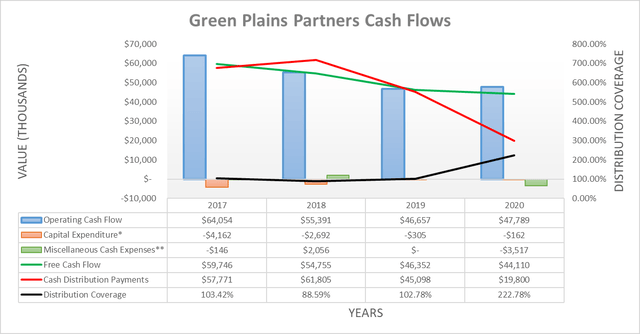

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

Detailed Analysis

![]()

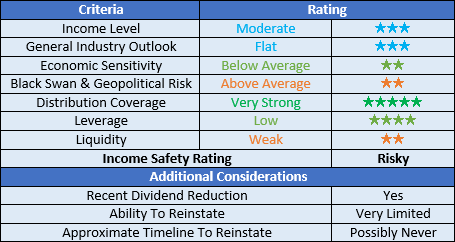

Image Source: Author.

Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact on their financial position. The main difference between the two is that the former ignores the capital expenditure that relates to growth projects, which given the very high capital intensity of their industry can create a material difference.

When originally reviewing their cash flow performance the two primary takeaways were that their distribution coverage was now very strong following their massive distribution reduction in early 2020 but at the same time, their ability to reinstate these previous distributions is very limited. If interested in further details regarding these aspects, please refer to my previously linked article since nothing material has changed since publication.

Now turning to their recent performance and once again it appears that despite the turmoil across the economy due to the Covid-19 economic downturn, 2020 ended