Even after doubling since my last article, I still think DarioHealth (NASDAQ:DRIO) is a very underrated company, more so after the recent deal acquisition of Upright Technologies and the recent deal signings. I still believe that the company has the potential to become one of the leading digital therapeutics player in the market, and these recent activities have only increased my confidence.

Recent Events

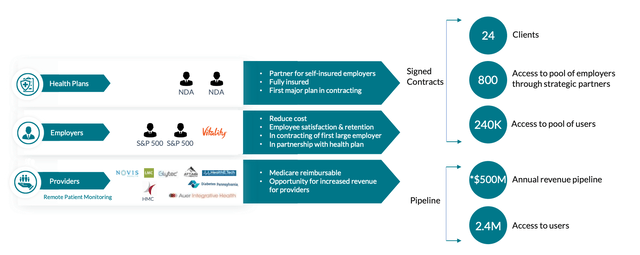

DRIO has accomplished a lot since I wrote my last article. In a recent presentation, management disclosed that the pipeline has increased to over $500mil with potential access to 2.4mil users across its 3 marketing channels from $350mil at the end of Q3 2020.

Source: DRIO Investor presentation

In the employee channel, DRIO was selected by a Fortune 500 company as well as the subsidiary of a Fortune 500 tech and engineering company. Again, I think this demonstrates the strong competitive positioning of DRIO as it is not easy for new companies to win contracts with these large enterprises.

In the RPM channel, DRIO signed a deal with Presbyterian Medical Services, New Mexico's largest qualified health center with 90k patients per year. RPM codes could generate up to $160 per patient per month, so they definitely represent a sizeable revenue opportunity for DRIO.

In the health plan channel, management have told me that there will likely be some contract signings in H1 2021, and while the names of the providers likely won't be disclosed, a press release should be put out when the agreement is finalized. If a health plan is signed, revenue will ramp way faster as thousands of patients can be enrolled overnight.

Upright Acquisition

In a call I had with DRIO's CEO (before the acquisition), I learned that the company was willing to look at acquiring companies that would allow them to expand their selection