Source: Open Text

Open Text's (NASDAQ:OTEX) subscription business has been growing above expectations. The margin and liquidity profile have also improved. This gives Open Text the option to improve its growth initiatives. As Open Text scales its subscription business, I expect its valuation to improve relative to the modest EV/S multiple of 5x and non-GAAP FWD P/E of 14x (47% discount to the sector median). The non-GAAP earnings multiple provides a better picture of future earnings expectations given recent earnings volatility to GAAP metrics due to acquisitions, non-recurring charges, and investments in the cloud business.

Growth (Bullish)

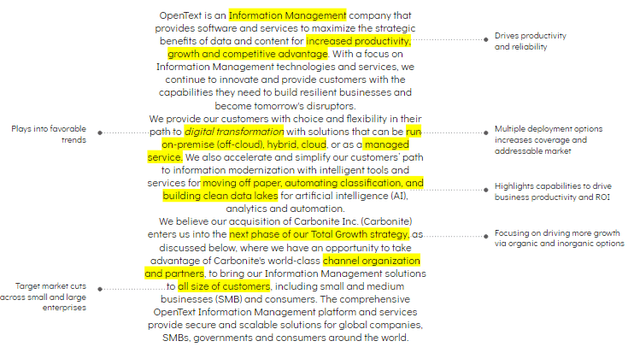

Open Text reported impressive growth metrics last quarter. Given the improved growth prospect of its subscription business, I will be maintaining a bullish outlook on the growth factor. According to its profile, Open Text provides a suite of software products and services targeting the information management space. These offerings play into favorable trends that are driving impressive topline results.

Source: Author

The topline results continue to be driven by expanded capabilities into new tech segments (cybersecurity, content management). This has resulted in cloud wins and impressive customer expansion and retention. Last quarter, Open Text reported revenue of $855.6M. This represents a y/y growth of 11%. This extends the recent run of topline revenue beat to five quarters. Given the growing mix of subscription and cloud offerings, Open Text reports ARR (annual recurring revenue) and cloud revenue to give a better picture of the evolving growth drivers. Last quarter, annual recurring revenues were $684.9 million, up 21.5%. As a percent of total revenues, ARR was 80% for the quarter, up 73% y/y. This is in line with the ARR target model of 81%-83% in FY'21. Cloud revenues grew to $1.36B over the trailing twelve months. This represents a growth of 41% y/y.

Going forward, Open