I've been moaning about how top-heavy the large cap index ETFs have become all year. Though I have long been an investor broad market index funds like the Vanguard 500 ETF (VOO) I can't see buying either when the Cap Weighted S&P 500 index currently invests 29% of its assets into just 10 stocks and almost 16.61% of those assents in just Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN). I'm not happy either about how it has invested 27.8% of its assets in stocks in the technology sector.

That kind of thinking made me revisit the Invesco S&P 500 Equal Weight ETF (NYSEARCA:RSP) to see how it has fared over the past few years. It first came on my radar a good five years ago, but at the time it wasn't heavily traded, and when the S&P 500 dropped dramatically one day, I noted that RSP's price dropped much farther than did VOO's. That made me question how liquid it was so I passed on investing in it.

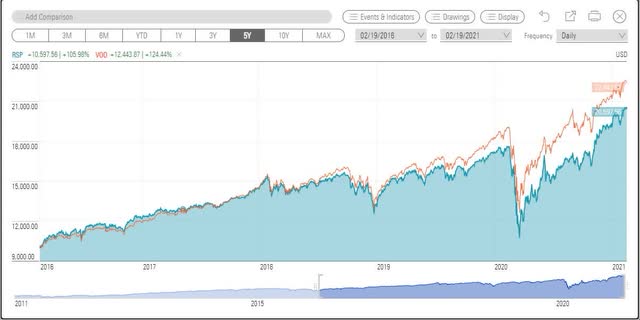

AI didn't miss out. Over the past 5 years RSP's total return has mostly lagged behind that of the S&P 500. Over the past two year it has lagged dramatically, as you can see from the chart below.

RSP (dark blue) vs VOO (Orange) 5 Year Performance

This should come as no surprise, since most of the growth in value of the S&P 500 over the past year has been driven by the enormous growth of its 10 top stocks.

Equal Weighting Has Advantages When Cap Weighting Gets Out of Control

As its name suggests, the Invesco S&P 500 Equal Weight ETF owns shares in all the stocks in the S&P 500. You can learn more about how the S&P 500 index is designed and what kinds of stocks it holds