The Global X SuperDividend REIT ETF (NASDAQ:SRET), which seeks to provide income and price gains to its investors by investing in 30 high-yielding global REITs, was cruising in steady waters until COVID-19 reared its ugly head, smashed into the commercial property market, and disrupted the sector for a long time to come.

The good news is that after crashing from a high of about $16 in February 2020 to a low of about $4.5 in March 2020, SRET has retraced 50% of its fall and is trading at about $9 as of February 19, 2021. Volatility has reduced and investors can expect SRET's price to move in a narrow range until the economy recovers fully.

Image Source: Trading View

Here is my analysis on whether SRET qualifies as an investment for income investors:

Long-Term Impact of COVID-19 on REITs

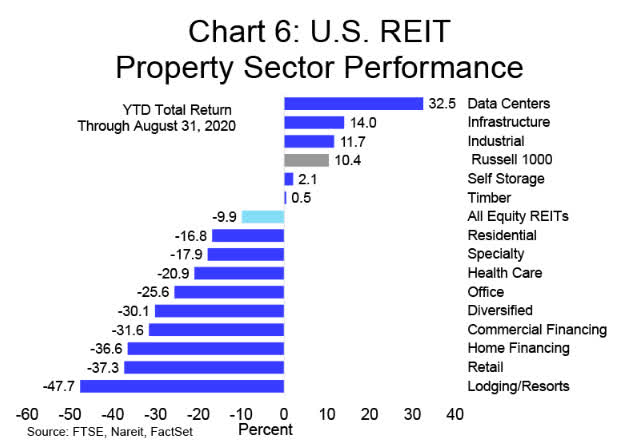

As per the Fall 2020 Report of the National Association of Real Estate Investment Trusts (NAREIT), the only REITs that delivered positive returns were data center, industrial, self-storage, and infrastructure REITs. The rest - residential, healthcare, commercial and home financing, office, hotel, retail, etc., REITs - delivered negative returns.

Image Source: NAREIT

NAREIT says that the sector will recover entirely only after the economy stabilizes. That seems to be a couple of years away because otherwise, the Fed wouldn't have pledged to keep interest rates near-zero until 2022 end.

NAREIT estimates that retail real estate will be impacted by e-commerce and that shopping patterns will transition to buy-online-and-pick-up-at-physical-store kind of shopping. Hotels and resorts can witness a full recovery only after the economy stabilizes. The organization is unclear about how office demand will shape up, given the economic hole and the WFH culture gathering pace.

I believe that if the hybrid working model (home-office) becomes the new normal, commercial real estate will suffer badly.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it's too late.

That's why it's important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.