Introduction

The WisdomTree India Earnings ETF (NYSEARCA:EPI) is one of quite a few options that potential investors are faced with, as they contemplate exposure towards one of the most promising yet expensive geographical regions-India. In this article, I will first touch upon the underlying conditions in India, followed by a few reasons highlighting why EPI may not necessarily be the best ETF to play India if you choose to expose yourself to the country’s risk assets.

India - An attractive landscape but frothy valuations leave little room for error

As per the IMF's forecasts last month, the country is on course to become the fastest-growing major economy in FY22 with an expected GDP growth rate of 11.5% (incidentally also the only major economy forecasted to grow at double-digits), followed by 6.8% in FY23 (also one of the highest GDP forecasts in the world).

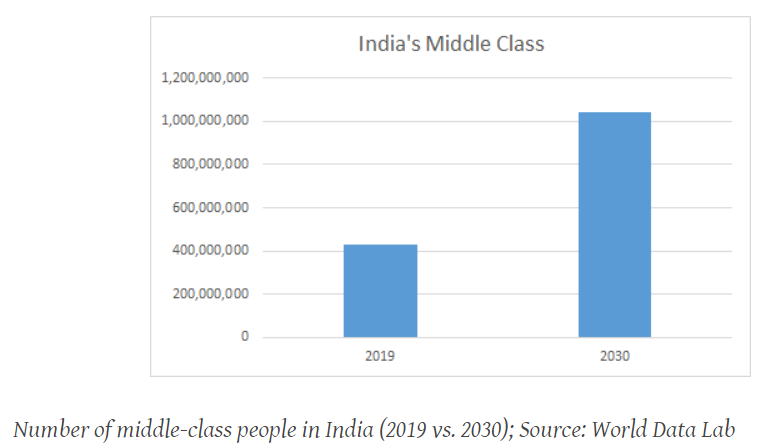

The country also enjoys some very favorable demographics, most notably the rising middle class which is expected to more than double to 1 billion over the next decade, and increase the spending power within the country by almost 3x!

Source: OECD

More recently, over the last couple of months, conditions there have turned healthier. At the start of this month, the country came out with its latest budget which was widely lauded for both its pro-growth and reform stance. Ample coverage was devoted to crucial segments such as infrastructure and health, whilst sectors such as banking saw some long-awaited reform measures come through. In addition to that, the central bank there continues to support the markets with an ongoing accommodative stance. All this has seen Indian risk assets come to the forefront, making this one of the most expensive equity markets around. As you can see from the chart below, the P/E valuation on the Nifty 50 benchmark, recently breached