Investment Thesis

While all ears were on the commentary about Clubhouse, Tony Zhao, the CEO, was tight-lip; instead, he reminded investors why Agora's (NASDAQ:API) RT solutions are better than the incumbents and why the use cases will continue to multiply as digitalization accelerates.

In this article, we discuss Agora's FY2020 results, the first full year of the company going public, and why Agora will remain a core position of our portfolio.

Q4'20 and FY2020 results

Fourth Quarter 2020 Highlights

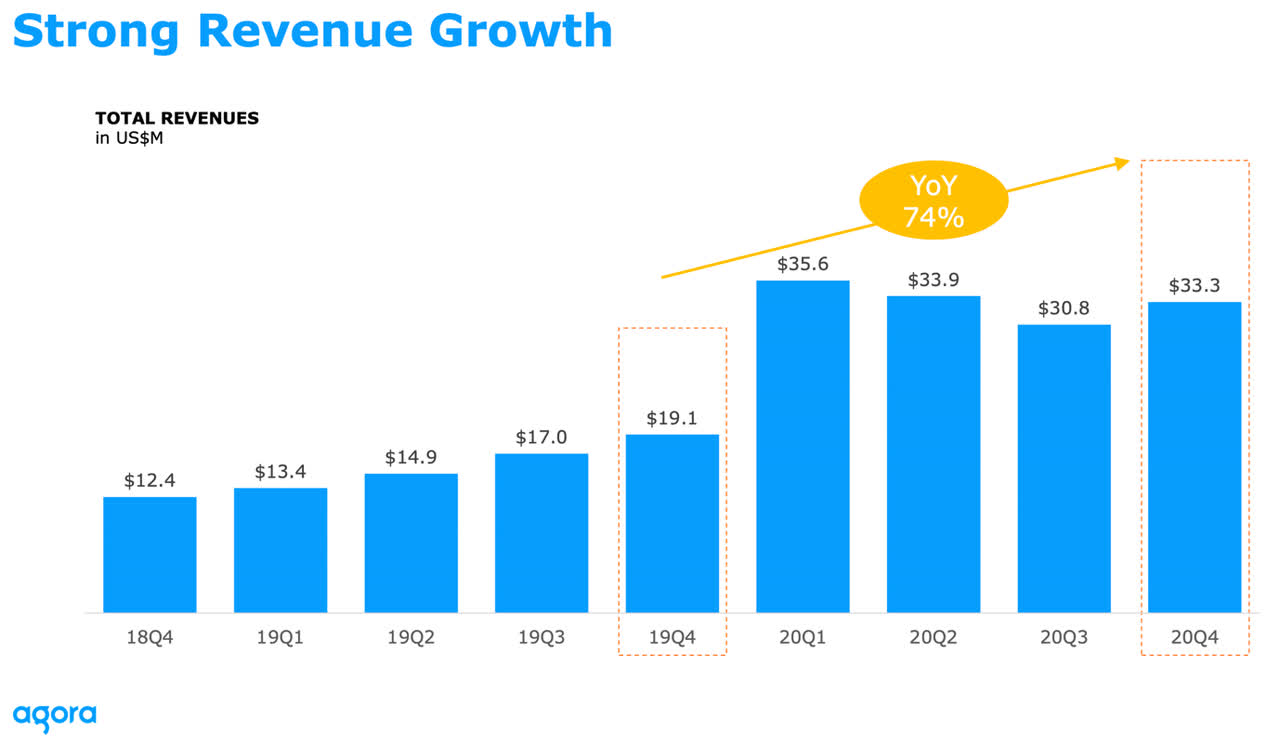

- Revenues were $33.3 million, up 74.1% YoY from $19.1 million.

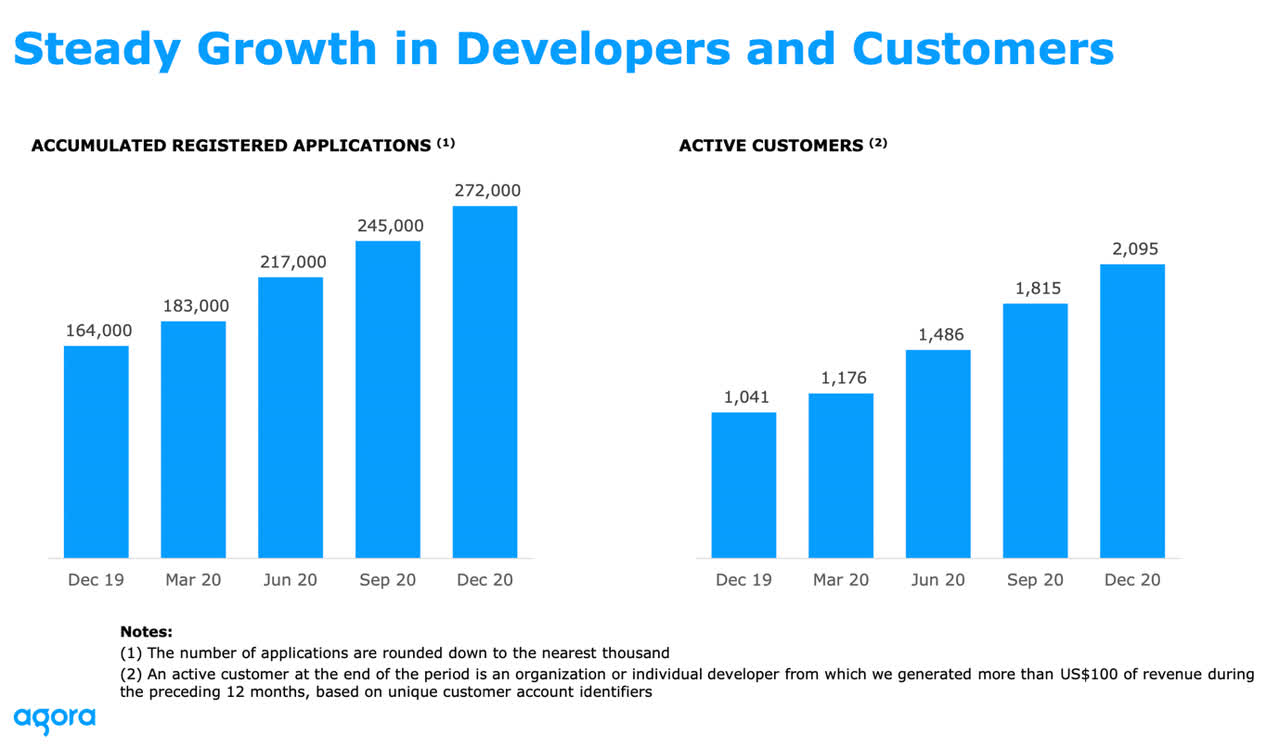

- Active Customers were 2,095, up 101.2% YoY from 1,041.

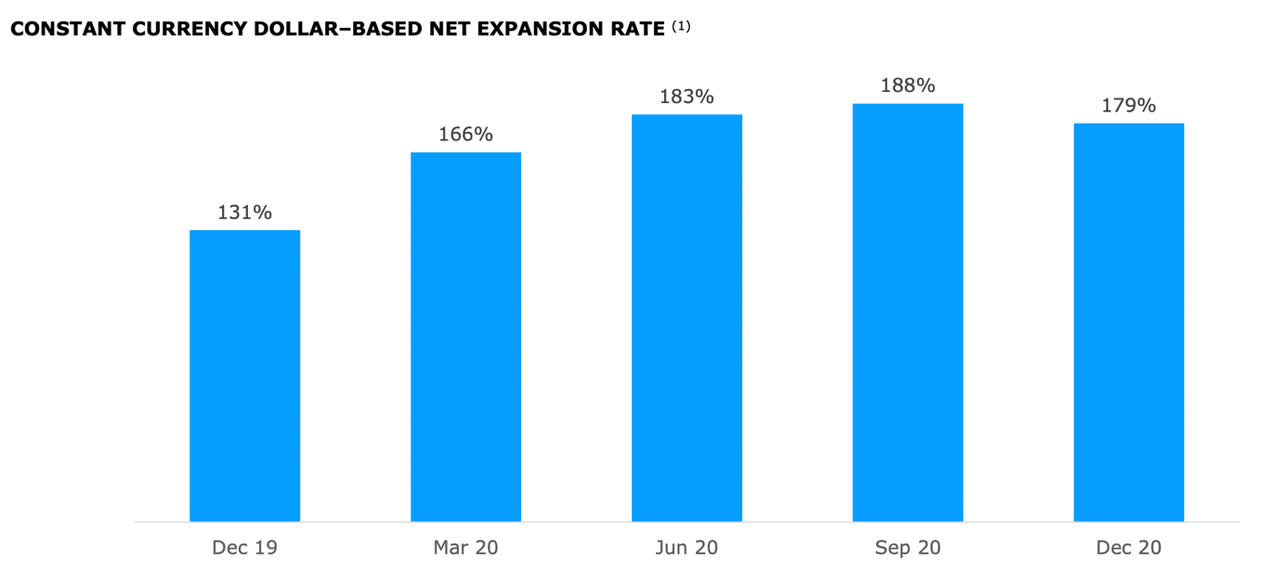

- Constant Currency Dollar-Based Net Expansion Rate was 179% for the trailing 12-month period ended December 31, 2020.

- Total cash, cash equivalents, and short-term investments as of December 31, 2020, was $635.4 million.

- Net cash generated from operating activities was $2.0 million, compared to $2.1 million in the fourth quarter of 2019.

- Free cash flow for the quarter was negative $1.4 million, compared to $0.9 million in the fourth quarter of 2019.

Fiscal Year 2020 Highlights

- Revenues were $133.6 million, up 107.3% from $64.4 million.

- Net cash generated from operating activities in 2020 was $6.6 million, compared to $0.7 million in 2019.

- Free cash flow in 2020 was negative $6.3 million, compared to negative $4.1 million in 2019.

For more detailed information, please follow this link here.

We intentionally left out the net loss from operation numbers as they are minimal, and profitability is not a focus at this early growth stage.

What we want to highlight are:

First, the company revenue results were impressive. Q4'20 results of £33M wildly beat the previous guidance of $26M, by 25%. Boosted by the increased usage during the pandemic in China, Q4 revenue was also higher than Q3, which averted the downward trend since Q1, which was $35.6M.

The fiscal year 2020 revenue was $133.6M, which showed an incredible triple-digit growth at 107% YoY. This hyper-growth number may not continue, but it shows the potential and scalability of the company.

Source: Agora FY2020 results presentation

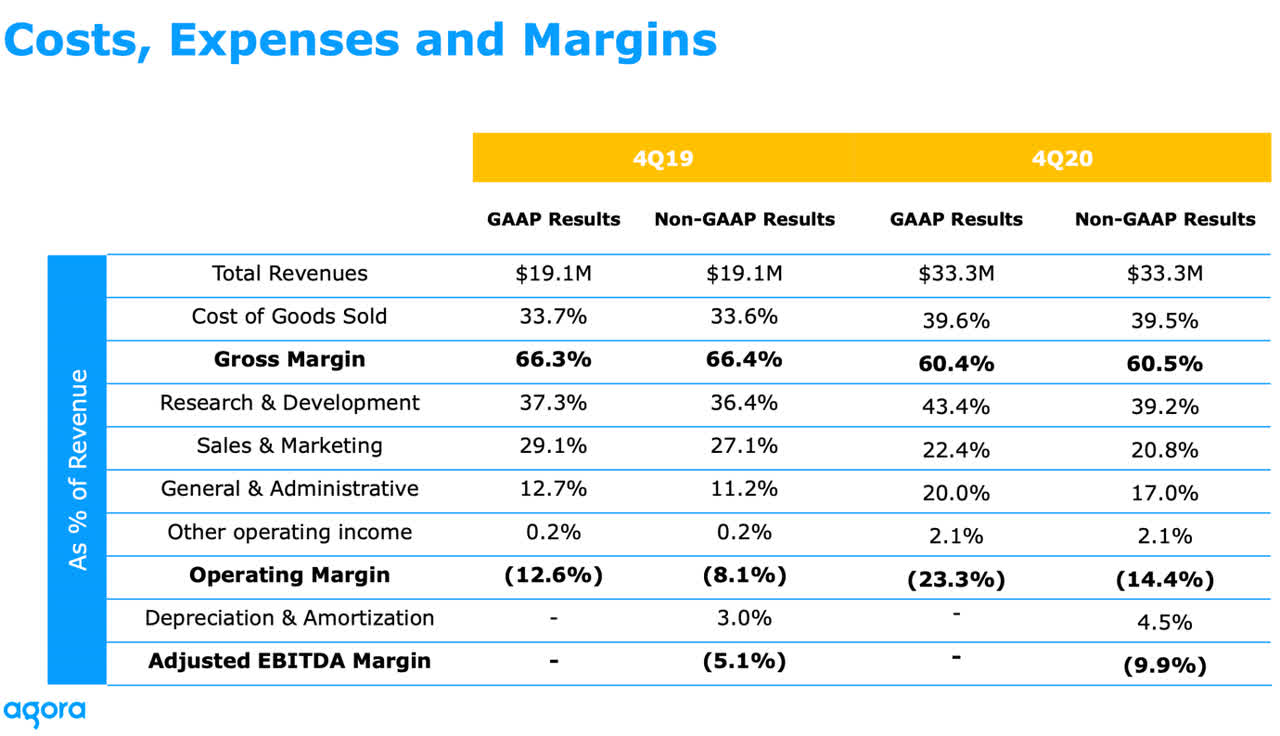

Secondly, gross margin remained high at above 60%. Even though it looks like concern on operating leverage, we are happy with two counterpoints. One, Agora shows signs that it can expand overseas, which explains the lower gross margin due to higher infrastructure costs associated with the increased usage. Secondly, if we look down the financial statements, sales and marketing grew only by 33.8%, much lower than the topline's growth rate, indicating strong sales efficiency and operating leverage.

The following slides explain that Agora has a very sticky service. Dollar-based net expansion rate ('DBNER') remained at very high rates at 179% in Q4. It indicates that customers continued to spend more each year primarily through higher usage.

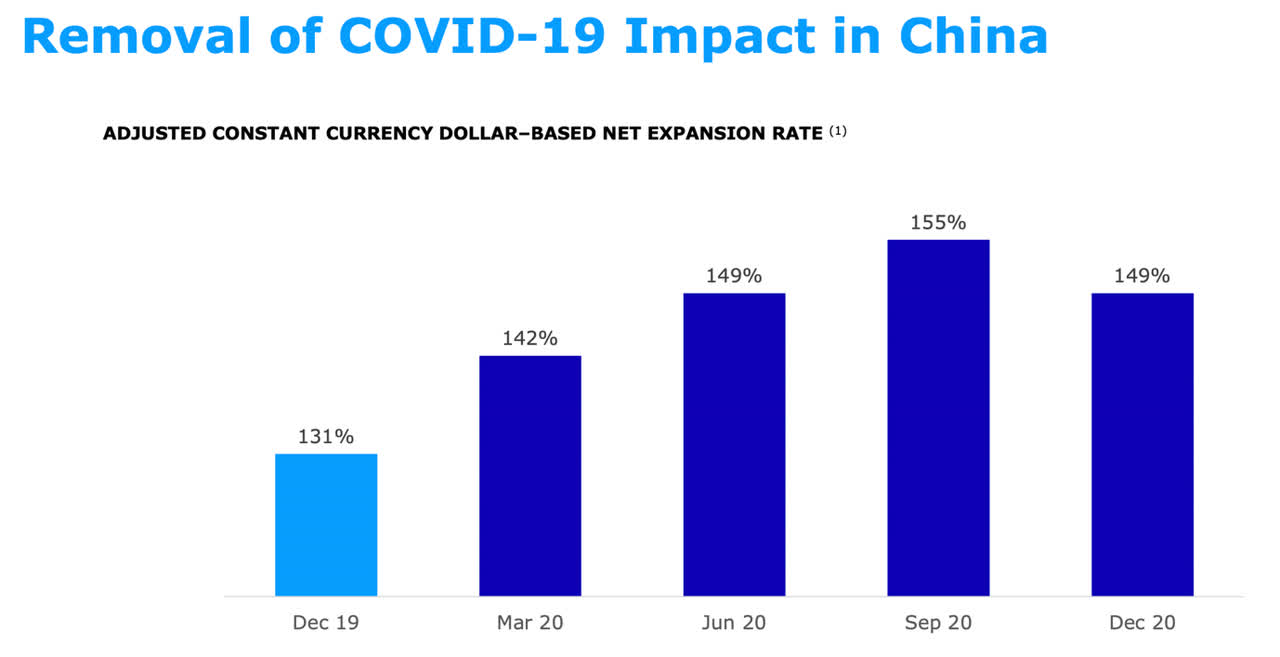

Removing the elevated demand of Covid-19, the DBNER numbers are still very high (on adjusted revenue numbers).

Finally, since Agora's RTC business model is developer-first. To be successful, it's essential the number of applications continues to grow. Impressively, it grew by 65% YoY in Q4.

The high rate of development on Agora's platform is indicative that the flywheel is working effectively, or a clear sign of network effects. As more developers come to Agora, they create more applications, which adds functionality and improves its quality. As a result, it attracts more customers to try out their use cases. Rinse and repeat.

In the next section, we will see why Agora is a class apart from the incumbents and why it is the core reason for our bullishness.

Coming back to the results, we are happy that:

+The company continues to grow rapidly, guiding 35% revenue growth for 2021. Although conservative, if history tells us anything, Agora will smash the target by some margin again. A 25% beat like this year implies FY2021 revenue of $225M. We are confident of high performance because we expect Clubhouse and many other applications such as Yalla and TalkSpace to grow much faster this year.

+The company is expanding overseas successfully. FY2019 revenue breakdown was 80% in China and 20% overseas. FY2020 ratio was closer to 70/30. By 2023, the management expects overseas to generate the same amount of revenue in China. Thus, the Q4 gross margin compression is not a concern as the infrastructure and G&A expenses should gradually decelerate.

Why Agora remains highly attractive

Agora's stock fell 20% before earnings were released, then fell another 15% at the open the day after. On days like these, investors should take a step back, review the facts, and know why they are invested in Agora. To give a helping hand, we offer our reasons why.

First, Agora's RTC technology is distinctively better than traditional audio/video streaming services. An emerging company that looks for the best quality audio and video will want to try out Agora.

Agora | Incumbents | |

Latency | 0.3 second | 3 second |

Communication | Multiple ways | One way |

Time to market | Faster and cheaper | Long and required higher initiation investments |

Development | Low code, customizable | Off the shelf or build from scratch |

Data and Brand name | Doesn't store client's data and doesn't place Agora's brand on the application | Store client's data and use their brand |

Source: Corporate website, blogs, compiled by the author

Agora's latency is 0.3 second on average, which is ultralow and substantially better than the 3 second average on traditional providers. The minimal transmission interruption enables more interactive, real-time, and higher engagement in large discussions such as classrooms, conference calls, or 'real cast' (like Clubhouse rooms where there are multiple speakers). Ultralow latency also sparks spontaneous conversations and leaves participants with a feeling of real connection akin to face-to-face interactions. Features such as whiteboard, polls, raise of hands to speak without interruptions make a discussion on Agora much more 'real.'

Agora's low code and simple APIs also allow faster time to market. It is precisely why Clubhouse was born within a week of development and scaled up from thousands of active users to 10 million within months. While the management could not comment on this particular detail, we see that Clubhouse will not be the last hyper-scale app born out of Agora. This adds a lot of optionalities that can't be priced in the current high valuation.

We track Agora use cases frequently. It grew from four last year to six recently. Now, we see even more use cases presented on the following slides.

The last item is exciting. It looks like the crystal-clear voice quality on Agora could apply to IoT use cases as well! This opens up another huge market opportunity and steps on Twilio's (TWLO) path, which is not necessarily a bad thing.

Since investing in Agora requires a bit of imagination and optimism for the future. We think that Agora's success in certain use cases could place it in the spotlight as a potential acquisition target. Zoom (ZM) has been mentioned a few times due to the overlap in enterprise use cases and a perfect match-up for Zoom's technology stack. With IoT, Agora places itself on Twilio's radar, a company that isn't shy from acquisitions either.

Conclusion

To sum it up, Agora's FY2020 results show a highly scalable and sticky business model, demonstrated with high gross margin and a top-class DBNER and growing demand for Agora's RTC technology as use cases expand rapidly. As a result, we envisage incredible potential for expansion in the future. Agora remains highly regarded in our portfolio despite its high valuation.