I realize that the title of this article may come across as a bit "On the nose." How does one, after all, compare a pure Asia-focused growth stock like Alibaba (NYSE:BABA), with the largest managed health care insurance company in the US, namely Anthem (ANTM)?

The answer to that question is clear to me - as potential investments with the goal of making market-beating rates of return.

To me, questions like these are going to become more and more relevant as I move forward investing in 2021.

Let's take a look at the two candidates.

1. Alibaba - Chinese Tech and e-commerce

The Alibaba Group Holding Limited is a Chinese multinational tech company, mostly known for its Amazon-competing marketplace Alibaba.com. It also focuses on retail, internet, and technology investments. It can trace its roots back 22 years to the dot-com bubble and was IPO'ed back in 2014 which gave the company an initial market value of around $231B. At that point, it was the largest IPO in world history.

(Source: Wikipedia, "Alibaba")

At this point, the company is one of the world's largest retailers and e-commerce companies. It's also ranked as the world's fifth-largest AI company, a large venture capital firm, and one of the overall biggest investment companies on the globe.

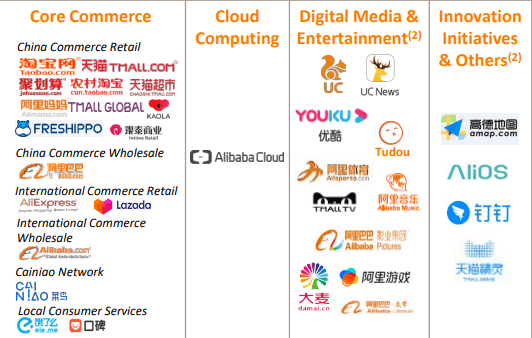

At this time, it hosts the world's largest B2B marketplace, Alibaba.com, the world's largest C2C marketplace, Taobao, and the largest B2C marketplaces in the world (Tmall). The company is expanding into media as well, with revenues rising in triple percentage points year over year.

(Source: Alibaba 3Q20 Presentation)

The way I view it is essentially the Chinese version of Amazon (AMZN), which is a comparison often heard when looking at this company. Trying to describe all of Alibaba in one article is a bit of a task, so I'll attempt to stick to the basics.

The basics, of course, include the company fundamentals. On a strictly fundamental basis, and ignoring the foreign-associated or sovereign risks with investing in the Alibaba Holding group stock, the company has always thrived on the basis of its growth. That growth, as I'm writing this article, is continuing. The measurable metrics concerning China Retail, the company's biggest market, is confirming an increasing number of annual purchases, growth in new consumer ARPU, and growth across its marketplaces, including Alibaba, Taobao, and Tmall.

Taobao, for instance, saw a recovery, not unlike some market leaders in the EU and NA.

(Source: Alibaba 2020 Investor's Day Presentation)

Results in streaming and media were also encouraging in the latest results.

(Source: Alibaba 2020 Investor's Day Presentation)

The company is moving from being a licenser of content, which was essentially where it started out in 2017-2018, to a producer of content, with over 50% of volume now being owned rather than licensed.

(Source: Alibaba 2020 Investor's Day Presentation)

These are only singular examples. Results across the board, if we view the results on a much broader basis, were excellent. YoY quarterly revenue growth was 30%, and the cloud segment saw 60% cloud computing YoY revenue growth. Consumers have grown to 881M based on mobile access (unique), and 775M annual active customers in the China retail marketplace. The company reported quarterly EBITDA of $6.1B adjusted and $6B of non-GAAP free cash flow.

Growth was robust, and across the board, including the logistics segment, things are driving upward. The revenue breakdown shows promising trends, and things we can't really afford to ignore.

(Source: 3Q20 Alibaba Presentation)

By that, I mean that the growth is found across every single segment in the business to one degree or another, which is of course excellent. The one place we can see declines are in the company's margins, with drops of around 1-9% in terms of adjusted EBITDA margins. I choose not to include the Innovation Initiatives segments, as this segment is tailored toward investments that may initially be unprofitable.

Alibaba is the world's largest e-commerce company in terms of GMV, or the gross merchandise value. The volume of transactions alone notes the moat and competitive advantage the company has. It has also managed to integrate multiple products for customers in a way that Amazon, in the same way, has not, noticeably Taobao, with Tmall for selling branded products.

Because of its first-mover advantage in its native China, it was also able to attract major vendors and buyers due to the vast offering of products, and the company's ecosystem is as extensive (or more) as amazons, with hundreds of thousands of products ranging from food delivery to retail products.

The company's ecosystem is a distinct advantage over competitors, which are notably Pinduoduo (PDD) and JD.com (JD). Alibaba has a ridiculous amount of market share, coming in at around 55-60%. Amazon China was less than 1% back in 2018, and it's unlikely that it's grown to rival Alibaba's position since, and the company shuttered its Chinese marketplace business back in 2019.

I wrote in my article on Amazon that the company has not grown in Europe as quickly as it expected to. The danger is of course of Alibaba as a potential competitor for Amazon in Europe, which could have the effect of limiting the company's market share outside of the US. I don't think that Amazon will be dislodged in the US for the foreseeable future, but I don't think the same is true for the EU, where markets are far more individual and fluid.

The same can be said for China as well, where Alibaba may not face the sort of competition that Amazon is facing in the US or EU, it being the company's home market just as the US is for Amazon. The big difference is that Alibaba owns a bigger market share of the Chinese market, which is bigger than Amazon does of the US e-commerce market - significantly so. Amazon owns 39%, Alibaba owns 58% respectively.

This is not an Amazon vs. Alibaba article, but I thought it interesting to mention here. Barring certain complications, I might consider Alibaba the better growth investment based on valuation and future potential.

Alibaba - Risks and Valuation

The valuation from a strictly earnings-based perspective shows remarkable promise. At a forward expected growth rate of around 23% on average in terms of EPS, the company typically trades at a valuation premium of 29-32X P/E. It currently trades at closer to 26.5X. Since the failure of the Ant IPO, the stock has taken a significant beating. Based on the current estimates, which have been right most of the time, the investment could appreciate significantly in only 2-3 years' time.

(Source F.A.S.T. Graphs)

There's little else to be said about the potential here. If you believe in the company's premium due to its massive, historical, and projected growth rate, then based on its projected earnings growth and historical premium, this is a good time to buy Alibaba. The company is A+ rated, and at a CAGR of 31.68% per year over the next 2-3 years, this would vastly outperform the broader potential market. If I were to value Alibaba as a growth stock to the exclusion of the sovereignty-related company risks (or if it was a standard NA/EU stock), I would put its fair value somewhere around $330/share, which would put the company at undervaluation and make it a "BUY" here.

For some investors, that's really all there is to it, and I certainly understand the sentiment here. However, there's of course more to it than that.

Those discussing the risks talk about things like the Holding Foreign Companies accountable Act, which would essentially de-list BABA if they fail to comply with US auditing regulations 3 years from now on. This is a minor point - I think any Chinese business worth its salt will look at the 3-year timeframe and give a hearty chuckle. Complying here won't be a problem.

The other risks are far higher. First off, the Ant group IPO fiasco was a big one, and it was the Chinese government putting its boot down due to lending business concerns. Let's be honest though, there were certainly some political motivations behind closed doors as well, given Jack Ma's tendency to anger the political establishment in China. Will Ant Group ever go public? I wouldn't count on it, at least not insofar as an investment thesis for BABA. The internal political quagmire in China is such a big risk that I view it as quite literally impossible to expect what may happen going forward. While not versed in Chinese law or trends, I fail to see what, if anything, could prevent the government from simply seizing BABA entirely, turning it into a state-owned business.

Granted, there has been no signal whatsoever of this, but when investing in a country like China, it often seems that everything/anything's on the table.

Secondarily, and this would be a smaller concern if BABA had an EU listing, China and US relations are frosty, to say the least. It remains to be seen if Biden will do anything to thaw this, but initial signals have been "No", with no plans to rapidly lift any of the tariffs instituted on Chinese goods.

This isn't as much an issue to Alibaba as a business, because their main market and growing market is China and South East Asia - however, the listing is on the NASDAQ, and this could cause potential problems.

Furthermore, Alibaba is as liable as any company to be hit with lawsuits and fines for practices - such as monopoly/competition. This is a small one, and I believe Alibaba, like Amazon (AMZN), will come out mostly on top here and adjust where they need to in ways that don't carve swathes out of their bottom line.

A short history lesson

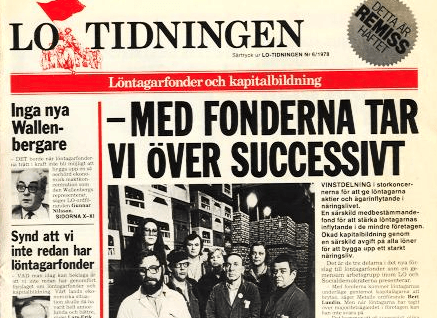

(Source: LO)

In the end, however, there's a reason why my portfolio doesn't yet hold a single Chinese investment, and why I'm extremely hesitant to commit to even one.

Hailing from a traditionally socialist nation, I know well what a government like China could decide to do, given certain situations or climates.

It's not all that scary for consumers/employees, but it's certainly scary for investors and business owners. In Sweden, we saw attempts to forcibly nationalize or "democratize" companies through forced profit sharing with government-influenced unions, where they would essentially become shareholders, eventually owning majority stakes in successful businesses.

The process would essentially make private ownership public, and turn companies into collectively owned businesses. The title of that article from the worker organization newspaper says it all: "With the funds, we're successively taking over." Even decades later, it makes me shudder.

This utter horror was actually partially instituted in the form of a far-reaching corporate tax during the years of 1984-1990 and was one of the direct causes for the conservatives winning the election in 1991, with the socialists/democrats below 30% for the first time in history. It also caused the largest political protest in Swedish history, gathering more than 100,000 opponents of the idea.

The "Employee funds", as they came to be called, also caused the deepest rift on record between business owners and the left-leaning government, contributing to entrepreneurs and their businesses leaving Sweden permanently. These businesses include but are not limited to IKEA (Not listed), Tetra Pak (Not listed), and Hennes & Mauritz (OTCPK:HNNMY). The companies and the owners' entire families left Sweden to never return. Ingvar Kamprad, the founder of IKEA, lived in Switzerland until he passed (in Sweden).

Hennes & Mauritz was the only company to return to Sweden, and they did this only after the leader of the social democrats in the early 90's personally guaranteed that no "employee funds", in any way, shape, or form would ever be reintroduced. The conservatives, at the beginning of the 90's canceled them and through legal means prevented the more extreme versions from ever being legal again. This also wasn't long ago - we're talking less than 30 years.

I believe that without the Employee funds, Sweden would be a far more socialist country today and would have seen privatization happen far later than it did (instead of the early '90s) - perhaps more akin to the development in Norway, where many businesses still partially state-owned and were fully nationalized for a very long time.

In a way, the funds were the "true" socialist-leaning government's last hurrah, as everything following became far more center-leaning. They are part of the legacy that some tried to push Sweden towards, but which never really occurred, yet still caused the downfall of more socialist thinking here.

To this day, no such proposal has ever been reintroduced, and only the more "passionate" youth organizations of the left party consider them something to aim for anymore. No party publicly supports them - not even the left-wing, which are near-communists here, and would certainly be communists by US standards. Famously, Minister of Finance Kjell-Olof Feldt was captured on camera while writing a negative poem about the funds in his bench in Parliament already when they were introduced.

I believe any political party, even the left, knows that even mentioning them in a positive light would be losing every business owner vote they have.

(Source: Vectorstock)

The reason for this little detour is simple. Most of you from the US have probably rarely considered, lived, or realized what may happen to companies that hail from nations like that, or how political things might affect investments.

While I'm too young to have personally been part of it, I assure you that China is a long way from being free from such potentials scenarios, and whether you believe this to be true or not, it's at last something to be acutely aware of when investing in any company legally domiciled in the PRC.

Again, I'm not saying this will happen, or it makes BABA uninvestable - but it's in my mind when I look at any Chinese company because I do see tendencies of the Chinese government dabbling in the free market. This is of course not unique to China, or to Sweden. Germany in fact has a mandatory law as well, where union representation on the board of directors is mandatory after a certain company size, and it pays to understand such things when forecasting how companies may or could develop.

Let's look at option number 2.

2. Anthem

Anthem is of course an entirely different company than Alibaba. I recently wrote a comprehensive piece on Anthem as a business and investment. The article can be found here.

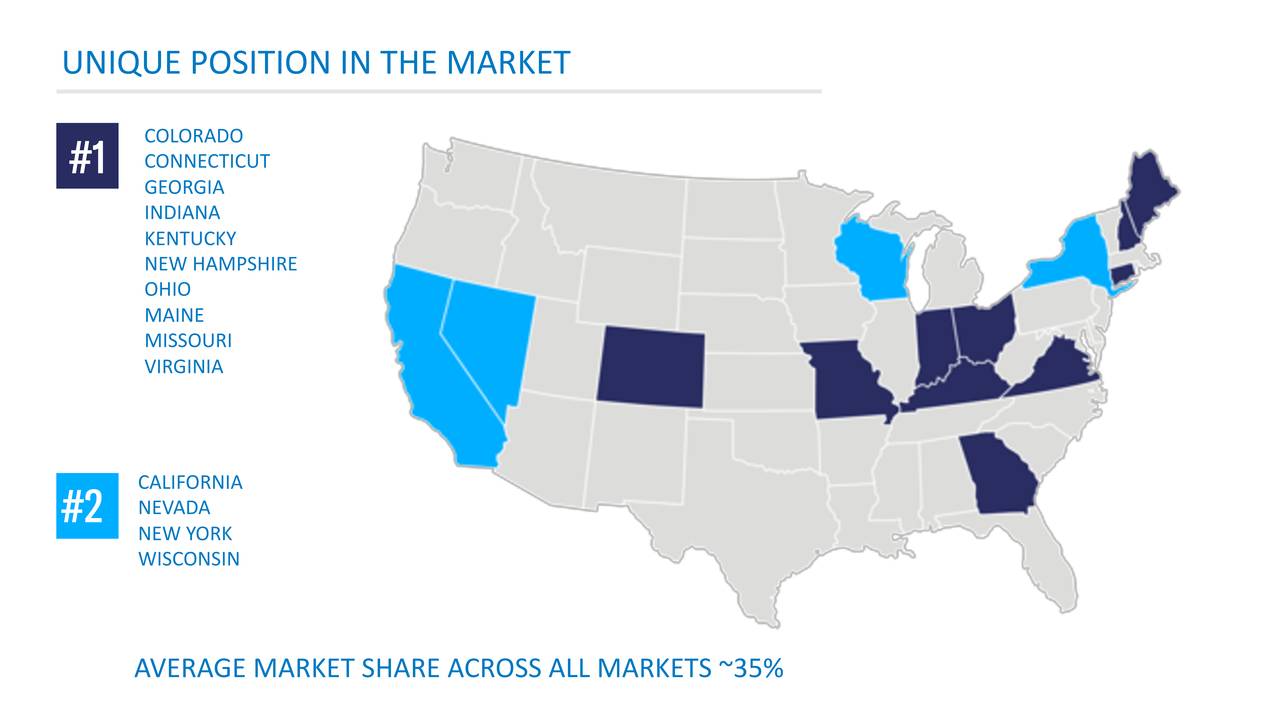

(Source: Anthem Investor Presentation)

Anthem is the largest managed healthcare insurance company in the United States. It has an impressive scope of operations going back decades, and it currently has the enviable market position of serving over 43 million Americans with various types of healthcare and wellness insurance, as well as introducing scrip management, AI, and other forms of healthcare-related services.

(Source: Anthem Investor Presentation)

The company does not only have an impressive history in terms of earnings and company, it also has an impressive dividend history, with growth over the past decade amounting to nearly 17%, nearly quadrupling the original dividend of $1/share since 2011. And even today, that payout ratio is still below 20%, meaning there's plenty of room to grow, should the company decide to do so.

Anthem's fairly unique market position means that it dominates several key geographies, and has near-dominant positions in others. In a market with hundreds of millions of policyholders, this is not insignificant.

(Source: Anthem Investor Presentation)

With a service offering covering mostly everything, and those services being offered to federal employees and through government contracts, Anthem is in the profitable position of also working tightly with various governmental entities in the US, allowing them to grow further.

(Source: Anthem Investor Presentation)

(Source: Anthem Investor Presentation)

There's very little to suggest, except policymaker opinion that "Healthcare costs too much", that Anthem or the overall healthcare market will face some sort of dire straits going forward. Demographical trends, enrollment trends, chronic diseases, medicine development - all trends are showing potential growth, and so are the future forecasts for the company.

Anthem needs less of an introduction than Alibaba given the article on the company, as well that it, at least compared to Alibaba, a far more simple business.

Let's look at what makes this a competitor to a growth stock.

Anthem - Risks and valuation

Unlike Alibaba, Anthem trades at a significant discount valuation to its usual premium, currently marking an average weighted P/E of 12.7X. While not as low as some of the numbers we saw during the pandemic crash, the numbers are still remarkable.

(Source: F.A.S.T. Graphs)

This is an A-rated healthcare company that hasn't missed 10% MoE-adjusted estimates in 10 years. That, or its dividend history, is of course not enough to qualify it as a growth stock, but I believe that the expected earnings growth averaging around 12% going forward, and historical growth between 10-32% in EPS does qualify it as a "growth" stock, at the very least.

(Source: F.A.S.T. Graphs)

Just reverting to an around 15X P/E coupled with the appreciation from growth, the returns could be around 20% per year until 2023, totaling around 67.5% total RoR. This is of course lower than the returns projected from Alibaba, but I don't think you'll find a lot of people who view this as a "riskier" investment than Alibaba. In fact, I think most would agree this qualifies as a far less risky investment than Alibaba, due to the Chinese company's multitude of segments, but most of all the political and sovereignty risks.

At the current valuation, I would view Anthem as around 20% undervalued to a fair price value of $350/share, which would make it a "BUY". The company's dividend is considered safe as can be, the 3-year average forward PEG ratio is, based on current estimates, around 1.55X, and the company is considered to have a moat.

Comparing it to other growth stocks, there would be little in the way of drawbacks except for perhaps the limited (compared to other growth stocks) appreciation potential. However, this is made up in part by a strong dividend.

Decisions - what's the better choice?

These two companies are certainly different choices.

The upsides are also somewhat different. Alibaba offers an impressive annual potential return of over 30% over the next 2-3 years, while Anthem offers around 10% below that, albeit at a substantially different overall risk profile.

Neither of these companies is a "Bad" choice - they both offer extensive safeties and good fundamentals. However, one of the companies does hold a significant amount of political risk, whereas the other one holds more of a policy-oriented sort of risk going forward.

While the upsides aren't directly comparable - 20% is far less than 30% annually - I view both of these as a type of "growth" stock, with Alibaba being the more pure growth company.

To me, the political risks surrounding Alibaba and its operations in China, amplified and confirmed by the Ant IPO failure, makes Alibaba an unfavorable risk, even with the company's massive upside. We just don't know what the future holds for China from a political perspective, and investing in a company with China as its home market, therefore, constitutes a risk. I don't believe investors of BABA would be hung out to dry if something happened. If this were the case, virtually any Chinese investment would become a no-go for international investors, and this would be contrary to Chinese interests as well - at least for the time being.

That does not mean, however, that China can't assert political pressure or control on the company short of taking it over. This is not unique to China, but few other nations are declared "authoritarian states". This is not my opinion, that is the EIU and their democracy index, which gives China a 2.26 out of 10.

(Source: Wikipedia, Democracy Index)

I love investing in Norway, which wins the index at a 9.81 in the first place. Sweden is 9.2, Finland 9.2, and Germany 8,67. The US comes in at around 7.92, which is still respectable.

But just like I wouldn't invest money in Iran, Sudan, Eritrea, Venezuela, or Yemen, I'm at least hesitant to touch even the best of companies out of a nation that shares democracy index values with the nations mentioned here. Part of the reason our market looks like it does are the values of democratic states and freedom - as I believe anyone would agree to.

If the company had been domiciled anywhere else with a respectable safety from political maneuvering, it's entirely possible that my pick here would have been BABA.

I also don't fault those of you who pick BABA out of the two. The risks of which I speak in this article are, for the most part, theoretical when looking at the longer-reaching/more extreme scenarios. There's no indication of something such as this happening at this time.

However, if the world in 2020 taught us anything, I believe it taught us that things may change - therefore, between these two companies, I choose Anthem.

Wrapping up

Anthem is on my "BUY" list and has been for about a month since I got my eyes opened for the company at this valuation. I view the company as one of the better potential investments on the entire market today.

The current market is not a good one for value investors. Out of around 300-400 companies I follow and track in my QO-system, including 13 data points, only 27 companies are what I would consider "attractively valued" and "Investable". In this, I'm not including companies from southern Europe at this time, due to the troubles still at work there which make visibility poor. These 37 companies are Swedish, Norwegian, Finnish, US, Canadian, and Germany - and one French.

At no point that I can remember, even prior to the COVID-19 crash, has the market shown this lack of valuation opportunity.

This, to me, makes me caution every investor I know and every person whose funds I either manage, hold or advise on. The current market temperature feels exuberant - too much so. Buffett said it best, we need to be very careful when others are greedy - even fearful.

So, I'm fearful. And fear dictates that we only focus on the clear opportunities out there at the moment.

Alibaba is certainly one such opportunity, provided you can get past the political risks involved in the stock. Compared to Anthem, I cannot - and the comparison was the point of this article.

I choose a 20% potential annual RoR in Anthem with a 1.5% yield as a "growth" investment prior to a 30% potential annual RoR in Alibaba which comes with all of its political caveats.

What about you?