The world of REITs is vast. Investors who are looking for consistent income have a wide range of companies to focus on. Some players in this space invest in one particular type of asset, some invest in many, and some based their investment philosophy largely on a specific region. One interesting REIT for investors who are looking for a particular niche is Industrial Logistics Properties Trust (NASDAQ:ILPT). While the company does have a presence in more than half of all US states, the bulk of its business is located in Hawaii. In addition, as its name suggests, it focuses in large part on industrial and logistics related assets. Based on the company's historic track record, it also appears to be an attractive play for those who are looking for long-term growth, and consistent, robust cash flow. And unlike many REITs that are out there today, shares of this business look attractively priced.

A look at Industrial Logistics

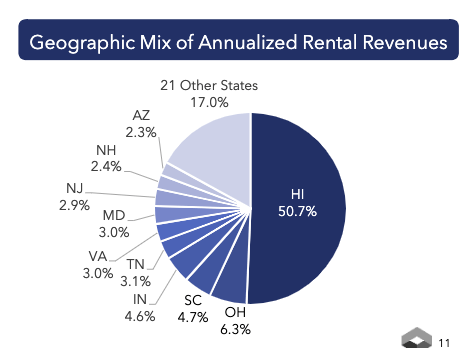

Operationally, Industrial Logistics is a simple business. The company owns 289 industrial and logistics properties spread across 31 US states. While this looks like a well-diversified operation at first glance, the fact of the matter is that the bulk of its business is focused on Hawaii. Only 63 of its properties are located on the mainland in the US. That represents 18 million square feet. Those particular assets boasting 99.7% leased rate, and they have a weighted average term remaining on their leases of 5.7 years. Collectively, these assets only account for 49.3% of the company’s annualized rent.

*Taken from Industrial Logistics Properties Trust

The majority of Industrial Logistics’ presents is in Hawaii. There, it owns 226 properties, amounting to 17 million square feet. The leased rate of these assets is a bit lower than their mainland counterparts at 97.2%. However, what is currently occupied boasts a considerable 13.2 years

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!