Introduction

Whilst the Covid-19 inspired economic downturn has been rough for PBF Energy (NYSE:PBF), their midstream partnership subsidiary, PBF Logistics (PBFX) has remained shielded along with their high 9% distribution yield, as my previous article discussed. This article provides a follow-up analysis that takes a look at their year ahead in 2021 and also reviews their subsequently released financial results for the fourth quarter of 2020.

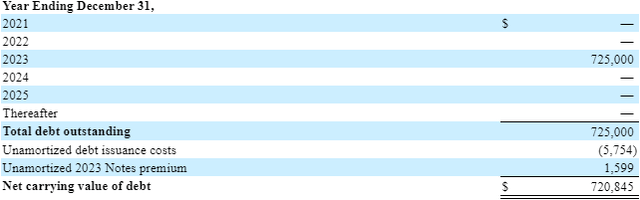

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

*There are significant short and medium-term uncertainties for the broader oil and gas industry, however, in the long-term they will certainly face a decline as the world moves away from fossil fuels.

**Whilst the oil and gas industry to which they service has high economic sensitivity, given the more stable nature of the midstream sub-industry this was deemed to be average.

Detailed Analysis

![]()

Image Source: Author.

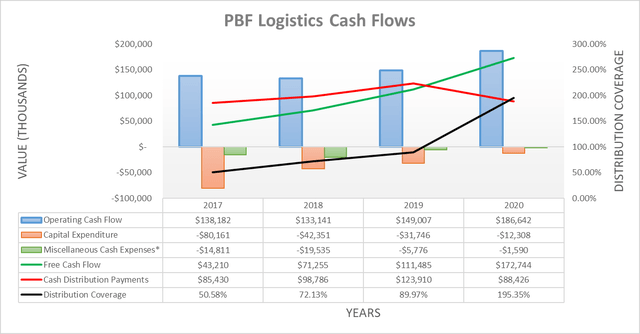

Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact to their financial position. The main difference between the two is that the former ignores the capital expenditure that relates to growth projects, which given the very high capital intensity of their industry can create a material difference.

Since their fourth quarter of 2020 results have been released, it can be seen that they fared extremely well during 2020 despite the severe economic downturn with their operating cash flow actually increasing 25.26% year on year from $149m in 2019 to $187m in 2020. Unlike some of their peers, this was not simply due to favorable working capital movements since their operating cash flow excluding working capital movements increased by 28.56% year on year and thus confirms the strength of their downturn defying results. When looking ahead into 2021, there are reasons to expect this strong performance to continue based upon the following guidance from management.

“Going forward with changes I just mentioned, we expect partnership revenues for 2021 to be in the $330 million to $350 million range. With 2021 EBITDA in the $210 million to $220 million range.”

“Our 2020 total CapEx was $12.3 million. For 2021, we currently expect the CapEx to be approximately $15 million.”

-PBF Logistics Q4 2020 Conference Call.

Overall their guidance indicates for 2021 to be broadly similar to 2020 and whilst this may be not as exciting as their double-digit growth that 2020 saw versus 2019, it nevertheless remains excellent news for income investors. Their management is currently forecasting 2021 EBITDA of $215m at the midpoint, which is very close to the $230m that they reported for 2020, as per their fourth quarter of 2020 results announcement. In theory, there should be a strong correlation between changes in EBITDA and operating cash flow and thus it stands to reason that their operating cash flow for 2021 should be of similar magnitude to that of 2020. Since their very minor forecast capital expenditure increase of $15m for 2021 versus $12m for 2020, this should ultimately lead to very similar free cash flow for 2021 as that of 2020 at approximately $173m.

This free cash flow will easily provide very strong distribution coverage at over 200% since their current quarterly distributions of $0.30 per unit only costs them $75m per annum, based upon their latest outstanding unit count of 62,365,612. This means that they have very solid prospects to increase their distributions higher in the future because as subsequently discussed, their financial position remains very healthy and the envy of many midstream partnerships. At the moment management seems to still be prioritizing further strengthening their financial position but nevertheless, they have still left the door open to review their distribution policy, as per the quote included below.

“Debt paydown and strengthening liquidity are the priorities. Today, we maintain our distribution of $0.30 per unit. We will continue to review our distribution policy going forward, with respect to the company performance, market conditions and alternate use of funds.”

- PBF Logistics Q4 2020 Conference Call (previously linked).

They have been flagging strengthening their financial position as a priority over higher unitholder returns for a while now and I doubt that this will last too much longer, as an earlier article of mine explained. This means that it would not be unreasonable for unitholders to expect an even higher distribution yield later in 2021.

Image Source: Author

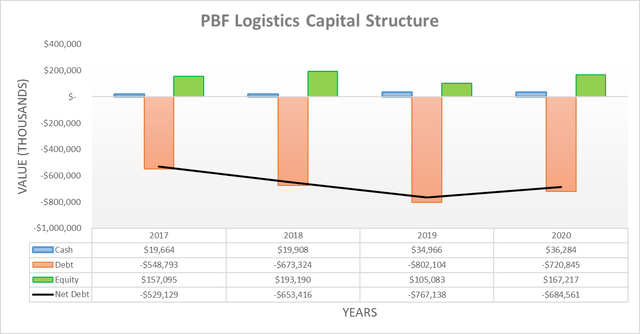

Once again another quarter has passed and their net debt has continued ticking lower, dropping to $685m versus $706m during the fourth quarter of 2020 and thus now leaving it down 10.76% since the end of 2019. Meanwhile, their cash balance climbed higher along with their equity during these same time periods, thereby reinforcing their high distribution yield and setting themselves up for even higher payments in the future. Looking ahead into 2021 and unless they increase their distributions, they should reduce their net debt by approximately another $100m or 14.61%, based upon the previously discussed cash flow performance. This means that if no distribution increase is forthcoming in 2021, then the probability rises even higher for 2022 with their net debt further decreasing.

![]()

Image Source: Author

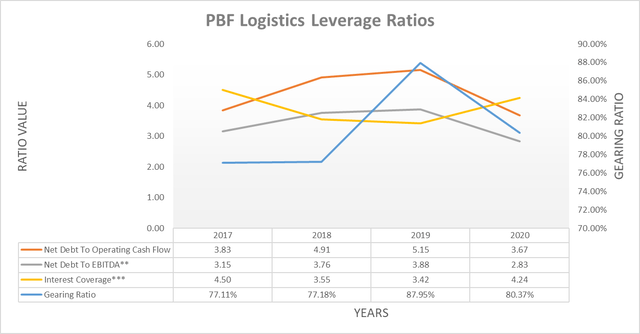

Following their impressive cash flow performance and net debt ticking lower, it was no surprise to see that their leverage followed in tandem during the fourth quarter of 2020 and thus further helps keep it safely within the moderate territory. This is primarily evidenced by their net debt-to-EBITDA of 2.83 sitting comfortably between 2.01 and 3.50, along with their interest coverage of 4.24. Whilst their gearing ratio saw an improvement by the end of 2020 at 80.37% versus 87.95% at the end of 2019, it nevertheless remains very high but similar to my other analysis, I feel that leverage relative to earnings is a superior indicator than relative to the accounting value of net assets. This provides a solid base for 2021 and beyond, which should remove any handbrake on a return to distribution growth.

Image Source: Author

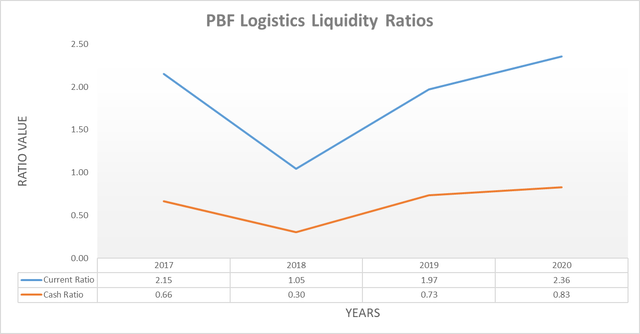

Not only did their leverage tick lower but their liquidity has strengthened further into the strong territory with current and cash ratios of 2.36 and 0.83 respectively versus their previous lower results of 1.84 and 0.52 respectively. Given their continued solid outlook to generate ample free cash flow after distribution payments in 2021, they are not likely to require their credit facility but if required, it retains a further $295m available.

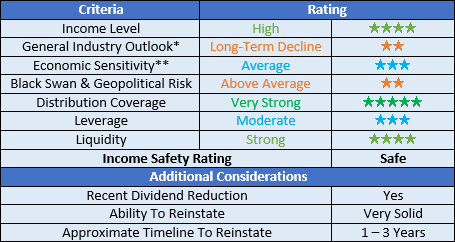

Their debt maturity profile sees them having zero debt maturities until 2023, as the table included below displays. Whilst this is favorable, on the other hand, all $721m of their debt matures in the same year. This creates one big hurdle to jump but given their continued deleveraging and already moderate leverage, this should provide them with ample time to either repay or refinance as necessary. At the moment this is nothing to worry about but may become an important topic for later as the end of 2022 approaches.

Image Source: PBF Logistics 2020 10-K

Conclusion

When seeking a safe and sustainable high distribution yield, there is plenty to love in this instance with very strong distribution coverage, resilient cash flows and topped off with a very healthy financial position. This all means that unitholders can realistically expect their already high distribution yield to get even higher in the future and thus I believe that maintaining my bullish rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from PBF Logistics’ 2020 10-K (previously linked), 2019 10-K and 2017 10-K SEC Filings, all calculated figures were performed by the author.