This article series helps to keep investors informed of upcoming dividend increases. Any company can increase its dividend, but these companies have a history of annual increases. For investors, this can be an opportunity to start or add to positions before an increased payout. Dividend increase notifications can be essential for retirees who live on dividend checks. Many companies cut their dividends during the pandemic, so receiving increased income is welcome.

The lists I've compiled provide various stats for the stocks that are increasing their dividends next week.

This list is a trimmed-down version only covering dividend increases. A full upcoming dividend calendar is always available here.

How It's Assembled

I created the information below by combining the "U.S. Dividend Champions" spreadsheet hosted here with upcoming dividend information from Nasdaq. This meshes metrics about companies with dividend growth history with upcoming dividend payments (and whether those payments are increasing). These companies all have a minimum five-year dividend growth history.

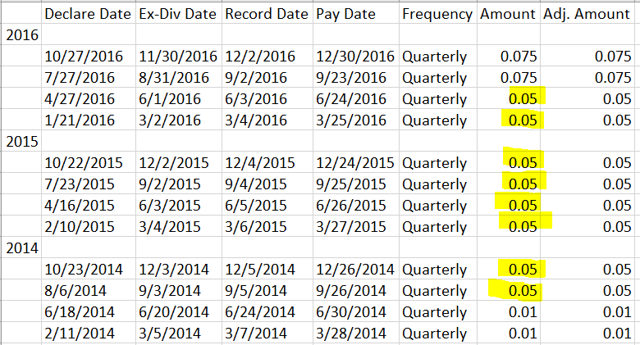

Companies are required to have higher total dividends paid out each year. A company may not raise its dividend in each calendar year, but the total annual dividend can still increase. Here's an example showing increasing total payments each year, but with the same dividend amount over eight consecutive quarters.

What Is The Ex-Dividend Date?

The "ex-dividend" date is the date you are no longer entitled to the dividend or distribution. You need to have made your purchase by the preceding business day. If the date is a Tuesday, you need to have purchased (or already owned) shares by the market close on Monday. Be aware that for any stock going ex-dividend on a Monday (or Tuesday, if Monday is a holiday), you must own it by the prior Friday.

Dividend Streak Categories

Here are the definitions of the streak categories, as

Wheel of FORTUNE is a one-stop-shop, covering all asset-classes (common stocks, preferred shares, bonds, options, commodities, ETFs, and CEFs), across all sectors/industries, through single trading-ideas and model-managed portfolios.

The extremely-wide scope of the service allows us to cater all types (of investors) and (investment) needs/goals, making WoF a true one-service-fits-all.

Our offering includes, but isn't excluded to, the following:

- Weekly macro coverage of the markets.

- Trading Alerts. We generate >250 suggestions a year, every year!

- Trading Alerts Directory, where all trades are monitored.

- Funds Macro Portfolio, comprised of up-to-25 funds.