After a month of license assignment work, the FCC finally released the final C-band license bidders. The amounts paid by AT&T (NYSE:T) and Verizon Communications (VZ) were shocking as well as the lack of bidding by the cable operators. My investment thesis remains more neutral on the wireless and media giant after overspending on spectrum, but the company did avoid major disaster by blocking other players from acquiring spectrum.

Image Source: AT&T website

Wireless Giants Dominate Auction

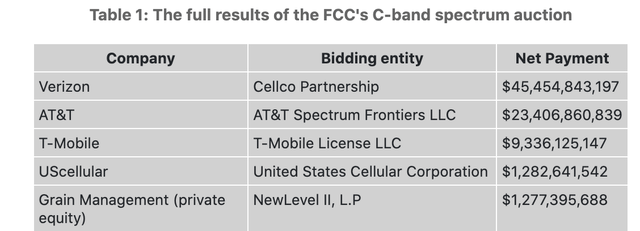

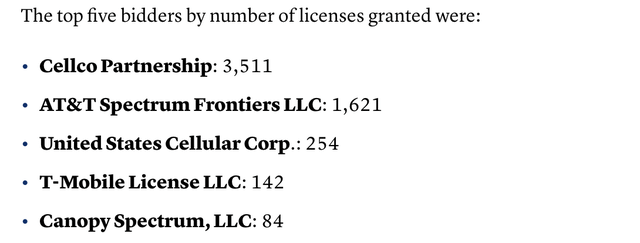

The FCC revealed that Verizon and AT&T combined to spend nearly $69 billion on the C-band auction to acquire needed 5G spectrum. The total bids on the auction were $81 billion leaving the remaining bidding at only ~$12 billion with the vast majority of those bids going to T-Mobile (TMUS).

Source: Light Reading

The original analyst estimates were roughly half this spending level. Morgan Stanley Research had originally forecast the whole auction raising only $26 billion in proceeds, yet AT&T actually spent an amount in excess of the total estimates to acquire less than 30% of the licenses up for auction.

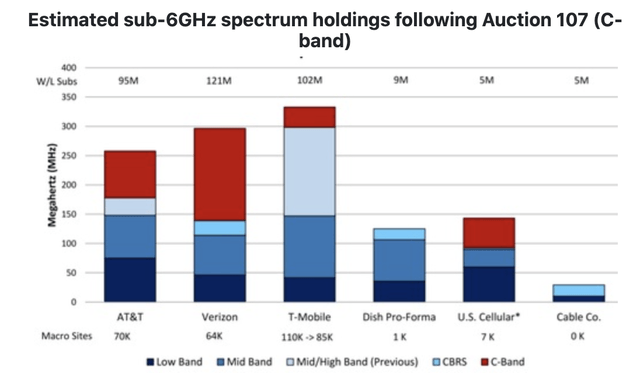

In total, AT&T acquired 1,621 licenses out of the 5,684 licenses up for grabs. The FCC broke the 280 MHz of spectrum up into 20 MHz blocks divided into 406 geographic regions.

Source: CNBC

The wireless giants combined to snap up 5,133 licenses with the DISH Network (DISH) only acquiring a single license in Cheyenne, Wyoming. The more amazing part was that Comcast (CMCSA) and Charter Communications (CHTR) didn't even bid in the auction.

The biggest fear was that AT&T would spend up to $20 billion on the auctions while still allowing the cable partners and Dish to snap up enough spectrum to create competitive fourth and fifth 5G wireless networks. The wireless and media giant avoided this worst case scenario, but the company will have a full price tag estimated at $27.7 billion to cover the additional costs. The additional clearing costs of up to $14 billion are needed to cover the costs of moving the satellite operators off the c-band spectrum.

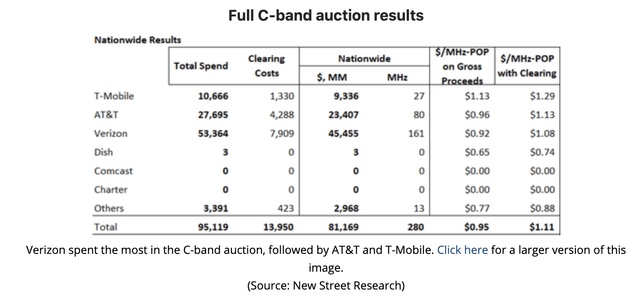

While AT&T and Verizon successfully kept the cable operators out of buying valuable 5G spectrum, the wireless giants still failed to catch up to T-Mobile in sub-6 GHz spectrum. Even worse, AT&T let Verizon leapfrog them into the second spot in the valuable spectrum while Dish and U.S. Cellular now have solid spectrum levels.

Source: Raymond James (vis Light Reading)

No Cash From DirecTV

At the same time, AT&T is spending nearly $30 billion to acquire 5G spectrum to remain a leader in the domestic wireless space, the company is apparently near a deal for DirecTV. Once again, the wireless giant appears on the wrong side of multiple trades by chasing the hot new item (5G spectrum) while dumping the old asset (satellite TV).

The company plans to sell a minority stake in the video unit to private equity firm TPG. The stake is being sold potentially at a $15 billion valuation for a business bought for $48.5 billion plus debt back in 2015 while also throwing in the U-Verse business previously owned by AT&T.

The devil is in the details with some reports suggesting the deal value of $15 billion includes debt. Most importantly, a private equity firm buying a minority stake in a $15 billion valuation won't pay AT&T a large sum of cash.

The market appears to think AT&T will obtain $15 billion in cash for selling the video unit, but the deal isn't anywhere close to the case considering the company will maintain majority ownership. The details aren't fully known and a deal might never actually close, but either way, AT&T isn't going to obtain the cash from selling the video unit to cover the expenses from the spectrum auction.

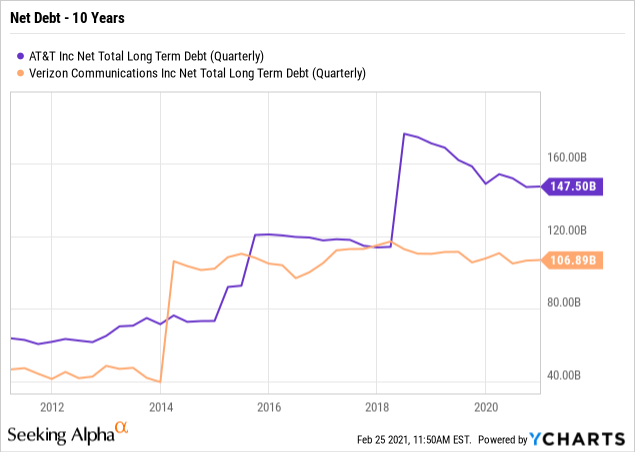

Both AT&T and Verizon entered this auction with substantial debt loads. AT&T ended 2020 with $147.5 billion in net debt and the net effects of these deals appear to add up to $25 billion in net debt leaving the company with a pro-forma balance likely topping $170 billion.

Data by YCharts

Data by YCharts

Verizon just set up a $25 billion loan agreement with JPMorgan Chase and Morgan Stanley highlighting the absurdity of these wireless giants basically bidding against each other to obtain spectrum needed to remain in a domestic spectrum leadership position they previously held in 3G and 4G.

Takeaway

The key investor takeaway is that AT&T is spending a lot of money to chase the 5G wireless market while dumping an asset at a serious discount that was once seen as a hot asset. As the company builds up the net debt levels again, the stock is likely stuck in neutral offering investors returns of the 7% dividend yield at max. The risk is the stock trades down as the company becomes a lagging 3rd player in the competitive wireless market and the media space.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years without taking on the risk of over priced momentum stocks.