Step One: Wide-moat stocks with 5-star and 4-star ratings

Historical evidence says that while quality alone is a poor indicator of outperformance, when combined with a decent valuation filter, Morningstar's moat rating proves to be more than useful. Based on the available data, stocks with a wide-moat rating that also fit into the 4- or 5-star category deserve to be the subject of further analysis. See the detailed explanation and the underlying evidence of our first step in this article.

We focus on those companies that are covered by a Morningstar analyst as assigning a wide-moat rating without thorough analysis is a questionable practice in our opinion. As of February 25, there were 177 wide-moat stocks meeting our criteria. (Up from 176 a month ago, as Workday, Inc. (WDAY) was added.)

Only 1.7% (3 stocks) of this wide-moat group earned a 5-star (most attractive) valuation rating. Here are they:

| Company Name | Ticker |

| Bayer AG | OTCPK:BAYRY |

| British American Tobacco PLC | BTI |

| Imperial Brands PLC | OTCQX:IMBBY |

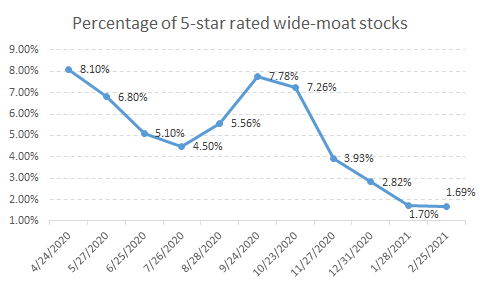

We believe that the percentage of 5-star-rated wide-moat stocks is a good indicator of market sentiment. When this percentage is high, even the best companies are on sale. When the percentage is extremely low, market conditions may warrant caution. (Please note that this is not an indicator for market timing!).

Source: Data from Morningstar

As these best of breed companies may be worth a closer look even when they are just slightly cheaper than their fair value but are not in the bargain bin, we also list the 4-star-rated wide-moat stocks as of February 25:

| Company Name | Ticker |

| Airbus SE | OTCPK:EADSY |

| Alibaba Group Holding Ltd | BABA |

| Alphabet Inc. | GOOGL |

| Altria Group Inc. | MO |

| Amazon.com Inc. | AMZN |

| Ambev SA | ABEV |

| Anheuser-Busch InBev SA/NV | BUD |

| AstraZeneca |