Summary

The intralogistics segment is expected to grow at a CAGR of 7-13%, and Daifuku (OTCPK:DFKCY), Cognex (CGNX) and Toyota Industries Corporation (OTCPK:TYIDF) are well-positioned to capture a large part of this growth nationally and internationally.

The largest material handling system provider Daifuku and machine vision expert Cognex went through the roof within the past few years. The pandemic was a catalyst for these companies and their stock prices. A DCF valuation shows that these companies are currently very expensive, even with high multiples and generous growth rates.

Toyota Industries Corporation appreciated by more than 60% within the last 12 months, but the company is still below fair value by classical valuation metrics. Due to very low volumes and very large static assets like their stake in Toyota Motors (TM), just looking at classical valuation metrics might not be sufficient to determine if Toyota Industries has much room for further stock price appreciation.

Nevertheless, Toyota Industries has a stable cash flow and can sustain any economic environment. From the three companies introduced, it is probably the best value for the buck.

Material Handling and Automation - An Overview

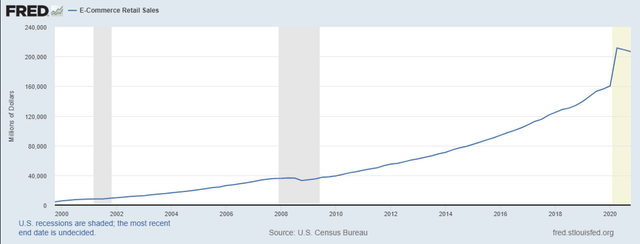

The pandemic was a strong catalyst that materially shifted our consumption behavior from offline to online consumption. Retailers worldwide had to shift their business model from an offline model to an online or a hybrid "order online and pick-up offline" model.

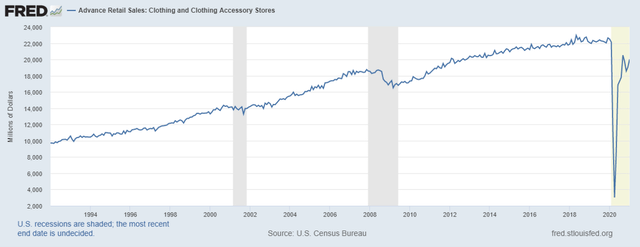

Source: FRED data

This shift from an offline model to an online model is clearly shown when we look at e-commerce retail sales and retail sales. The pandemic had a highly positive effect on e-commerce and quite obviously a negative effect on retail. But in most recent numbers from retail sales, we see an uprising trend, which is in part because of more online-focus retail or the hybrid model that companies are adapting to.