Lexicon Pharma (NASDAQ:LXRX) has had a wonderful couple of months, trading at $1 in December to $9 today at the end of February. The spike came after the success of sotagliflozin, an oral dual inhibitor of two proteins accountable for glucose regulation, which met the primary endpoint in two phase 3 trials, SOLOIST and SCORED, showing statistically significant reductions in cardiovascular deaths, hospitalizations for heart failure and urgent heart failure visits in patients treated with sotagliflozin as compared with placebo.

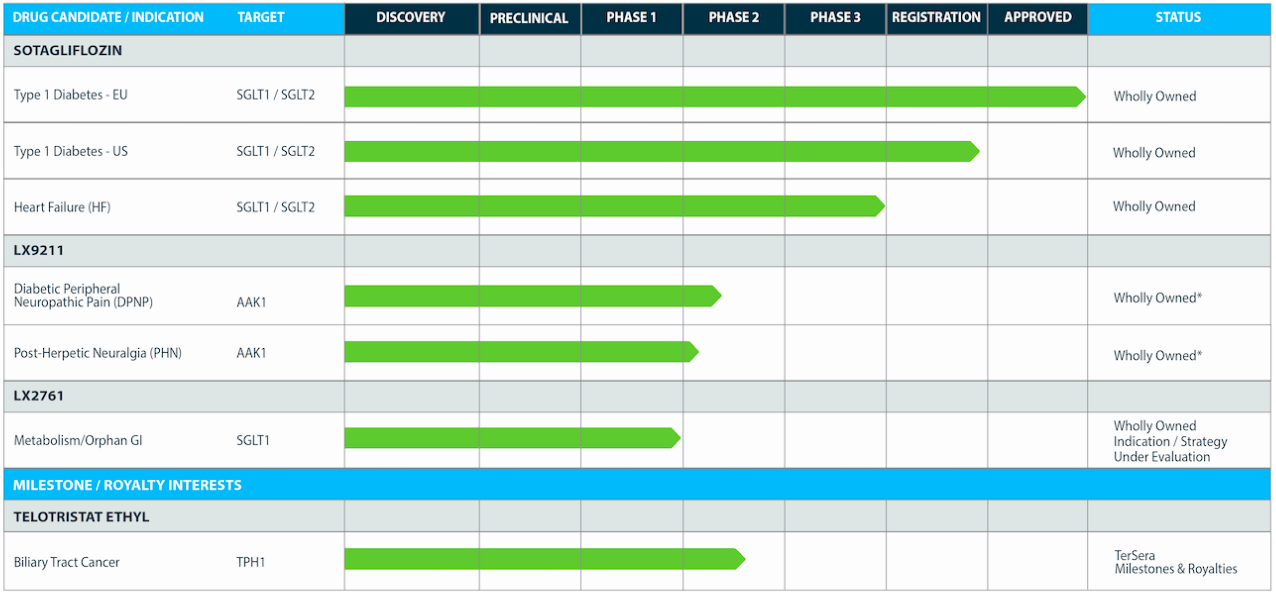

Their pipeline looks like this:

Sotagliflozin was approved for Type 1 diabetes in the European Union way back in 2017, under the trade name of Zynquista. Developed in partnership with Sanofi, it was refused approval in the US on an 8-8 split advisory committee vote in 2019. The molecule has now made a complete turnaround, and is mainly responsible for the current spike in the share price. The single key reason for this is that the trial showed a CV benefit for the molecule, which is nowadays a gold standard for cardiometabolic drugs.

XERMELO is/was Lexicon's only US-approved drug. XERMELO is a prescription pill, used along with somatostatin analog (SSA) therapy, for Carcinoid Syndrome diarrhea in adults who are not adequately controlled by SSA therapy. In the third quarter, the drug made $6.5mn in net sales in the US, just prior to it being sold out to TerSera Therapeutics LLC for “$160.4 million in cash and up to $65 million in additional milestone payments for the development and commercialization of XERMELO in patients with biliary tract cancer and mid-teens royalties on net sales of XERMELO in biliary tract cancer.”

Now, after the successful trial outcomes, Sotagliflozin will apply for an NDA with the FDA. On January 14, the company announced that it received regulatory feedback that “clears a key hurdle

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.