The recent rise in the US 10-year Treasury yield has taken a toll on domestic growth stocks and ETFs - but Chinese equities have been hit even harder (see graphic below). That may make sense considering China had the fastest-growing economy last year. In addition, given the continuing US/China trade war, investing in Chinese equities can be both tricky and risky. One way to reduce trade risks is to focus on investing in the Chinese consumer discretionary companies held in the

Global X MSCI China Consumer Discretionary ETF (NYSEARCA:CHIQ)

As can be seen in the graphic above, China stocks - as measured by the CHIQ consumer discretionary ETF, the SPDR S&P China ETF (GXC), and the Fidelity China Region Fund (FHKCX) - had been leading the SPDR S&P 500 (SPY) and Invesco Nasdaq ETF (QQQ). Yet these China-focused funds rolled over in the last month and under-performed the US benchmarks. This is an opportunity for investors by presenting an excellent entry point into Chinese equities.

Investment Rationale

There are two primary reasons US investors should consider investing in China: economics and demographics.

Last year, China was the only major economy that showed positive GDP growth (+2.3%). Meanwhile, and despite the trade war and hot-rhetoric from the previous administration, the Washington Post reported that the US trade deficit with China hit an all-time record last year:

... Chinese officials said exports hit an all-time high of $2.6 trillion in 2020. Despite a bitter trade war with President Trump, China’s trade surplus with the United States reached a record $316.9 billion for the year.

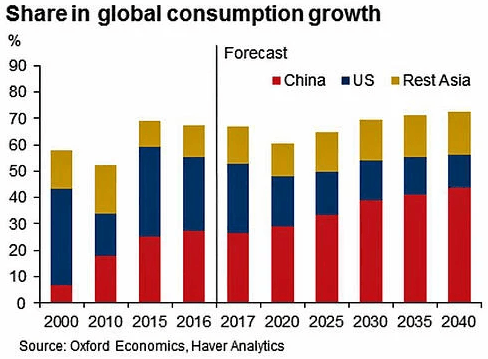

Meanwhile, China's share of global consumption growth keeps powering ahead:

Source: Oxford Economics

According to Oxford Economics, as recently as the year 2000 China accounted for just 7% of the growth in global consumer spending.

And by