In this article we will review Urstadt Biddle Properties Inc. (UBA, UBP) and we will try to assess whether it represents an investment opportunity at the present timing and within the current context.

Urstadt Biddle is a real estate investment trust owning and operating retail properties. Geographically, they are focused in the suburbs of Connecticut, New York, New Jersey and New Hampshire. More specifically, the company owns retail properties in high end submarkets within the areas mentioned above. According to their 2020 annual report, the median household income within a 3 mile radius from their properties is approximately 70% higher than the U.S average. In addition, 22% of the company's portfolio is located in districts ranked above the 95th percentile in the U.S., in terms of education and income, the so called "super zips".

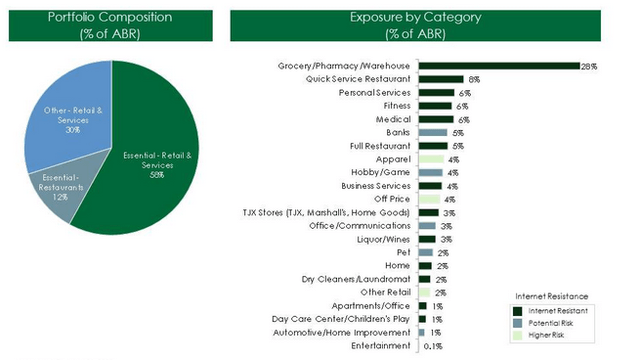

According to the company, 99% of their tenants are open and operating based on October 31th 2020 data. As we can see in the graph presented below, there is some concentration of revenues generated from Grocery / Pharmacy / Warehouse properties which account for 26% of the total annual base rent. However, according to the company this property category, along with some others, reaching a total of 73% of the annual base rent, is characterized as internet resistant. This means that the already evolving progress of decentralization and the shift to online services which reduce the need for high class physical space cannot harm the majority of the company's revenues, at least directly.

Source: UBA FY 2020 annual report

We do tend to read company financial statements with some degree of skepticism and this is why we double checked this "internet resistant" label. Indeed, according to Fidelity Investments, consumer staples sector seems to be more resilient both to economic downturn and internet decentralization.

In our opinion, the