The song we chose to embody this week's stock market sentiment is Diana Ross', "Upside Down":

Upside downBoy, you turn me inside outAnd 'round and 'round

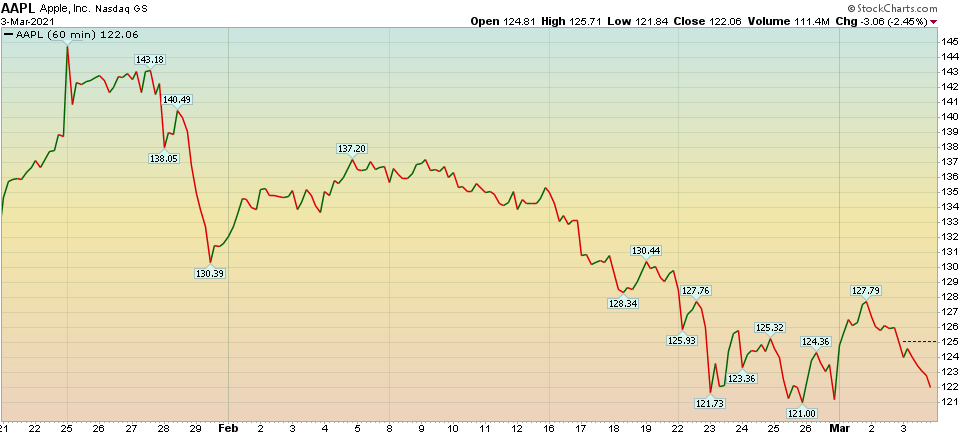

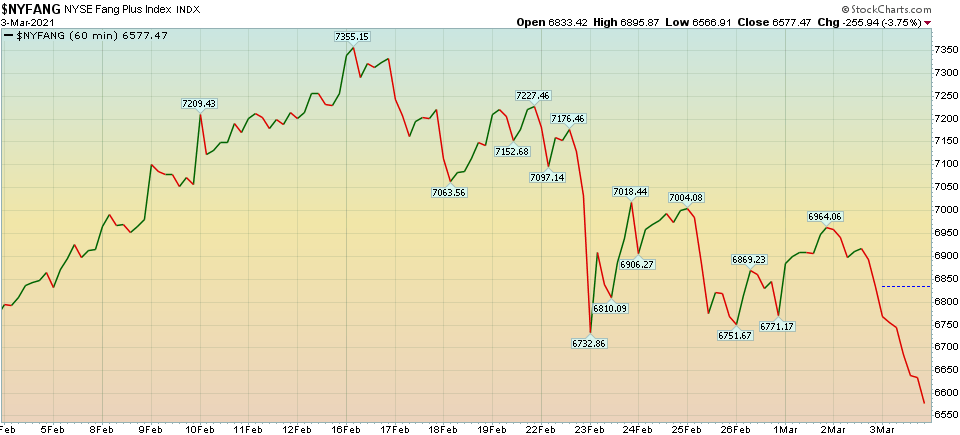

In our recent weeks' podcasts/video we have continually emphasized that we were watching AAPL as the key to the market. Our view was that the unwinding of several Hedge Funds from the GameStop debacle would take weeks (not days) - and would lead to the use of AAPL and FAANGM as a "source of funds" to meet redemptions (and in some cases - complete fund wind downs). A classic case of selling winners to pay for losers…

Here's what that has looked like:

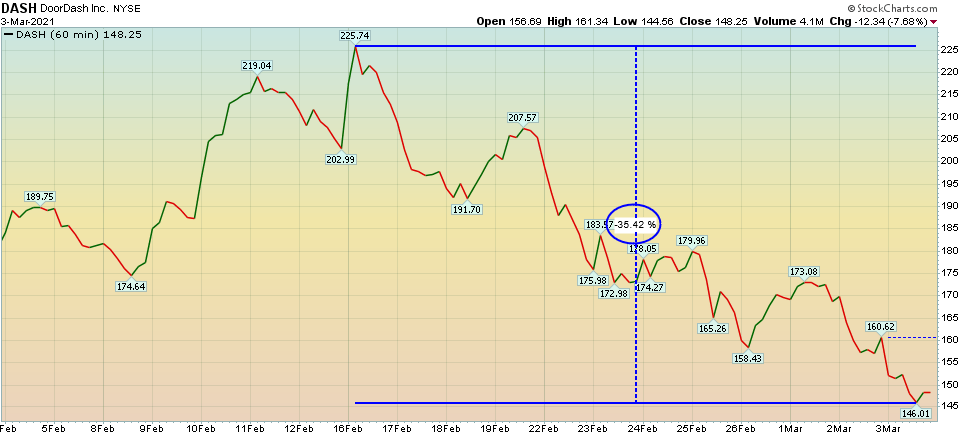

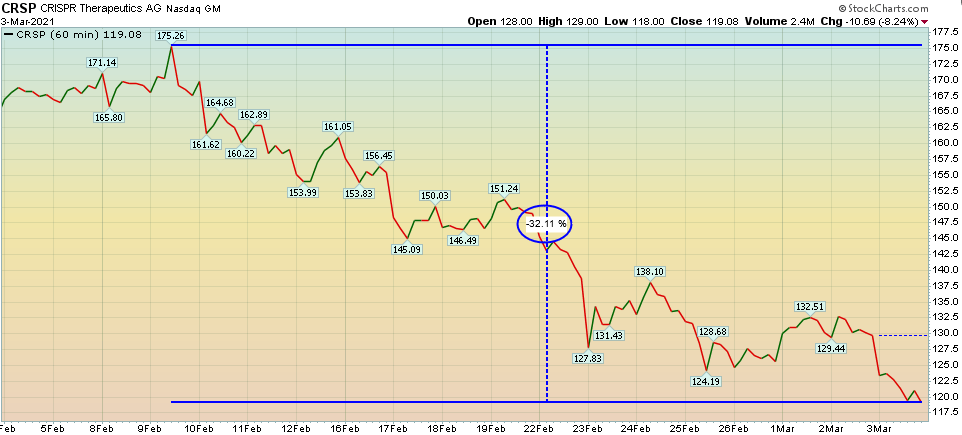

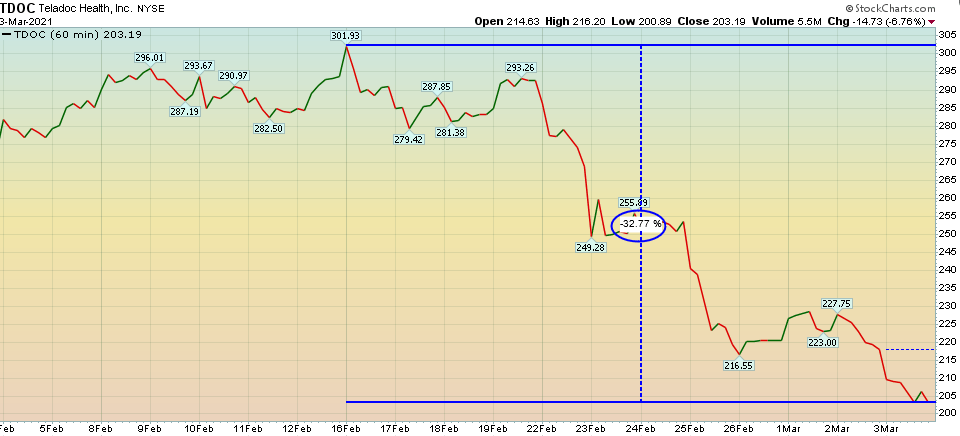

You've also seen a slaughter of (high-multiple, low profit) growth stocks:

Yesterday's Stats:

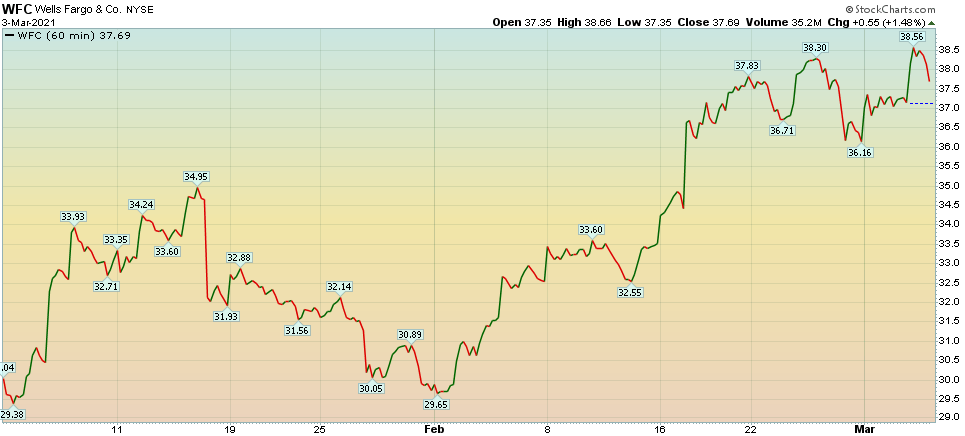

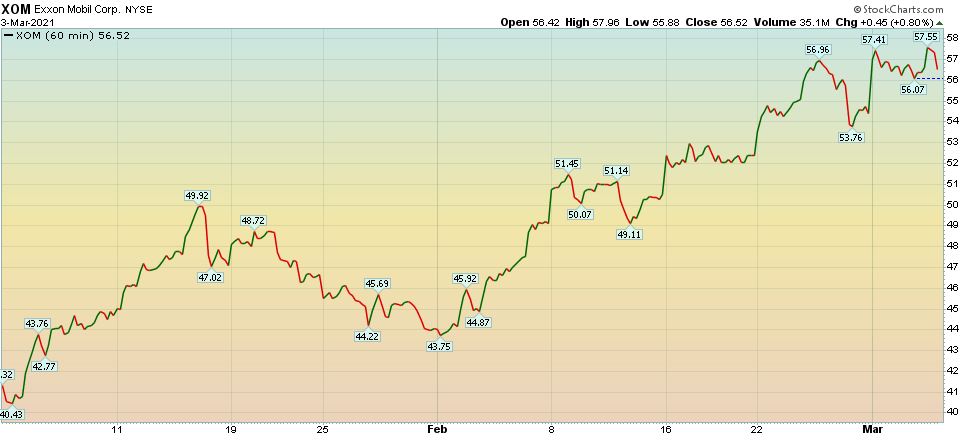

At the same time, here's what is working:

Source: John Authers - Bloomberg

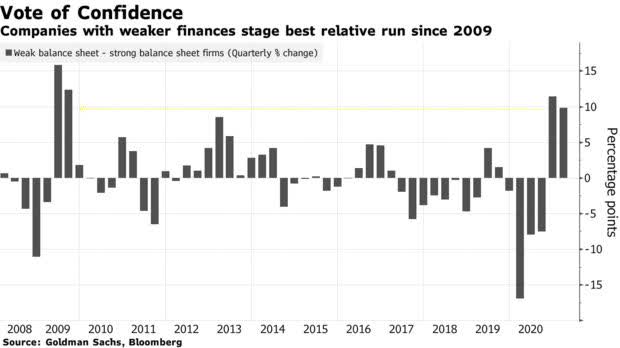

As is the case in all new business cycles, the leveraged balance sheet plays outperform - due to their economic sensitivity. When GDP grows fast - off of a low base - these are the groups that outperform:

Source: Sarah Ponczek - Bloomberg

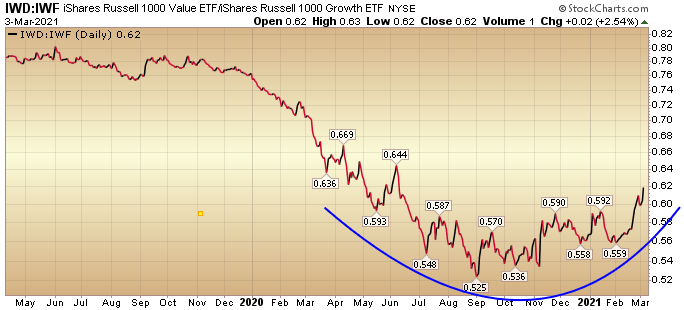

Value has continued to outperform growth since late Summer of 2020.

While we've covered what has and has not worked, the key question now is, "what could work NEXT?"

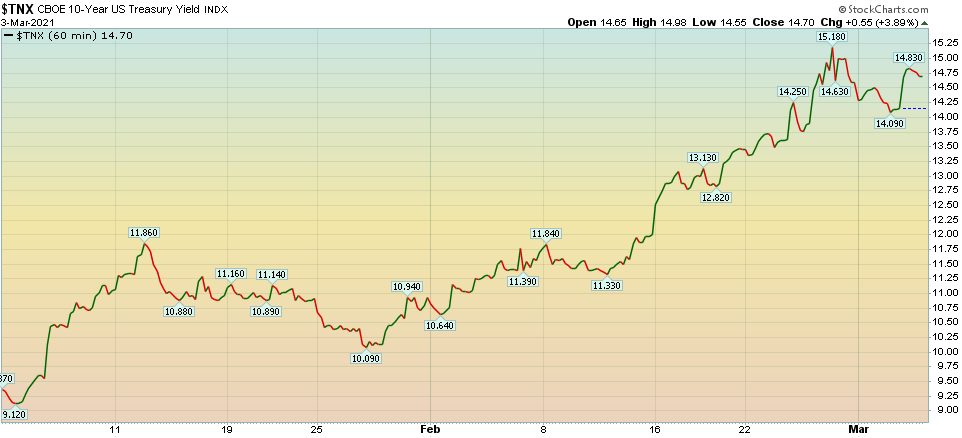

On Fox Business last week we talked about the "rate of change" - for the rate rise - potentially moderating in ensuing weeks. It appears there is an attempt to make a stand here:

If these levels can hold or reverse for a bit, we could see a significant reversal in defensive (higher yielding) stocks like Consumer Staples, Big Pharma, and Utilities - as their yields would become attractive once again.

Either natural market forces will cause a pause in the rate rise, or we'll begin to see Fed speakers start to "trial balloon" a repeat