One intriguing type of REIT to look at these days is the type dedicated to shopping centers with anchors. These provide access to tenants that are often considered essential no matter how the economy performs, and that stability is something that should appeal to many investors. One company dedicated to this approach is Urstadt Biddle Properties (UBA) (NYSE:UBP). While fairly small with a market capitalization of just over $600 million, Urstadt provides investors with an interesting play on the local economy. In recent years, performance has been alright, but where the opportunity lies is in the fact that shares of the business are likely trading at a slight discount to where they probably should be.

A look at Urstadt

As of the end of its 2020 fiscal year, Urstadt owned 81 different properties. Collectively, these accounted for 5.3 million square feet of gross leasable area. 84% of these assets by gross leasable area are anchored by grocery, pharmacy, and/or wholesale club tenants. This can be a tricky market to play in for a REIT because the quality of the assets is often determined by cash flow, and cash flow is often determined by location. Property is located in low-income areas, for instance, are likely to yield less and to see lower occupancy rates. Fortunately for Urstadt’s investors, this has not been a problem.

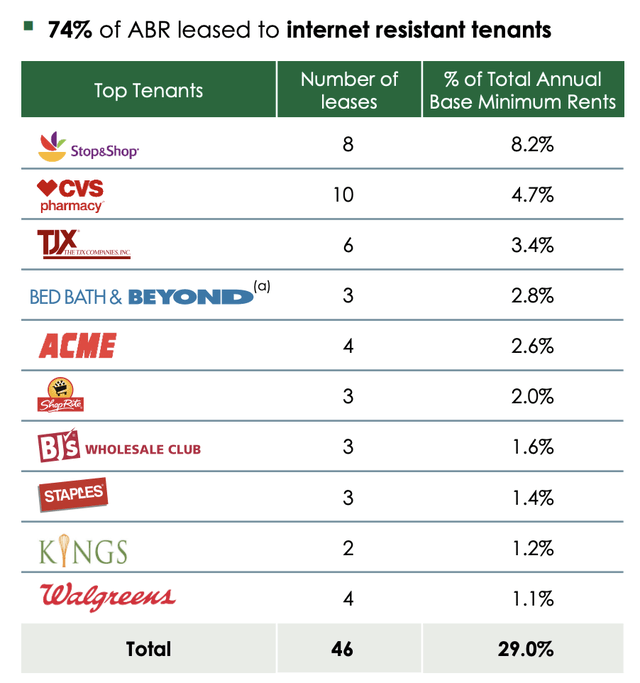

According to management, the median income of households within a three-mile radius of its properties is about 70% higher the national average. In addition, management has said that about 74% of its annualized base rent is leased out to companies that are considered Internet resistant. If this is an accurate approximation, it means that these firms should fare well even as the economy moves more toward e-commerce providers.

*Taken from Urstadt Biddle Properties

*Taken from Urstadt Biddle Properties

It's also very important

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!