Despite a rough fiscal year brought on by Covid-19 disruptions, Miller (NYSE:MLR) had recent fourth quarter results that blew past our expectations. We revise up our price target with a higher EPS and P/E multiple leading to upside of 72% based on strong fundamentals and high backlogs [defined by management as four months of production] going forward.

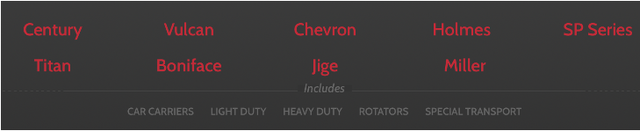

Miller's product offerings and brands. [Source: Company Website]

Miller is a franchise business and market leader in the towing and recovery business, and has the largest distribution network [over 80 distributors in the US]. With a P/E of 13.2x on FY21 estimates, the company is inexpensive; it also has 12% net cash on the market cap or $5.00 per share, with zero debt [as a result of increased deleveraging efforts, recently]. It has been growing at a staggering EPS CAGR of 21% and revenue CAGR of 10.9% over the last 5 years [2014-2019]. The EPS CAGR is one of the most rapid growth rates seen amongst companies today. We see this growth continuing as the company looks to innovate and tailor itself to a changing marketplace environment, especially one presented by Covid-19.

Miller has responded well during this pandemic in FY2020 [with 85% of its revenue generation coming from the US], having administered adept cost-cutting measures to boost financials. They have 6 production facilities located in the US, UK, and France. The company continues to innovate, producing the largest tow truck “M100” in FY19, and employing a new enterprise software system to improve sales efficiencies this latest quarter. Miller has faced numerous headwinds related to supply chain issues which have been greatly resolved, creating a significant backlog in the process. The backlog [defined by management as four months of production] will help top-line growth in the coming FY21, as things greatly improved on easing of Covid-19.