J. M. Smucker (NYSE:SJM) is a well-known consumer staples business with several well-known brands outside of its namesake including JIF, Folgers, Meow Mix and many others. While the business has been steady, the share price has severely underperformed the S&P 500. Over the last five years, Smucker's share price is down 8.9% compared to the S&P 500's 88.0% rise. The stagnant share price while the business has continued to post modest results has led to an arguably cheap share price.

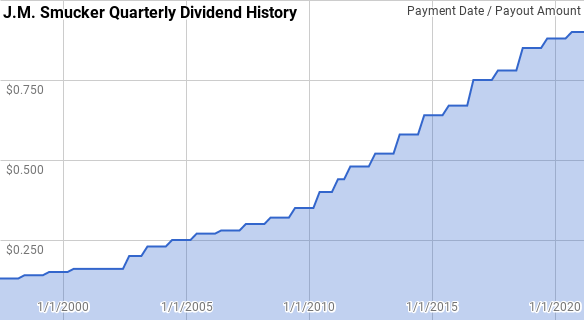

Dividend History

The dividend growth strategy is the one that appealed most to me when I began investing into individual companies. The concept is simple which is to focus on businesses that have a history of paying and growing their dividend payout as a means to harvest the fruit while keeping the tree.

Image by author; data source J. M. Smucker Investor Relations

Smucker is a Dividend Contender with 23 consecutive years of dividend growth. Its consecutive year streak dates back to 1997 which is quite impressive considering the numerous economic environments that have occurred over that time.

During its streak, there have s been 23 year-over-year periods with annual dividend growth ranging from 1.6% to 41.0% with an average of 10.4% and a median of 8.2%.

There have been 19 rolling 5-year periods during Smucker's streak with annualized dividend growth ranging from 6.3% to 13.1% with an average of 9.8% and a median of 10.4%.

Over that same period, there have been 14 rolling 10-year periods with annualized dividend growth ranging from 8.6% to 11.7% with an average of 9.8% and a median of 9.6%.

The rolling 1-, 3-, 5- and 10-year annualized dividend growth rates since 1997 can be found in the following table.

| Year | Annual Dividend | 1 Year DGR | 3 Year DGR | 5 Year DGR |