I was a dividend growth investor. I was a compounder. Whenever I invested money, my aim was pure and true: use portfolio income to buy more income-generating assets (and I would then gleefully sit back and watch my portfolio income proliferate like mushrooms on a rotting log).

Yet I was hardly any cowboy. I never bought an asset simply because of the yield. Instead, I'd focus on companies or funds that I deemed likely to maintain or even raise dividends over time. Should I stumble across a brilliant business with a low (or even no) dividend, I tended either to take a pass or to confine the investment to a mere measly sub-percentage of my overall portfolio. No, oddly enough I liked getting paid for taking risks, which is why nearly every single company or fund I owned paid me cash and paid it like clockwork.

All was going well until April of 2018 when I noticed something strange on my Form 1040 that I could hardly believe. Why... could this be true... I was actually paying TAXES on my investment income?! The very notion induced waves of nausea, outrage, and regret because I knew that this particular predicament was so completely unnecessary. Thus it became clear that my monotheistic worship of income growth had reached a point where I would have to at least contemplate the possibility of such phenomena as unrealized capital gains.

My investment Odyssey commenced. Earn less money.

To appreciate some of the monsters and strange lands I came across during my strange investment journey, I'll have to share some background with you first. My wife and I are in our early 50s and retired six and ten years ago, respectively. All of our income comes in the form of dividends and capital gains. Five-and-a-half years ago, we moved from the Washington DC area to Lisbon, Portugal which offers a tax incentive unique in Europe: ex-pats can live there for up to 10 years without incurring Portuguese income taxes on certain types of non-Portugal-source income including dividends.

Our financial plan was simple: drop our living expenses by cutting our tax bills, medical insurance bills, private school tuition for our son, and owning our own home with no mortgage. Part two: reinvest the savings into income-producing assets (or at least reinvest whatever savings didn't get consumed on Portuguese wine, road trips to the Douro Valley, and plate after plate of scarlet shrimp cooked gently in olive oil with garlic, lemons with just a pinch of sea salt and black pepper).

Tax Planning For Early Retirees

One advantage to retiring early with no pension, social security payments, or required minimum distributions from an IRA is that cutting our US Federal tax bill was fairly easy. The centerpiece of our plan to minimize taxes: own stocks that pay either qualified dividends or return-of-capital distributions. For a married couple like us, that means we can get up to $80,800 per year in qualified dividends and long-term capital gains completely tax-free.

(Source: Motley Fool, current marginal rates on qualified dividends for 2021)

Then we add in our standard deduction (currently $25,100 for a married couple) and that leaves us with up to $105,900 of tax-exempt dividends and/or long-term capital gains. Next, we claim a $2,000 tax credit for our one child, boosting our total annual tax-free income to $119,233 per year... far more than enough for a family of three living in Lisbon.

Of course, we made a point of converting our IRA assets into ROTH IRAs from time to time over the past 10 years. For example, if we owned shares of a company like Citibank (C) in our IRA, we'd wait for the stock price to crash and would then promptly hustle those shares unceremoniously out the back door and straight into our ROTH IRAs. Low stock prices equal low tax costs for converting IRA assets into ROTH IRA assets.

There are two reasons why we opted to convert all of our IRAs into ROTH IRAs. First, we can earn a virtually arbitrary level of tax-exempt income in our ROTH IRAs to augment the $119,233 of tax-free investment income on our taxable brokerage accounts. Second, the ROTH conversions eliminate future required minimum distributions that otherwise would have reduced the amount of tax-free qualified dividends we can earn. ROTH IRA conversions can be a way for younger retirees to lock-in relatively low income tax rates for years and years to come.

As a quick aside, this year might be a good opportunity for some taxpayers to consider ROTH IRA conversions. Depending on the upcoming fate of the next stimulus package, a family of three like ours might be able to claim a $2,000 Recovery Rebate credit per person, plus a $3,000 child tax credit for a total of almost $9,000 worth of tax credits or stimulus checks. Divide the total number of credits (or stimulus checks) by your top marginal tax rate and you’ll see how many ROTH IRA conversions you can offset.

High Yield and Low Returns

Back to my day of reckoning, I arrived at the shores of 2018 to find that our taxable dividend income was over the tax-exempt threshold, meaning every additional penny's worth of qualified dividends had now become egregiously tax-inefficient.

And that situation is the one situation by which I cannot possibly abide.

I was faced with the need to prune away the highest yielding components of my portfolio - and there were more than a few candidates on my chopping block. Each of these cash-gushers I swapped for low-yielding (or in some cases, NO-yielding) stocks. Almost 25% of my entire taxable portfolio once upon a time consisted of the following ETFs and individual shares and of that 25% of my portfolio, the investment allocations were thus:

(Source: Author's personal spreadsheet)

The yield on this portfolio segment clocked in at over 5.6% per year and was responsible for much of the metastasizing tax inefficiency seeping through our investment portfolio. And so it was that over the next two years, I started to sell off bits and pieces of these positions to purchase shares in companies such as Microsoft (MSFT) or Visa (V), with exceptionally low yields but thriving - one could even say booming - earnings growth. I exited all of our oil, gas, and pipeline investments such as ALPS Alerian MLP ETF (AMLP), Valero (VLO), and ONEOK (OKE) and scaled back some of our real estate investment trusts such as Healthcare Properties (HCP) (Healthpeak Properties, Inc. (PEAK)) and Omega Healthcare (OHI). I was making fine (but not overly rapid) progress until...

... along came Covid19.

Perhaps the greatest (maybe only) benefit of the Covid19 catastrophe was that at least temporarily, stock markets around the world not only crashed but crashed violently. Oh, happiest of happy days! The bear market came as the perfect opportunity to exit ALL of my remaining higher-yielding investments at a vastly reduced capital gains tax rate. Losses on holdings such as EPR Properties (EPR) were so extreme that they practically wiped out gains on longer-term holdings such as the iShares Select Dividend ETF (DVY) and SPDR S&P Dividend ETF(SDY). I was ecstatic. I poured all of the sales proceeds into more low-yielding stocks in companies like Hermes (OTCPK:HESAY), Mastercard (MA), and Amazon (AMZN). In the process, I brought my overall portfolio yield down from the 3.85% it had been back in 2018 to around 2.5% today.

Did I pine for the lost portfolio income? I suppose I would have but for the fact that every single restaurant and store in Lisbon is closed and I have nowhere to spend the money. We cannot travel. Scarlet shrimps cooked in olive oil and just the right amount of garlic exist now only in my fading dreams. On the bright side, at least we've discovered that we need dramatically less money to live on than we had ever appreciated before. Nevertheless, I suppose that at least part of me did miss all that long-lost portfolio income. That is, until this past Sunday when I filed our US Federal Income Tax Return and saw something that I haven't seen in over 30 years: a tax refund. I nearly fainted. I even had to ask a CPA to double-check my return because I literally couldn't believe what I was looking at.

Those magical words of lovely Brenda the CPA ("well, your return looks right to me") are not the only reason why I was able to overcome my nostalgia for those halcyon days of overflowing dividends. You see, it turns out that my once yield-centric portfolio stank (although I didn't know it at the time).

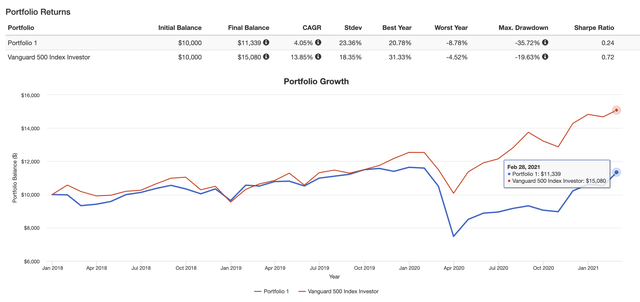

(Source: Portfoliovisualizer.com, data inputs from Author's portfolio).

According to PortfolioVisualizer.com, my erstwhile love affair with a steady and predictable yield would have underperformed the S&P 500 by over 37% from December 2018 to the present - and that's assuming portfolio dividends were 100% reinvested each month. I dodged a bullet entirely by accident.

Lessons Learned

Contrary to popular opinion, I say that one can garner a very great deal of wisdom from dumb luck.

Lesson one: don't pay attention only to the stocks and funds that you currently own. Look at what you've already sold, why you sold it, and whether the power of retrospect reveals a mistake or a prescient success. Anyone who reads my articles and blog entries on Seeking Alpha knows that I routinely crow about the virtues of never selling. In fact, my experience ought to convince me that selling can be a perfectly justifiable thing to do. This is not the only time I’ve noticed that empirical evidence often contradicts my most firmly-held and widely-broadcast philosophies.

Lesson two: my idea that a regular dividend payment can cushion downside risk to the price of a stock was simply wrong. It doesn't take much for me to amuse myself these days, but I'm awestruck that my idea that should have been right for every reason turns out to have been wrong for either no reason or no reason that I'm sophisticated enough to perceive.

Lesson three: figure out what you are good at and then go do it... even if you don't like it. I genuinely don't enjoy low-yielding stocks anywhere near as much as I enjoy higher-yielding stocks, but it turns out that I've made more and lost less money buying high-priced companies like Apple (AAPL) and Amazon (AMZN) with paltry or nonexistent yields than I ever made with even my best higher-yielding investments.

To listen to my late grandpa playing his cherished violin, you'd quickly perceive that one is not always particularly good at doing the things that one loves most. In the investment game, you simply must care more about profits than personal preferences. In my case, as long as I succeed more often with lower-yielding investments, those are the investments I'll keep buying. At least until I learn to do better buying otherwise.

Conclusion

What does my portfolio look like today?

(Source: Author's current portfolio spreadsheet)

What am I looking to buy when the next round of dividends comes through this month? I'm planning to invest the cash into the newest additions to my portfolio that also happen to have the lowest representation. My portfolio business model is to collect dividends from lower-growth companies like Pfizer (PFE) and Altria (MO), and use those steady cash flows to buy shares of higher-growth companies like T. Rowe Price (TROW), Adobe (ADBE), Intuit (INTU), Facebook (FB), and Nike (NKE).