Enanta Pharmaceuticals (NASDAQ:ENTA) appears to be making a successful transition from older drug patent revenues and profits to new ones in the coming years. An estimated $100-120 million in yearly royalty payments for revenues on past discoveries is part of the base foundation. Management is reinvesting most of its revenues and an additional spend of $30-50 million in cash burn annually to fund a number of new drug trials. The good news for shareholders is the enterprise owns $445 million in cash and current assets vs. only $29 million in total liabilities. So, the company has at least 7-8 years of cash on its books to handle the ongoing R&D expense, and bridge to several new sources of revenue.

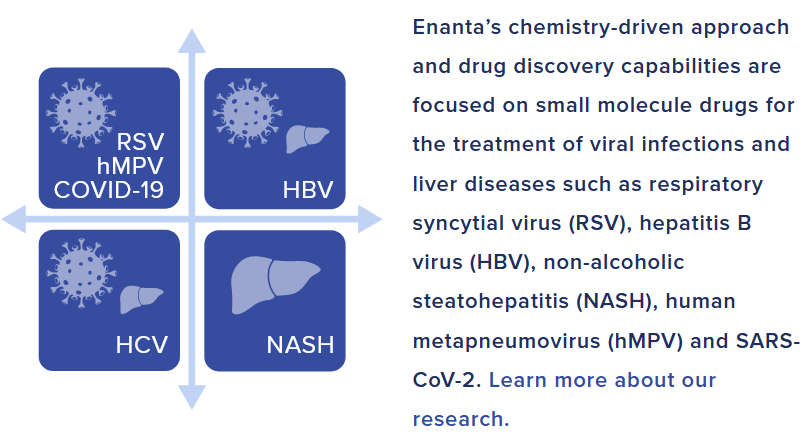

Image Source: Company Website

Business Operations

From Seeking Alpha’s business description:

Enanta is a biotechnology company, discovering and developing small molecule drugs for the treatment of viral infections and liver diseases. Its research and development disease targets include respiratory syncytial virus, non-alcoholic steatohepatitis, SARS-CoV-2, human metapneumovirus, and hepatitis B virus. The company offers glecaprevir for the treatment of chronic hepatitis C virus, or HCV under the MAVYRET and MAVIRET names. Enanta Pharmaceuticals, Inc. has a collaborative development and license agreement with Abbott Laboratories to identify, develop, and commercialize HCV NS3 and NS3/4A protease inhibitor compounds, including paritaprevir and glecaprevir for the treatment of chronic hepatitis C virus.

Several preliminary drug trial results should be announced in 2021, some as early as March-April. In the fiscal Q1 earnings release for December 2020, CEO Jay R. Luly explained Enanta’s expanding research and development efforts:

Our first fiscal quarter of 2021 was an especially active time, as we advanced and expanded our wholly-owned pipeline. In HBV, not only did we advance our two ongoing Phase 1b trials of EDP-514, but we also broadened our program with the introduction