By Philip Lawlor, head of Global Investment Research

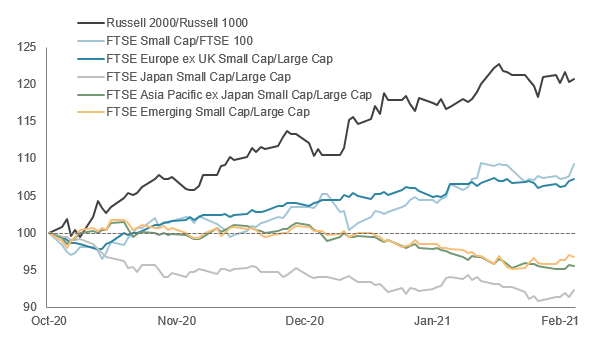

The powerful winning streak in US small-cap stocks has been a dominant theme since the vaccine-fueled risk rally began last fall. The outperformance of small stocks in the UK and Europe over this period has paled in comparison.

Russell 2000 outstrips the Russell 1000 by 21 percentage points since last November

Source: FTSE Russell. Data as of February 28, 2021. Past performance is no guarantee to future results. Please see the end for important disclosures.

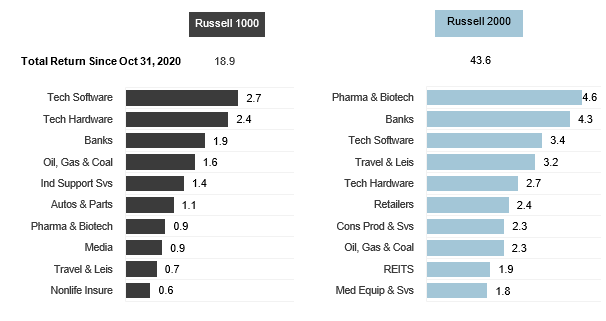

Small-cap leadership since last November has been bolstered by significant gains in pharmaceuticals, banks, software and the travel and leisure sectors.

Notably, the 10 largest sector-weighted contribution to returns over this period have been far more concentrated for the Russell 2000 than for the Russell 1000, supplying a combined return roughly twice that of the Russell 1000 (see below).

Top-10 sector contributors to returns since last November - Russell 1000 vs Russell 2000

Source: FTSE Russell. Data as of February 28, 2021. Past performance is no guarantee of future results. Please see the end for important legal disclosures.

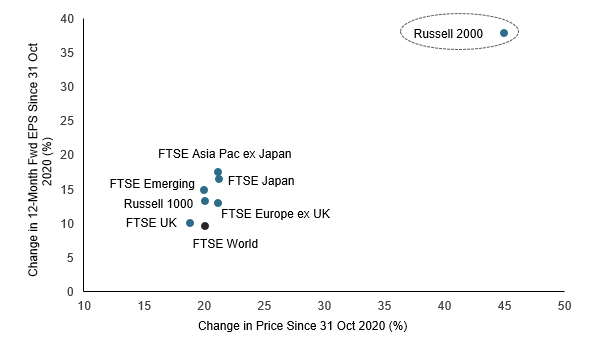

EPS upgrade cycle adds fuel to the small-cap fire

As noted in an earlier blog, many of these cyclical industries were among the worst-hit in the early stages of the pandemic and, unsurprisingly, are now among those expected to deliver the strongest EPS growth recoveries this year and next.

With its far greater exposure to these economically sensitive sectors, the Russell 2000's outsized gains since the beginning of November have closely tracked the equally strong upgrades in forward-looking EPS forecasts over the same period.

Changes in 12M forward EPS forecasts vs index prices since October 31, 2020

Source: FTSE Russell / Refinitiv. Data as of February 28, 2021. Past performance is no guarantee of future results. Please see the end for important legal disclosures.