Ian's Million Fund, "IMF," is a real-money portfolio that I've written about monthly since January 2016 here at Seeking Alpha. The portfolio is a largely buy-and-hold group of ~130 stocks. Each month, I buy 10-20 of the most compelling stocks available at then-current prices, deploying $1,000 of my capital plus accumulated dividends. If things go according to plan, this portfolio, which began when I was 27, will hit one million dollars in equity in 2041 at age 52. I intend it to serve as a model for other younger investors.

I made the IMF buys for January and February. The portfolio's old brokerage custodian, Folio, shut down its operations in January. Perhaps that was just in time given the total chaos that was about to kick off over at rival Robinhood. Anyways, the portfolio was transferred over to Interactive Brokers (IBKR) in mid-January.

Interactive has been my primary brokerage since 2012 if I recall correctly. However, I had no idea that they supported fractional share trading, and it took me a while to set up (it doesn't seem to work in their dedicated web trader, for example). Anyways, I got it figured out, but not in time to hit the January buying window.

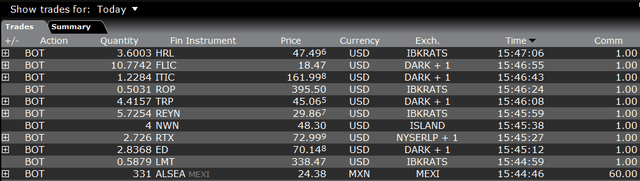

So, for February, I combined January's $1,000 of my capital and received dividends from December along with the normal $1,000 + dividends for this month. Here are the buys:

Source: Interactive Brokers / my screenshot

I divided the $2,000 equally across the positions, with one exception. This resulted in $200 ($199 plus the $1 commission) going into each stock. As you can see, for Alsea (ALSEA-Mexi) (OTCPK:ALSSF), the Mexican security, Interactive Brokers charges a 60 Mexican Peso ($3) commission, so I bought a double position to justify the higher fee.

As always, I keep dividend-funded stocks in a

This is an Ian's Insider Corner report published in February for our service's subscribers. If you enjoyed this, consider our service to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.