AT&T (T) is a retiree favorite on Seeking Alpha. While this is certainly understandable given its long and storied history as a reliable dividend grower and attractive yield backed by a stable, utility-like business model in an age of record low interest rates:

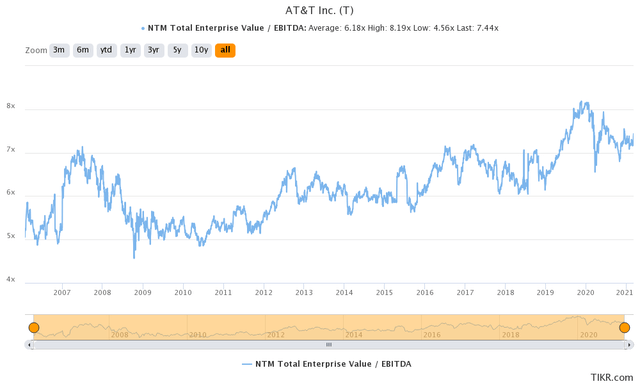

We do not share the conviction that it is meaningfully undervalued. In fact, as we laid out in Why We Are Staying Out Of AT&T, the stock is actually expensive on an EV/EBITDA basis:

Compared to its historical average EV/EBITDA of 6.18x, its current EV/EBITDA is 7.44x. Even on a more recent EV/EBITDA basis, its 5-year average is 6.96x. If it were to be priced equal to its 5-year average EV/EBITDA, the stock would have to trade at $26.25 (compared to its current $29.90).

How is this possible when the dividend yield is near an all-time high and the P/FCF multiple is also at a decade low?

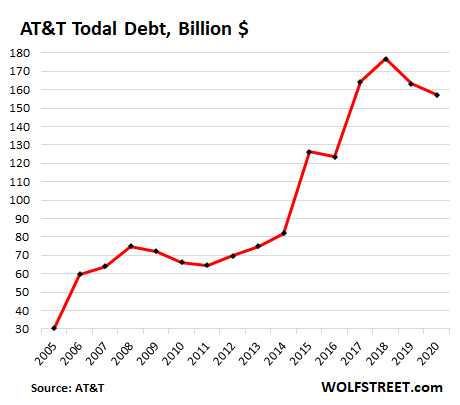

As we detailed in The Chickens Are Coming Home To Roost At AT&T, the answer is simply: massive leverage.

After essentially burning $67 billion on its failed acquisition of DirecTV, management is now reaping the consequences by having to write-off an embarrassing $15.5 billion for the business and is even trying to sell a minority stake in the business at a massive loss. Of course, this isn't the only capital allocation blunder they have made in recent years as evidenced by the additional $3.4 billion in write-offs that they made in 2020. Looking ahead, it wouldn't shock us if more of the same took place as T still has $150 billion in combined goodwill and other intangible assets on its balance sheet along with another ~$150 billion in long-term debt thanks in large part to their massive deal for Time Warner Inc.

If T is an overleveraged and - arguably - overvalued

What Are We Buying?

We are sharing all our Top Ideas with the members of High Yield Investor. And you can get access to all of them for free with our 2-week free trial! We are the the fastest-growing high yield-seeking investment service on Seeking Alpha with over 600 members on board and a perfect 5-star rating!

You will get instant access to all our Top Picks, 2 Model Portfolios, Course to High Yield investing, Tracking tools, and much more.

You will get instant access to all our Top Picks, 2 Model Portfolios, Course to High Yield investing, Tracking tools, and much more.

We are offering a Limited-Time 28% discount for new members!