Introduction

Markets are experiencing volatility on largely priced-in events: expected economic recovery, positive vaccine news, and large stimulus packages. This sell-off caused the yield curve to steepen, with the 10-year US treasury yields reaching 1.63% last week, while that rate began 2021 at only 0.93%.

The upward trajectory of yields is usually a reflection of higher growth and inflation ahead. As a result, this translates into higher risk premia for equities. Investing in the right sector during this stage of the economic cycle is crucial for investors seeking to outperform the market.

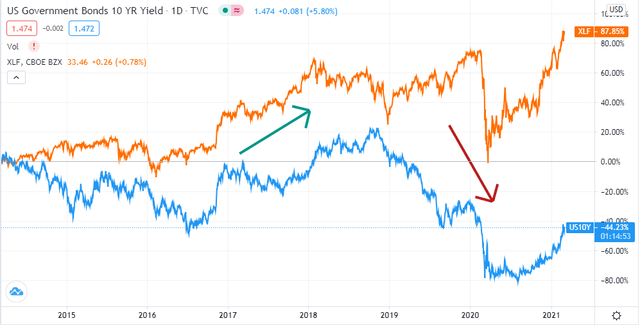

Yields and Financials

Changes in interest rates have a significant impact on the return of the financial sector. Higher rates go in hand with improved profit margins for financial institutions and lead to that sector’s outperformance.

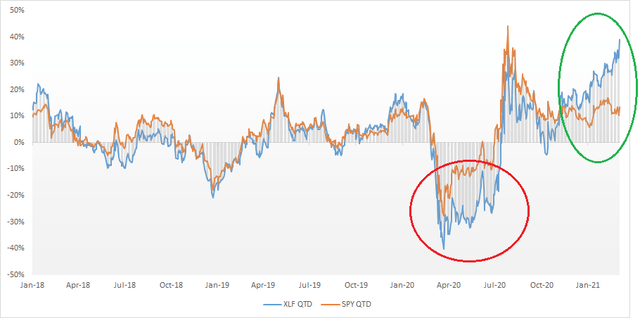

If we look at the six-month rate of change, financials are considered one of the best performing sectors. The Financial Select Sector SPDR Fund (NYSEARCA:XLF), has outperformed the S&P 500 (SPY) since the US elections.

We attribute this outperformance to the rotation in financials, energy and industrials. We began shifting our sector allocation to overweight financials in November. Please read our article “This Sector Rotation Strategy Made 17% Each Year Since 1991” for more information on our sector call.

Source: FactSet & Factor-Based

The above chart shows this dynamic. In 2020, financials were hit hard when the COVID-19 pandemic emerged. During the recovery period, promising economic data helped the market regain confidence in the sector.

Economists surveyed last February expected a US GDP growth rate of 4.9% in 2021. A year later, Goldman Sachs analysts are now anticipating an output of 6.8% this year. Regarding inflation, JP Morgan analysts are expecting inflation to exceed 2% in Q4 2021.These growth and inflation forecasts are strong tailwinds favoring higher earnings of financial stocks.

Source: TradingView & Factor-Based