(Pexels)

The past year has seen another boom in clean energy stocks. The popular iShares clean energy ETF (NASDAQ:ICLN) has risen 170% over the past year from $8.5 to around $25.50 today. The stellar performance has been fueled by the view that the new U.S administration will encourage green energy investments and growth over the coming years. Indeed, the clean energy industry has seen strong growth over the past few years and is expected to accelerate over the coming years in order to meet the 2035 decarbonization goal.

Of course, there has also been a surge in speculative investment/trading activity since COVID lockdowns began which may be fueling bubbles. While it is almost certainly true that the green energy industry will see growth over the coming years, that does not make clean energy stocks automatically good investments. It seems that the hype and exuberance surrounding the better future which green energy firms will help create has generated a bubble akin to the dot-com bubble of the 2000s. Many chronically unprofitable and/or small firms are trading for tens of billions of dollars.

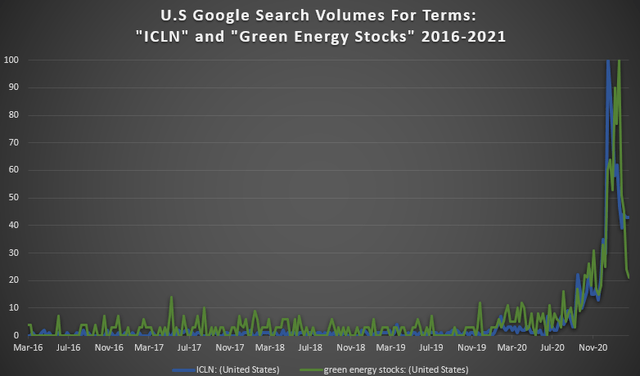

As if often the case, this "narrative exuberance" (see 'Narrative Economics') is evidenced by Google search volumes which are found on Google Trends. See below:

As you can see, there has been an extreme spike in U.S Google search volumes for "Green Energy Stocks" and "ICLN" (the top green energy ETF). The spike began well-before Biden won the election last spring as many new investors searched for a place to park their stimulus check or other COVID savings. Of course, there was also a surge in November (after the election) which lasted until mid-January. Since then, there has been an extreme decline in search volumes which I believe indicates the bull market for clean energy stocks may be ending.