Source: Enphase Energy

Source: Enphase Energy

The iShares Global Clean Energy ETF (NASDAQ:ICLN) invests in companies that produce energy from wind, solar, and other renewable sources. Shares are down around 10% YTD as the rotation from growth to value has taken a toll on some of the high-valued stocks within the portfolio. The sector had benefited - in part - from enthusiasm due to a new US administration that is focused on clean energy as opposed to "making coal great again". It is clear the future growth in the electric power generation sector is all about wind, solar, and renewable energy. That being the case, the recent pull-back in clean energy ETFs is an opportunity investors should take a hard look at.

Investment Rationale

Source: EIA

Source: EIA

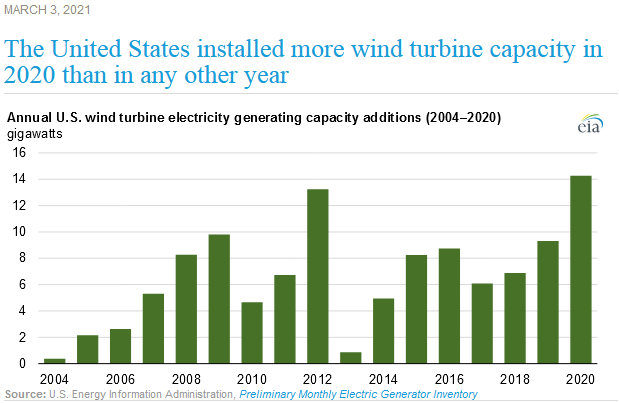

As the graphic above shows, new US wind-turbine electric generating capacity was a record 14.2 GW last year - surpassing the previous record set back in 2012 by 1 GW. Wind now provides 8.4% of the US's total electricity generation capacity - including a whopping 58% of electric power generation capacity in Iowa and 43% in Kansas.

Going forward, Congress extended the wind production tax credit ("PTC") at 60% of the full tax credit ($18/KWh) through year-end 2021. Current estimates are for another 12.2 GW of additional wind capacity to be added to the US grid this year. That's down from last year's record, but still the third largest annual wind capacity addition in US history.

Meanwhile, US solar capacity is expected to grow from a still relatively small base and the EIA expects solar capacity to exceed wind capacity by 2040 as the largest source of renewable power in the United States. As the graphic below shows, renewables are expected to double from 21% of US electricity generation last year to 42% of total US power generation in 2050 - mostly due to