Thesis Summary

I have owned Sumo Logic (SUMO) for a few months now. The latest fall in price after earnings had me questioning my investment; is there something wrong with Sumo Logic? This prompted me to take a deep look into Sumo’s technology, products, addressable market, competition and the acquisition of DFlabs.

Overall, I see Sumo Logic as an exciting play in a very fast-growing market. While competition is certainly stiff, Sumo does have the possibility of disrupting and becoming a prominent player. However, the market, which usually likes to get excited about up-and-coming businesses, is giving Sumo unfair treatment. This makes me believe that at the current valuation Sumo offers a great risk/reward ratio.

Sumo Logic’s Technology

Bear in mind, I am an investor first, and a technology “aficionado” second. I believe that the future lies in technology and those investors who can identify the best opportunities in this sector will garner the best returns. Tech is a very broad term that encompasses many complex issues, and it is up to us to narrow it down and do our due diligence on every company.

So, here’s what we know about Sumo Logic. The company offers a SaaS platform focused on data analytics. In broad terms, this is a SIEM software (security information and event management). One of the most important aspects of SIEM is log management. This process typically involves three steps: data aggregation, data normalization and data analysis.

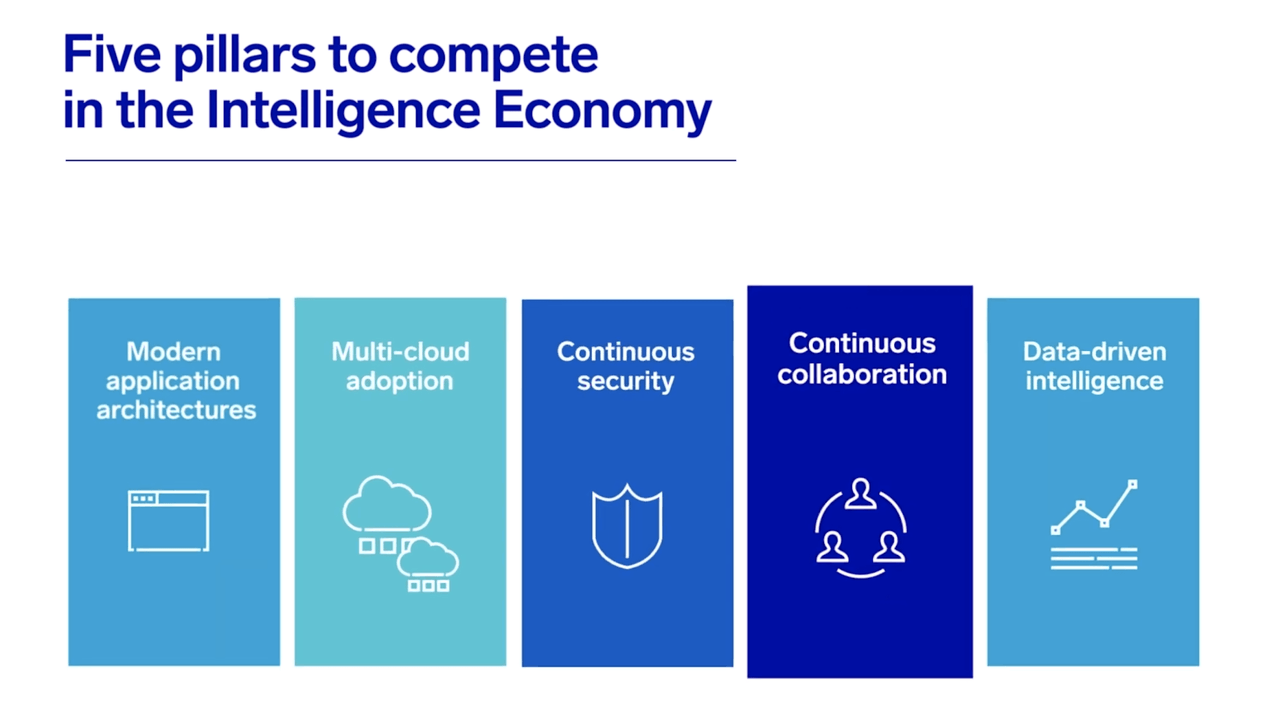

Sumo Logic provides all of these services in what it calls a Continuous Intelligence Platform. The idea behind this is to be able to deliver cloud-native real-time insights in order to optimize business procedures.

Source: Sumo Logic Website Video

The above image highlights the new paradigm faced by companies operating in this new digital age. Each of these represents a possibility, but