On March 8, Dada Nexus (NASDAQ:DADA), a company operating on-demand retail and delivery platforms in China, posted its unaudited financial results for the fourth quarter of 2020. The firm's annual revenue hit CNY 5.74 billion (around USD 881 million), up a staggering 85.2% year on year. On the next day, its Nasdaq stock soared 11.04%, propelled by a combination of solid financials and a market-wide pullback.

Meanwhile, there have lately been a number of bellwethers signaling the company's undervaluation. For one, BNK Invest - in a note on Nasdaq's website - suggested that Dada's stock is currently oversold, with its Relative Strength Index (RSI) diving below 30. Less than one year since its IPO, the firm comes off as yet undiscovered by many in the investment space.

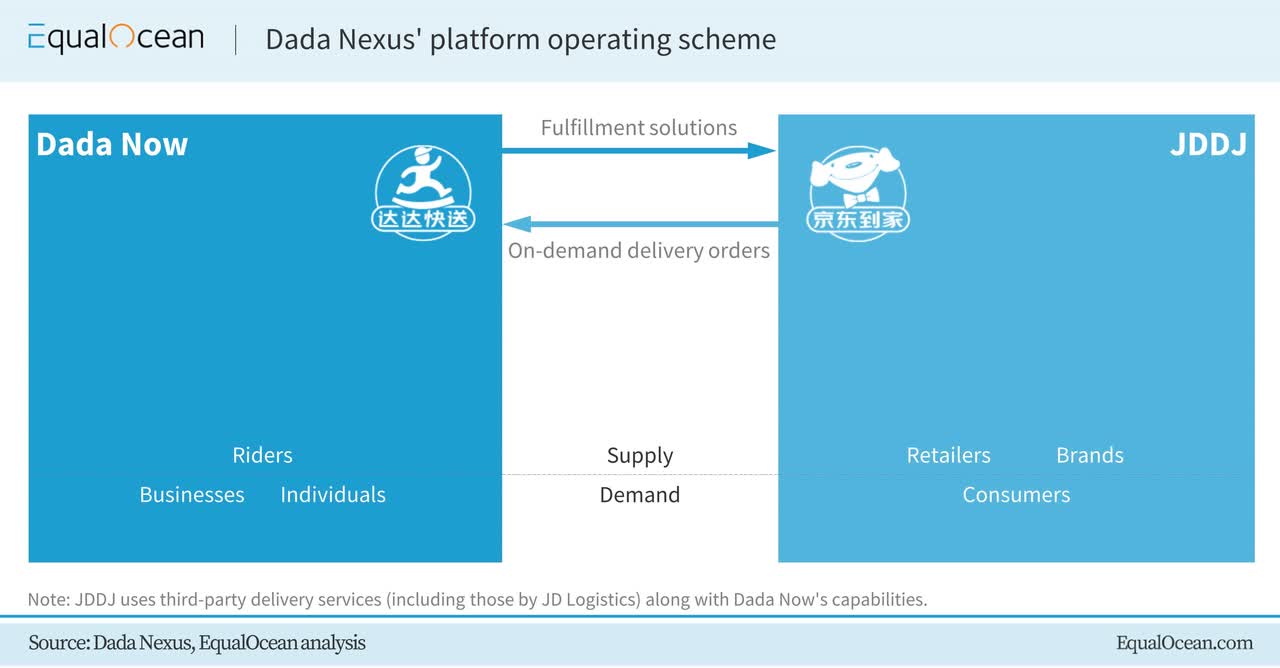

In November 2020, we analyzed Dada's competitiveness via its network and business models, as well as the key trends in the Chinese local on-demand retail and delivery industries. This article discusses the status quo of the company through the prism of financial analysis, also digging into Dada's strategic layout, plans and possible market developments. To approach these matters in a systematic way, we first take a quick glance at the duet of Dada's platforms – JDDJ (or JD Daojia) and Dada Now.

"Bringing People Everything on Demand"

Following the above motto, Shanghai-headquartered Dada has been developing two core businesses:

JDDJ, e-commerce titan JD.com's (JD, 09618:HK) ex-spinoff that merged with Dada in 2016, is a local on-demand platform that connects retailers and brand owners directly with consumers. Besides groceries, its main legacy segment, JDDJ, has now also extended its tentacles into a few red-hot FMCG categories like cosmetics and over-the-counter drugs, extensively partnering with national and regional chains. Furthermore, it has started to leverage JD's prowess in consumer electronics and reportedly inked a partnership with vivo, the world's fifth-largest smartphone