DISCLAIMER: This note is intended for US recipients only and in particular is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Refresher On DocuSign

DocuSign (NASDAQ:DOCU) is as the name suggests, primarily an e-signature business. Established in 2003, the company's IPO was not until April 2018. That's a fairly long period of time for a tech company to remain in private hands; the more banzai names tend to come out of the gate a little earlier. Indeed DocuSign is something of a sleeper stock in our view. Not sleep-y but sleep-er. For the purposes of this note we can ignore all the new stuff that the company is busily producing and marketing under the toe-curlingly-awful moniker of the "Agreement Cloud". Let's just think about e-signature for a while, which remains the core purpose of the company. E-signatures have been a

To learn more about our popular 'Marketplace' service The Fundamentals, click here.

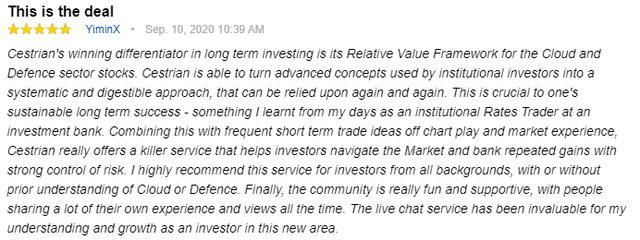

Our Marketplace service provides:

- Three long-term investment portfolios - Cloud Decade, CyberSecurity, and New Space Race (which is very much on!).

- Regular short-term trading ideas among the stocks we cover.

- Extensive investor education content.

- Vibrant, supportive chatroom featuring subscribers from many walks of life.

We run a real-money service publishing the research we conduct to invest personal account funds. Subscribers get alerts on any planned buy or sell order in covered stocks, ahead of time. You get the opportunity to buy or sell before we do.

Learn more & take a 2-week free trial.