Overview

iShares Self-Driving EV and Tech ETF (NYSEARCA:IDRV) offers an opportunity to invest in the market of electric vehicles and autonomous driving while diversifying risk through a bundled fund. Here, the ETF focuses on companies that produce autonomous driving vehicles, electric vehicles, batteries, or related products for such technologies. The 99 included companies are selected based on weight allocation, covering autonomous electric vehicle manufacturers, battery producers, and electric charging producers. The fund allows for stocks from both developed and emerging economies, while 52% of the companies are derived from the United States. The ETF has an expense ratio of 0.47%, representing the initial costs of investing.

As the electric vehicle market is ever-growing, with various companies getting closer to developing full autonomy, the ETF may be an attractive investment opportunity for growth-focused investors and could continue to outperform the broader market in the following years.

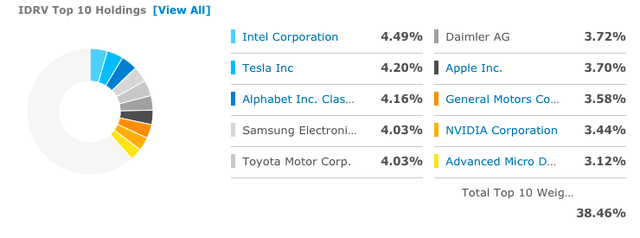

Components

Intel Corp (NASDAQ:INTC): Being the largest holding of the ETF, Intel mainly produces semiconductors and hardware for computers. These are crucial components for autonomous driving through software, cameras, and sensors. Here, Intel and Alphabet's Waymo have been collaborating, while Intel's subsidiary Mobileye aims to dominate autonomous driving by 2025. Shares of Intel are up by roughly 40% in a year.

Tesla (NASDAQ:TSLA): As one of the leaders of autonomous driving and electric vehicle, Tesla aims to reach Level 5 autonomy as soon as this year. The company is also making developments with its battery technology, revealing a 1-million mile battery. As Tesla beat delivery targets in 2020, the stock surged by nearly 700% in the year.

Alphabet (NASDAQ:GOOG): The U.S tech giant derives most of its revenue through advertising yet has invested heavily in building an autonomous vehicle. Here, its car project Waymo is already at level 4 autonomy and is beginning to roll