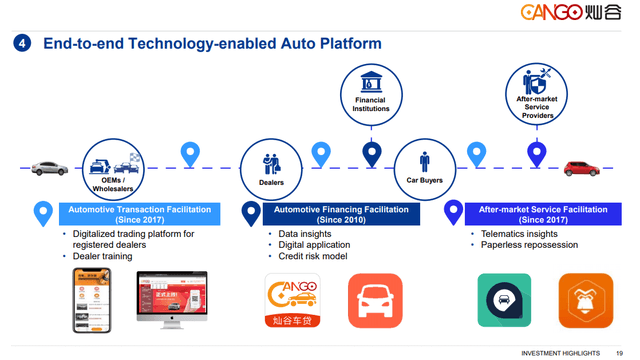

Cango Inc. (NYSE:CANG) offers technology solutions for the automobile market in China. Its online platform allows car dealers to trade inventory from wholesale channels while connecting with financial institutions for financing and logistical services. The company explains that the pandemic last year drove an acceleration in China towards online tools in the car market, which represented a big boost to its business. Indeed, Cango just reported its latest quarter result highlighted by record growth and earnings. While shares of the stock are up over 50% the past year, we are bullish and see more upside as operating and financial momentum continues. The company is well-positioned to benefit from several tailwinds supporting a positive long-term outlook as it consolidates its market position.

(Seeking Alpha)

Cango Earnings Recap

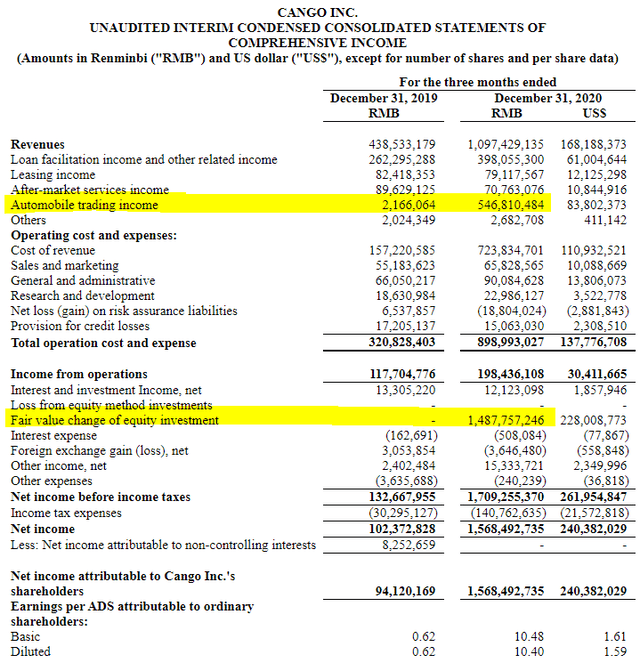

Cango reported its Q4 earnings on March 11th with GAAP EPS of $1.59 representing net income of RMB 1.6 billion or $240 million. Revenue of $168.2 million climbed by an impressive 150% year over year largely based on a surge in the auto trading transactions segment which has quickly become the core business of the company compared to loan facilitation service fees last year. For the full year 2020, revenues increased by 42.5% to RMB 2.1 billion or $314.5 million from RMB 1.4 billion in 2019.

(source: Company IR)

Auto trading here refers to the company's digital SaaS platform which offers dealers free access to wholesale car sourcing channels along with logistical services. The company generates fee income from the transactions across a variety of services. Cango also connects consumers to dealer inventory integrated with financing solutions from partner financial institutions. Indeed, the advantage of this type of integration is a big part of the company's bullish thesis.

(source: Company IR)

The shift towards more auto trading has resulted in a change to the

Add some conviction to your trading! We sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks/ADRs to find the best trade ideas. Click here for a two-week free trial and explore our content at the Conviction Dossier.