One need go no further than this author’s articles to read all about the rise and dramatic fall of Ebix (EBIX). I can unequivocally state that no company has allured me so greatly with its multi-bagger potential, and yet has also led to utter despair.

A summary covering an illustrious past, the mistakes in 2019, leading up to the 3Q 2020 earnings release that rekindled my hopes (and a recovery in the share price) is attached below as Appendix 2.

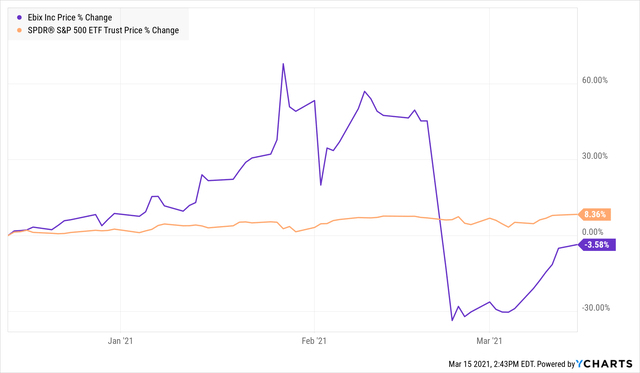

But now, let's focus on the immediate past, the incident that led to a +40% drop in a recovering share price, as evidenced in the 3-month chart below.

19th February 2021 Ebix reported that their auditor, RSM a global prestigious firm had resigned. These excerpts from Ebix’s SEC submission are important to understand the three issues (my emphasis).

19th February 2021 Ebix reported that their auditor, RSM a global prestigious firm had resigned. These excerpts from Ebix’s SEC submission are important to understand the three issues (my emphasis).

- In December 2020 the Company transferred $30 million to a commingled trust account of its outside legal counsel that was not under the direct control of the Company, and classified the funds as a cash or cash equivalent on its balance sheet. RSM discussed with the Company RSM’s view that these funds could not be classified as a cash or cash equivalent but could be classified as other current assets.

- RSM then advised the Chairman on the call that it was resigning as a result of being unable, despite repeated inquiries, to obtain sufficient appropriate audit evidence that would allow it to evaluate the business purpose of significant unusual transactions that occurred in the fourth quarter of 2020, including whether such transactions have been properly accounted for and disclosed in the financial statements subject to the Audit.

- RSM informed the Chairman that the unusual transactions concerned the Company’s gift card business in India. RSM asserts that on that call it further advised the