Sign up for Let's Talk ETFs on your favorite podcast platform:

Editor's Note: A full transcript of this conversation will be published next week. Sign up to follow Let's Talk ETFs to be alerted when that article is available.

Regular listeners of this show will know how partial I am to thematic exchange-traded funds as the rocket fuel within an otherwise fairly standard portfolio. Used as satellites strategically placed around core benchmark indexes, an investor can use insights into burgeoning trends to tilt their allocations in ways that align with how the global economy is likely to be transformed in coming decades. Thematic ETFs had a banner year in 2020. According to Global X, "on a year-over-year basis, Thematic ETF AUM increased 274% from $27.8 billion at the end of Q4 2019," with the majority of this rise in assets coming from positive inflows rather than fund performance.

In terms of my own portfolio, I have added water technology (FIW) as a result of the likely effects of continued population growth and climate change's effect on existing water supplies; Cybersecurity (CIBR), as wars are increasingly fought on virtual battlefields; e-Commerce (EBIZ), as less and less retail business is conducted via brick and mortar locations; and most recently, Vietnam (VNM), as supply chains diversify away from China in the wake of the COVID-19 pandemic. Of course, as a strong believer in diversified asset allocation, I still have exposure to stocks from all sectors both in the U.S. (via (QQQ) and (VOO), in other developed nations (VEA) as well as in emerging markets (IEMG). But I have tilted my allocations at the margins, skating to where I believe the puck to be going in the coming decade.

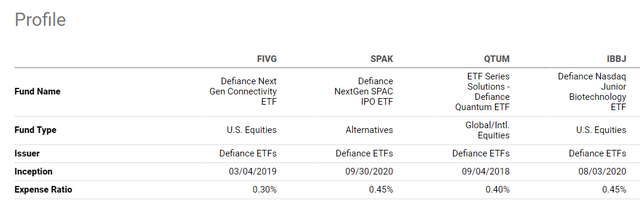

So, when I had the opportunity to talk shop with Defiance ETFs' Chief Investment Officer Sylvia Jablonski, I jumped on it. A relative newcomer to the ETF space, Defiance has managed to stay ahead of the thematic investing curve since launching its first fund back in 2018, the Defiance Quantum ETF (NASDAQ:QTUM). Defiance's largest ETF by far is the $1.1B Defiance Next Gen Connectivity ETF (FIVG), the first ETF to offer investors exposure to 5G as an investing theme. Also, first to market are the Defiance NextGen SPAC Derived ETF (SPAK), the first ETF to offer exposure to the red-hot SPAC market and the Defiance NASDAQ Junior Biotechnology ETF (IBBJ), which offers exposure to earlier-stage biotech companies. Rounding out Defiance's line-up is the just-launched Defiance Next Gen H2 ETF (HDRO), the first ETF to target hydrogen as an energy source.

For a full fund comparison of Defiance's ETFs, click here.

When speaking about Defiance and what sets it apart, Jablonski describes a different kind of ETF firm, one that is part asset manager, part fintech company.

When we looked at the successful ETF issuers already out there, we didn't see anyone focusing on the next generation of investors. There's $60T of wealth largely concentrated among baby boomers that is now transitioning to younger investors. We want to be the firm that focuses on technologies and ways of distribution that is entirely forward looking and will appeal to the new generation of investor.

Judging by their early success with funds like FIVG, it sounds like the people at Defiance just might be onto something.

Show Notes

- 2:00 - Why start a new ETF issuer when there are so many out there already: Defiance's mission statement

- 7:00 - How does Defiance manage to stay ahead of the ETF thematic curve?

Drilling into Defiance's lineup:

- 12:30 - Defiance Next Gen Connectivity ETF (FIVG): How big of an opportunity is the move to 5G for investors?

- 16:15 - What sectors are offering this exposure?

- 19:00 - Weighting holdings within FIVG

- 20:30 - Defiance NextGen SPAC Derived ETF (SPAK): To what do you attribute the current popularity of SPACs?

- 23:45 - What parts of the SPAC process does SPAK focus on?

- 30:00 - Defiance Quantum ETF (QTUM): What is quantum computing and how does this ETF offer exposure to this theme?

- 33:45 - How do you address the lack of companies in the portfolio that represent "pure plays" in the quantum computing space?

- 38:00 - Defiance NASDAQ Junior Biotechnology ETF (IBBJ): What makes a company a junior biotech company?

- 40;00 - What's the basic underlying strategy of IBBJ?

- 43:00 - How do you deal with companies that become successful and are no longer "junior"?

- 44:00 - Defiance's newest ETF: The Defiance Next Gen H2 ETF (HDRO)