Recently, two stocks have been brought to my attention by DSR members for different reasons: Booz Allen Hamilton (BAH) and Altria (MO). BAH has a very strong dividend triangle, shows great potential and can easily figure as a long-term investment for investors. About 50% of its revenue come from the defense sector, which means a stable source of income.

On the other hand, MO's recent stock price drop has been seen as an opportunity by some. I respectfully disagree with these investors. First of all, you should never buy a stock only based on valuation. Second, Altria has very few growth vectors. Sometimes, holding the Dividend King title is just not enough. Basically, Altria is stuck with highly profitable products with less and less consumers to buy it.

But let's start with the good news!

Buy Opportunity: Booz Allen Hamilton (BAH)

Dividend Yield: 1.55%

Market Cap: 11B

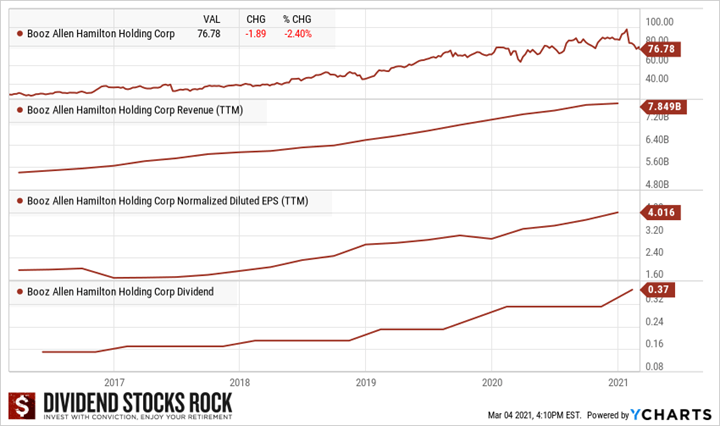

Booz Allen Hamilton Holding Corp is a provider of management consulting services to the U.S. government. Other services offered include technology, such as cloud computing and cybersecurity consulting, and engineering consulting. The consulting services are focused on defense, intelligence, and civil markets. In addition to the U.S. government, Booz Allen Hamilton provides its management and technology consulting services to large corporations, institutions, and non-profit organizations. The company assists clients in long-term engagements around the globe.

Latest Quarter

BAH reported a robust quarter with a strong earnings jump. Revenue also increased to $1.90B from $1.85B in Q3 of fiscal 2020, the consulting firm said. Booz Allen said the period saw slower-than-expected revenue growth due to the impacts of the COVID-19 pandemic and the presidential transition. The company still reported a 6.1% year-on-year rise in total backlog to $23B. With the improved results, Booz Allen announced a $0.06 increase in the quarterly dividend to $0.37/share, payable March 2 to shareholders of record as of Feb. 12.