Lemonade (NYSE:LMND) is a relatively recent IPO, going public in July of 2020 at $29 per share. The company provides renters, homeowners, pet, and life insurance products which are powered by both AI and behavioral economics. The company has a very friendly user interface and focuses on the growing population of the millennial generation, who have no paperwork and instant policies.

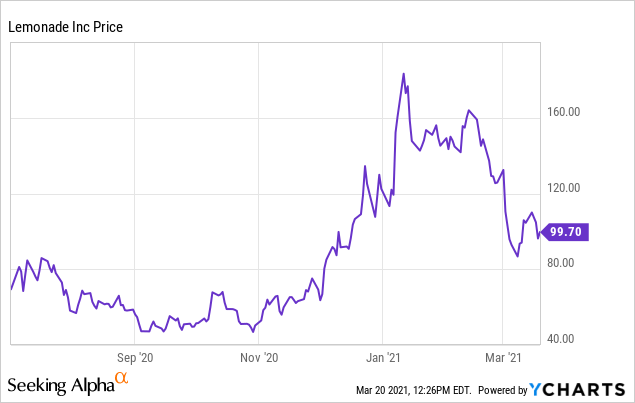

LMND quickly popped after going public and reached a high point of over $180 a share, a fast 6x return for investors. However, valuation was very aggressive and the company's recent quarterly earnings and guidance was disappointing, leading to the shares dropping below $100. While the company's long-term business model remains relatively strong, this is a highly competitive market and I believe the stock could struggle.

Data by YCharts

Data by YCharts

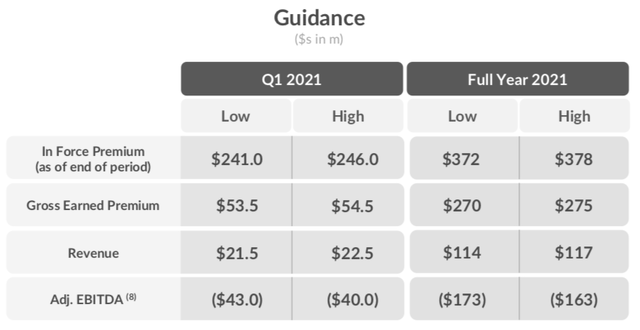

While the company provided 2021 guidance that demonstrates strong growth, consensus had expected higher gross earned premiums and lower adjusted EBITDA losses. Lemonade faces a challenging dilemma as their company's operating model is strong and there are long-term growth opportunities, however, their stock is overvalued.

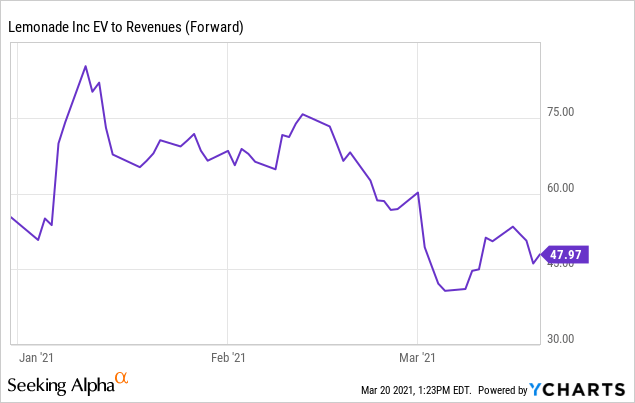

The stock is currently trading around $100 trades at 43x 2021 revenue. Even when assuming 50%+ growth over the next four years, investors are currently paying ~12x 2024 revenue, quite a steep multiple to pay.

For now, I remain happy on the sidelines and think the stock could continue to face downward pressure. It wouldn't be surprising to see the stock correct lower towards $75 and I would look to become a little more bullish around $60. Yes, this represents quite a bit of downside, but let's not forget the stock went public eight months ago at $29/share and at $60, which would still represent a quick double.

Q4 Takeaways and Guidance

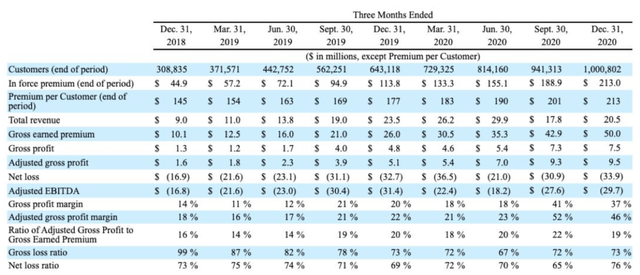

During the quarter, the company's in-force premium, which represents the total amount of premiums paid by Lemonade customers, to $213 million, representing growth of 87% compared to the prior year period. On a sequential basis, the company only grew in-force premiums by 13%, or ~$24 million.

In addition, the premium per customer grew to $213, which likely was driven by the company's continued penetration into the home and renters insurance products. These policies tend to be more expensive, thus generating an increase in in-force premiums and average premium per customer.

Revenue during the quarter declined 13%, though this is partially due to how to company accounts for revenue. Recall, LMND now pays out most of their premiums to reinsurance companies and Q4 revenue was calculated using gross earned premiums less reinsurance cost. Q4 2019 revenue only included the gross earned premium, meaning 2019 had a higher revenue, but also higher costs.

Source: Company Presentation

Source: Company Presentation

Nevertheless, investors should be looking at customer growth to help determine the future growth potential. The number of customers grew 56% and eclipsed 1 million for the first time, however, the number of customers only grew 6% sequentially. While there are other opportunities for future growth, such as expanding into the auto insurance market, the slowdown in sequential customer growth is a sign of caution.

Source: Company Presentation

Source: Company Presentation

For the full year, the company is expecting in-force premium of $372-378 million, which represents growth of 75-77%, slowing down from the 87% growth seen in 2020. Gross earned premiums are expected to be $270-275 million, or growth of 70-73%, compared to growth of 110% in 2020. Yes, growth is slowing down, but initial guidance was pretty strong.

Adjusted EBITDA for the year is expected to be a loss of $163-173 million, showing significant signs of inability to generate profit considering revenue is only expected to be $114-117 million. It appears consensus was expecting much higher gross earned premium and adjusted EBITDA guidance, which likely led to the post-earnings sell off.

Growth Opportunities and Valuation

LMND recently completed a follow-on offering in Q1, which raised ~$640 million of net proceeds and gives the company ~$1.2 billion of cash on their balance sheet to invest in growth opportunities. I think two of their biggest growth opportunities and geographic expansion and new products.

Lemonade is currently available in the United States, Germany, the Netherlands, and France, and continues to expand globally. The global insurance market is a massive opportunity for Lemonade, but it's quite expensive to move into new markets, expand your customer base, and take customers away from their current insurance carriers. Even with Lemonade only being in four countries right now, they are spending massive amounts of money and generate significantly negative adjusted EBITDA margins to expand their growth. On the Q4 call, management made some comments about international expansion (source: company presentation).

In terms of expanding into new markets like the UK or Asia, I'd say a couple of things. The first is that we have an expansive vision for Lemonade. We think that our cocktail, value proposition of great value strong values and delightful product is a cocktail that enjoys universal appeal and therefore it's a question of when not if with regard those new geographies.

The second thing I'd say is that in deciding when to launch more markets and in which order to sequence them we follow much the same algorithm as we use to determine where to invest our incremental dollar. We are very ambitious for Lemonade, but we try to temper that with the discipline of ensuring that we invest our energies whether we'll be most impactful and that really drives the prioritization in the roadmap.

While expanding to new geographies is a long-term opportunity, I believe it will be several years before Lemonade has the capital and scale to successfully launch in new markets.

There is also the potential for Lemonade to expand into new insurance vehicles, such as auto. Yes, the US auto insurance market represents a large opportunity, but let's not forget there are many legacy insurance companies who have competed for decades to penetrate the market. While some investors may argue that legacy insurance companies are ripe for disruption by newer insurtech companies, let's not forget that Metromile, who operates a unique "pay per mile car insurance" model, already has a leadership position among newer insurtech companies.

Yes, over time there are opportunities for Lemonade to expand into new geographies and products, however, the market remains very competitive with prices continuing to go lower. It's very expensive to enter new markets, especially for a company with not a lot of scale. These new growth opportunities will come at the price of large adjusted EBITDA losses for many years, which is not enticing for long-term investors who would like to see a return on their dollar.

Valuation remains quite expensive too. The company is still in early growth mode for revenue and will likely have strong growth for the next several years, but this is already baked into the company's stock price.

The company has a current market cap of $6.10 billion and with total cash of $1.2 billion (after including their Q1 secondary offering), this results in an enterprise value of $4.90 billion.

Lemonade is expecting 2021 revenue of $114-117 million and per Yahoo! Finance, consensus expects $183 million in 2022. Using these figures as our baseline, this results in a 2021 revenue multiple of ~43x and a 2022 revenue multiple of ~27x. Yes, valuation has significantly pulled back in recent weeks from 85x and higher levels, however, the stock still remains expensive and prices in significant revenue growth for the next several years.

Using consensus expectations for $183 million in 2022 and growing that by another 50% for two more years, this leaves us with 2024 revenue of ~$410 million, or a 2024 revenue multiple of ~12x. I would be a little more bullish if the company was trading at ~12x 2022 or 2023 revenue, however, the stock price is already implying 50%+ revenue growth for the next four years.

Given the valuation still remaining quite expensive and growth opportunities requiring a lot of capital investments and likely some losses for a few years, I think there continues to be downside. With the stock currently trading around $100, I believe we could see additional downside towards $75 and below. If the stock were to pullback towards $60, I would be tempted to take another look at valuation, though I remain satisfied on the sideline for now.

Risks

While there are some bullish areas for the company, including in-force premium and gross earned premium growth, I believe there are a few risks, among others, that should be addressed.

First, the company's expansion plans will likely require a lot of capital. After going public in July 2020 and seeing their stock trade well above $100 in Q1, the company quickly capitalized on a follow-on offering. If their stock continues to trade down, it might be more difficult for them to raise cash in the future. Their $1.2 billion of cash is impressive and gives them a lot of dry powder, but with already high adjusted EBITDA losses for the foreseeable future, the company may need to access the capital markets again for another capital raise.

The insurance industry is not only comprised of many legacy companies, but there has been a rise in new insurtech companies. Competition remains very high in this industry which can cause downward pressure on pricing. While legacy players may have an umbrella approach covering several insurance verticals, newer insurtech companies tend to focus on disrupting a specific vertical. For example, in the home insurance vertical, Lemonade and Hippo are just two of the new players. As previously mentioned, Metromile is offering a unique "pay by the mile car insurance," which can be difficult for other players to compete with. In life insurance, companies like Ladder are focusing on disruption.

Regardless of the vertical, competition remains high and that is not likely to change. In addition, one of the biggest drivers for consumers to switch insurance providers is cost. Meaning that if Lemonade wants to increase their customer base across several verticals, they may need to become a low-cost provider, thus putting increased pressure on revenue and profitability.